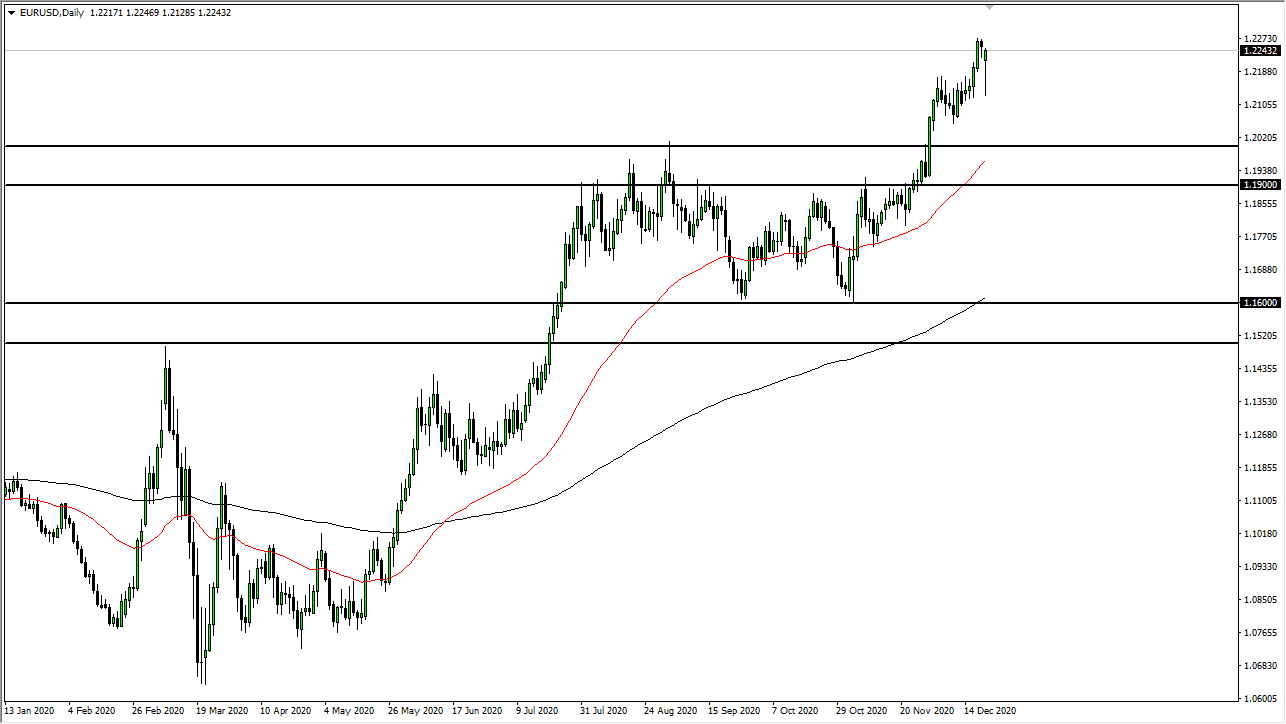

The euro broke down significantly during the trading session on Monday amid global concerns surrounding the coronavirus mutation in the United Kingdom. The US dollar got bid against almost everything, including the euro. In fact, when the US dollar gets a boost, that almost always, by definition, works against the euro. This is a market that has been in a significant uptrend for some time, so it follows that we would continue that move overall given enough time.

When you look at the move, one thing that you need to pay close attention to is the fact that the volume would have been almost next to nothing at this point in time, as we are in the midst of holiday trading. However, the move was extraordinarily exaggerated and that is something that lends itself to these wild swings. Notice that we stopped right at the 1.21 area which is where the previous bullish flag had formed. In other words, there is an area that should see a significant amount of support. That is exactly what happened and now we ended up forming a massive hammer. That hammer is a bullish sign in what has already been a bullish market. The market is likely to continue going higher, especially if we continue to see more stimulus coming out the United States.

After all, the first thing that we hear out of Chuck Schumer after the passing of the stimulus hurdles is that they are going to do even more later. That should continue to work against the greenback given enough time, so at this point it makes sense that we would continue to see US dollar depreciation.