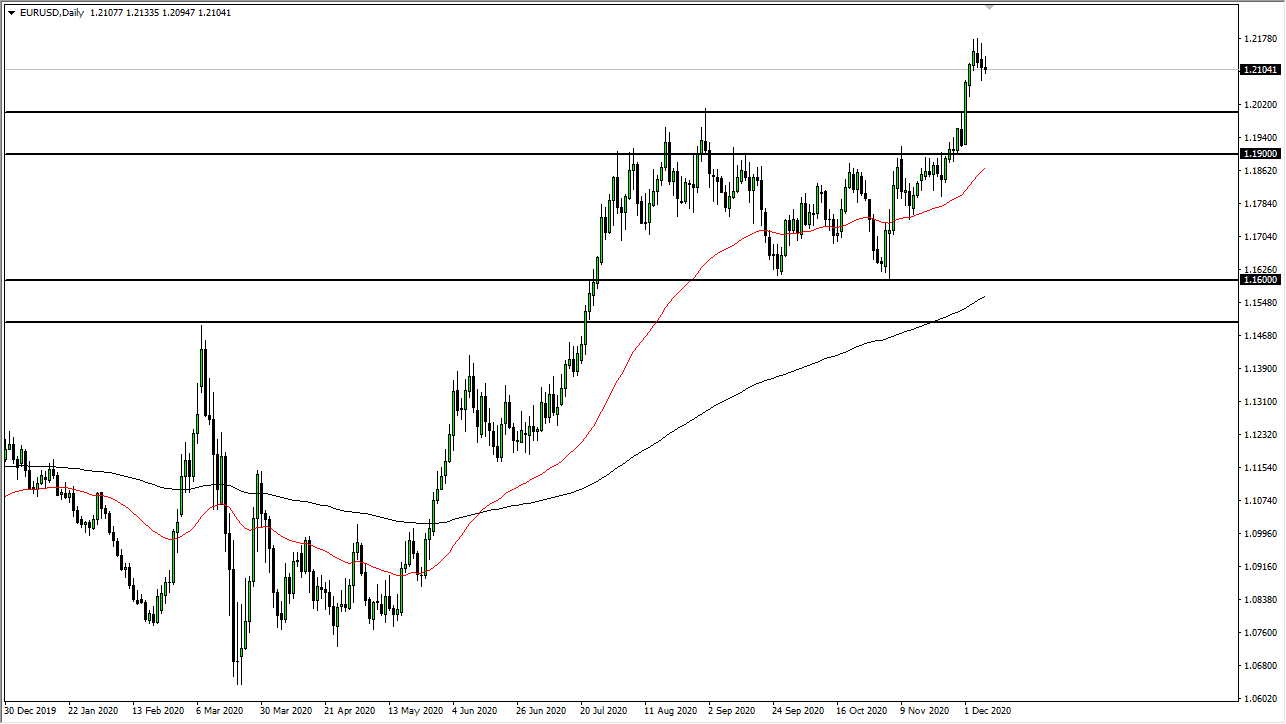

The euro initially tried to rally during the trading session on Tuesday but gave back the gains to form a shooting star. We could see a pullback, as we have gotten a bit over-stretched. The 1.21 level is starting to offer a short-term floor, but the most important, and perhaps obvious, support level is close to the 1.20 level. After all, it took a lot of work to break above it and, now that we have done so, a simple “retest” would be in order.

The 1.20 level is supported all the way down to the 1.19 handle and the 50-day EMA which is colored in red on the chart. There are multiple reasons to get long in that general vicinity, so I am hoping to see a pullback into that area that forms a supportive daily candlestick. The euro continues to see a lot of bullish pressure due to the fact that Europe is getting through the coronavirus numbers better than the United States currently, and many traders are paying close attention to the budget deal in the EU.

The US dollar itself has been on its back foot for a while, so we are going to see a continuation of a move higher in the euro, reaching towards the 1.23 level above which is where we had broken down from previously. I think you should buy short-term pullbacks, and we may get that opportunity over the next couple of days. We will find plenty of buyers on dips, as the market has so obviously broken out. Many people will have to react to the 1.20 level if we get down there, if for no other reason than to get out of what has been a very negative position. People will suffer from a case of “FOMO” as well, so I think that there is a lot of interest underneath. If we were to turn around and break above the 1.22 handle, that is in theory a buying opportunity, but it is a bit stretched so not exactly my favorite trade.