The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

It is a great time to be trading markets right now, as there are many valid strong trends in favor of stocks and riskier assets and against the U.S. dollar.

Big Picture 6th December 2020

In my previous piece last week, I saw the most attractive trade opportunities as likely to be long of the EUR/USD currency pair and of the S&P 500 Index. This was a great call, as the EUR/USD currency pair closed on Friday up by 1.33%, with the S&P 500 stock market index rose by 1.79%, so this was a nicely profitable call overall.

Last week’s Forex market saw the strongest rise in the relative value of the Canadian dollar and the strongest fall in the relative value of the U.S. dollar. There is a strong trend against the U.S. dollar, meaning it is an attractive time to be trading Forex, as the greenback is the prime driver of the Forex market.

Fundamental Analysis & Market Sentiment

The headline takeaway is that we are seeing a strongly positive trend in stock markets and in riskier currencies such as the commodity currencies (CAD, AUD, NZD) as well as the euro, and a strongly negative trend in the U.S. dollar. We are seeing stock market indices make new all-time highs (S&P 500, Nikkei 225, KOSPI) and the aforementioned currencies make new multi-year high prices against the U.S. dollar. Risk-on sentiment is firm, with the prospect of effective mass vaccinations against coronavirus firmly in view.

Last week saw a continuing moderate level of volatility in the Forex market, as there was very little news and no surprising economic data releases, although the key U.S. jobs data release (non-farm payrolls) came in a little lower than expected, which did nothing to halt the rise of the U.S. stock market but did boost the U.S. dollar slightly. Over the week, we saw the U.S. dollar continue to weaken while two of the commodity currencies (AUD and CAD) were strong and continued to advance. The EUR/USD, GBP/USD, AUD/USD, NZD/USD, and USD/CAD currency pairs made their highest (lowest in the case of USD/CAD) New York closes Friday in more than 2 years.

President Trump is still refusing to concede the Presidential election but there seems to be no real chance that any of his legal challenges will succeed in changing the results, so the electoral college seems set to confirm Joe Biden as President on 14th December.

Global stock markets remain very bullish, with the S&P 500, Nikkei 225, and KOSPI indices closing Friday at all-time weekly highs despite last week’s still-worsening coronavirus infection rates in the U.S.A. and globally.

The euro has been in focus this week as it continues to advance to long-term highs as the ECB announces a huge economic stimulus/recovery package which has encouraged many analysts to see opportunities in Eurozone value stocks, which is probably boosting flow into euros.

Last week’s major story in the U.S. has been a strong increase in new daily confirmed coronavirus cases, with new hospitalizations and deaths also continuing to rise strongly. Several states have announced new lockdowns and other restrictions in an attempt to stem the spread of the virus.

The big coronavirus stories globally right now are the sharp rise in deaths worldwide, and the fact that two major pharmaceutical companies, Pfizer and AstraZeneca, seem to have a 90%+ effective vaccine almost ready for rollout next week. It is expected that vaccinations in the U.K. will begin this week after the safety regulator approved the Pfizer vaccine for use.

Last Thursday saw an all-time record number of new daily cases confirmed globally at 688,333, and of global daily coronavirus deaths at 12,834. The European Union is reporting more deaths than the U.S. but is seeing falls in both deaths and new cases, while the U.S. is seeing strong increases in both.

Europe is leading the share of the global daily death toll, at about 31%, while the U.S.A. is accounting for approximately 18%. However, the U.S. is currently accounting for approximately 31% of all global coronavirus deaths. The strongest growth in new confirmed cases is happening in Albania, Azerbaijan, Belarus, Belize, Bosnia, Brazil, Bulgaria, Burkina Faso, Burma, Canada, Croatia, Cuba, Cyprus, Denmark, Egypt, Estonia, Finland, Georgia, Germany, Greece, Guatemala, Indonesia, Israel, Japan, Kenya, South Korea, Latvia, Lithuania, Mali, Mexico, Moldova, Netherlands, Niger, Nigeria, North Macedonia, Pakistan, Panama, Paraguay, Romania, Russia, San Marino, Paraguay, Senegal, Serbia, Slovakia, Slovenia, South Africa, Sri Lanka, Sudan, Tunisia, Turkey, the Ukraine, and the U.S.A.

The coming week is likely to bring a similarly moderate level of activity to the Forex market. High-impact economic data due over the coming week include central bank input from the European Central Bank and the Bank of Canada.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a bearish candlestick. It closed within the lower half of its price range, which is a bearish sign, but a sign that a bit more support is being felt, so the pace of the downwards movement may now slow. Significantly, this weekly close was the lowest in more than 2.5 years, suggesting a strong bearish trend, but the support level shown not far from the price at 11471 may stop much more downwards movement happening over the short term. Overall, next week’s price movement in the U.S. dollar looks somewhat likely to be downwards. This is a relatively good time to be trading the U.S. dollar short, so I am focusing only on trades which are short of the U.S. dollar.

USD/CAD

The USD/CAD currency pair again closed Friday at a 2.5 year weekly low closing price, which is a bearish sign. The candlestick closed right near the low of its price range, and the week’s range was unusually large, suggesting the price is likely to fall further over the coming week. A further bullish sign is that the price spent the week falling from the huge psychological round number at 1.3000. The only sign that bulls should be cautious is the area of potential support not far below the weekly closing price confluent with the psychological level at 1.2750.

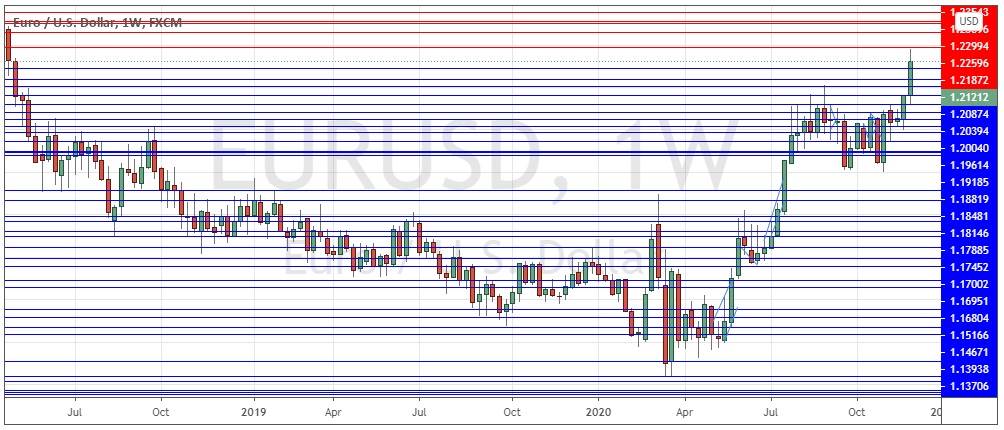

EUR/USD

The EUR/USD currency pair again made its highest weekly close in more than 2.5 years and closed within the top half of its weekly range on increasing volatility. These are bullish signs for this currency pair and suggest that now is a good time to be taking long trades in this currency pair which trends relatively reliably. However, it is worth noting that the price found resistance at the round number of 1.2200 last week so it may be due a pullback over the coming days.

S&P 500 Index

The S&P 500 stock market index just made its highest weekly close of all time, closing right at the high of its weekly range. These are very bullish signs for the most important and biggest global stock market index, suggesting that the price is likely to rise higher still over the coming week. However, bulls should note that there may be at least short-term resistance at the nearby round number of 3700. If Monday’s open is above this price, that will be a bullish sign.

Bottom Line

I see the best likely opportunities in the financial markets this week as long of the EUR/USD currency pair and of the S&P 500 Index.