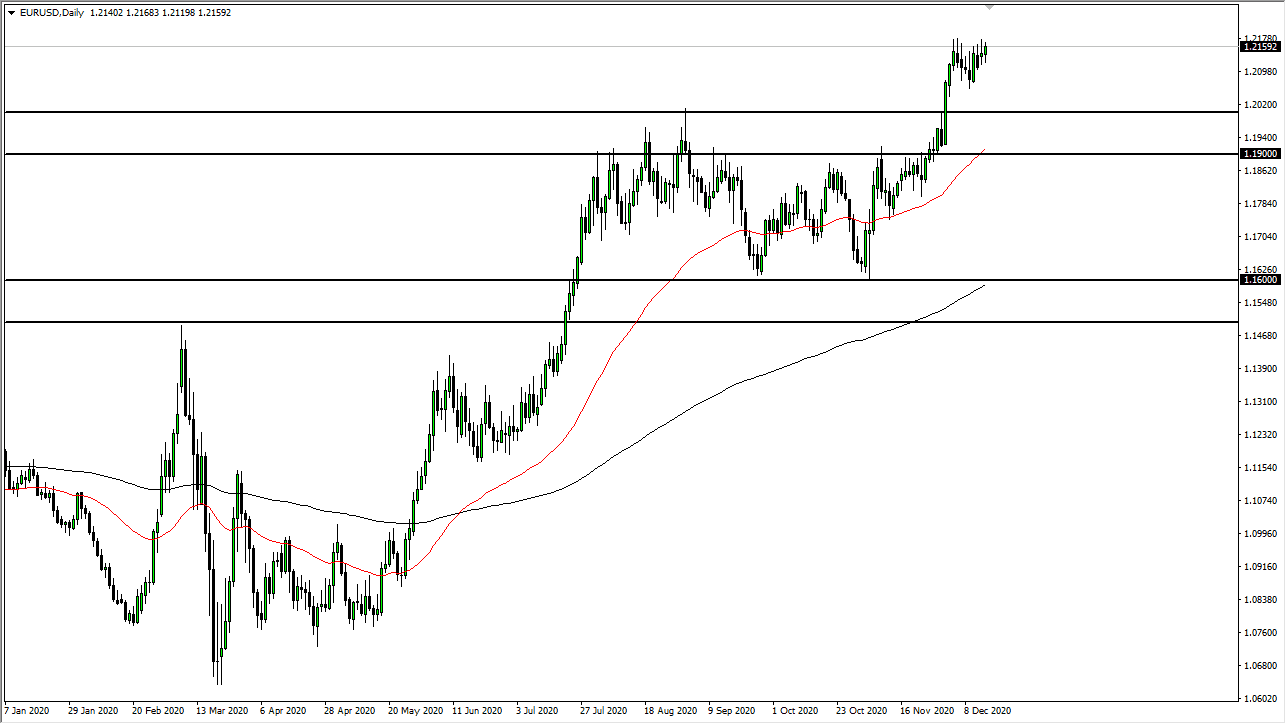

The euro initially fell during the trading session on Tuesday but turned around to show signs of strength again as we approach the 1.2150 level. The 1.22 level above is a significant resistance barrier, and with the coming of the Federal Reserve meeting and announcements, it is likely we will continue to see short-term pullbacks bought into. If the market falls ahead of the Federal Reserve announcement, it is very likely that it will become a “buy on the dips” scenario. To the downside, the 1.20 level underneath should be support, extending down to the 1.19 level.

The 50-day EMA is reaching towards that support level, so in time, it is likely that value hunters and buyers will show up in that area, assuming that we can even get down there. The question now is whether or not the 1.23 level will be broken through, as it is an obvious target for short-term traders, and people will try to get there. If we can break above there, the market is likely to go higher. However, it will be an area that will be difficult to break through unless the Federal Reserve comes out with a “quantitative easing bazooka.”

On the other hand, if the Federal Reserve disappoints currency traders, we could see a flight into the US dollar, and that is the one scenario in which we would see the euro drop down below the 1.19 handle. Because of this, the market is essentially a “one-way trade”, and when you look at the shape of the market heading into this announcement, you can see that we are already starting to lean towards the upside anyways. You can even make an argument for a bullish flag, which measures for a move to the aforementioned 1.23 handle. Therefore, it would follow that buyers will try to get to that target from a technical analysis standpoint as well. Keep in mind that during afternoon trading in New York on Wednesday, it could be very volatile.