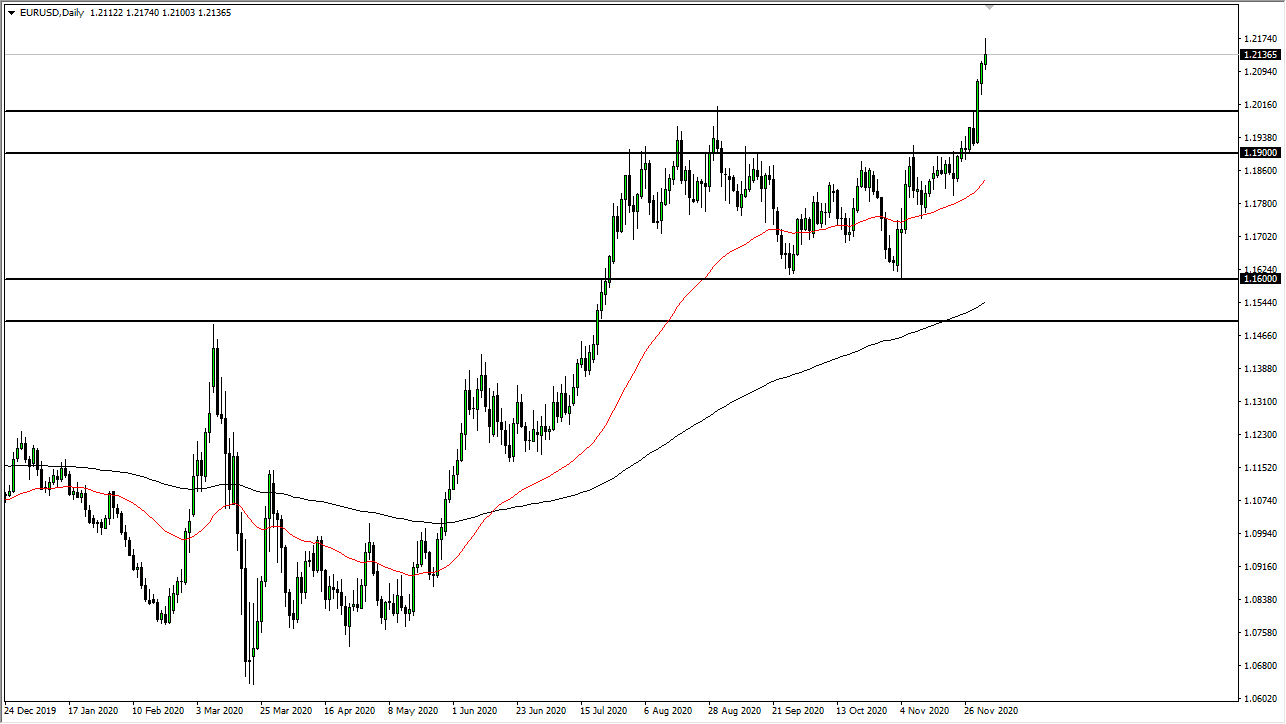

After all, you cannot see the market goes straight up in the air forever, it simply does not work like that. That being said, if we do get some type of pullback in the next couple of days, that should be thought of as a potential buying opportunity as the Euro has clearly broken above a major resistance barrier in the form of the 1.20 level.

Friday is the Non-Farm Payroll announcement, and that of course will cause some volatility in general. That being said, I do believe that it is only a matter of time before the Euro continues its move higher. In fact, based upon longer-term charts I fully anticipate that the Euro will go looking towards the 1.23 level, perhaps even the 1.25 level. Remember, this pair does not typically move that quick, so the fact that we would pull back from the last couple of days would not be a huge surprise. I would anticipate seeing a lot of support at the 1.20 level which was so instrumental in resistance previously.

With the Federal Reserve and the US government more than likely piling on stimulus and quantitative easing, it is really difficult to imagine a scenario where the US dollar suddenly picks up a lot of strength. Certainly, it would not be a sustainable situation. With the way things have been behaving, it is obvious that Forex traders out there are looking to unwind dollar long positions over the last several years, and therefore I think we have a long way to go in the destruction of the greenback. However, the US dollar will of course get a certain amount of a bid every time something negative happens, and let us face it here, there can be a lot of negativity when we are not paying attention.

The 50 day EMA is starting to reach towards the 1.19 level, which I see as the bottom of the zone of influence right around the 1.20 level. Because of this, I do think that it is only a matter of time before we will see buyer step in on some type of pullback even if we got that far. I look at pullbacks as opportunities to pick up “cheap euros.”