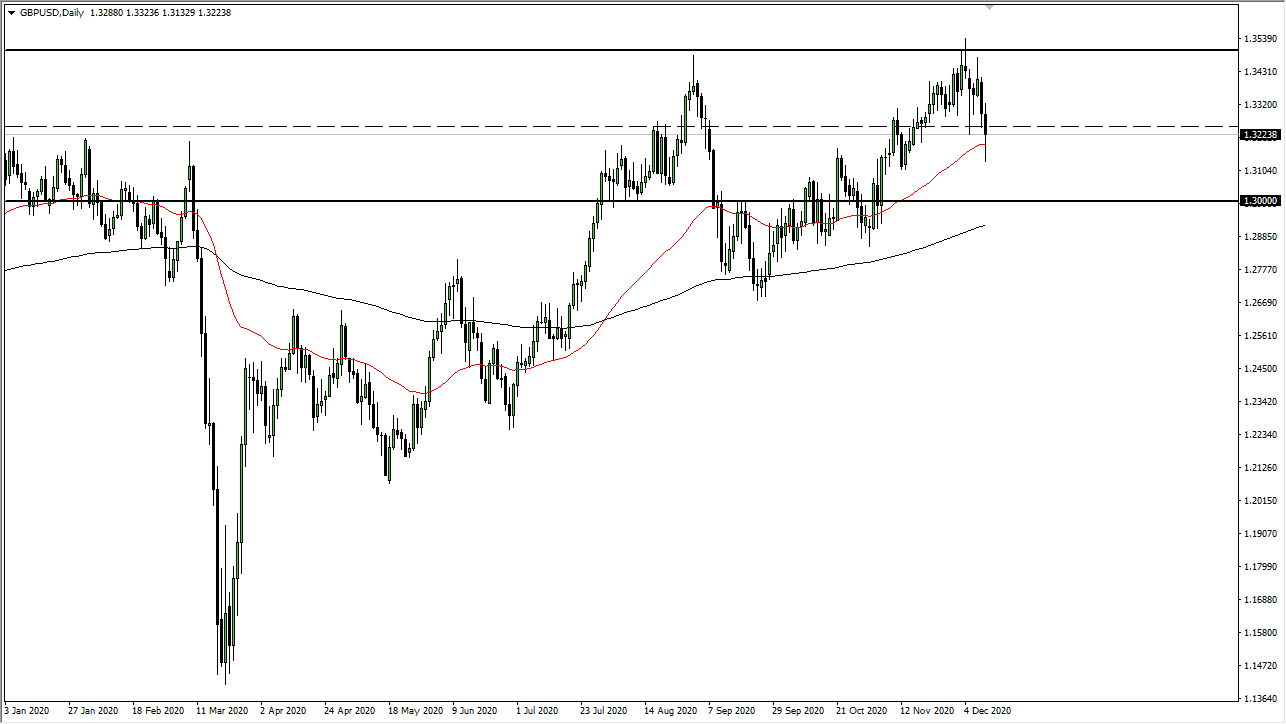

The British pound broke down significantly during the trading session on Friday to slice below the 50-day EMA. This was in reaction to Boris Johnson and Ursula von der Leyen both saying that the most probable outcome would be a “no-deal Brexit.” We have heard this before, so it is not overly surprising that we turned around to recover some of the losses. By the end of the day, we reached towards the 1.3250 level. This is a market that will be paying close attention to whether or not more talks are scheduled, as the leaders did suggest that they thought a new set of talks should be scheduled and announced by Sunday. The market will continue to base itself upon the idea of buying the dips at this point. However, there will come a breaking point sooner or later, and then we need to make a bigger decision.

The 1.30 level underneath is obvious support, so a lot of traders will be looking at that as a place to start buying as well. To the upside, the 1.35 handle would offer quite a bit of resistance, and if we were to turn around and break above there, then we would go much higher. This continues to be a “buy on the dips” scenario going forward until there is a definite “no deal Brexit". However, one thing that many traders are failing to focus on is that just because there may or may not be a deal between now and the end of the year, that does not mean that we cannot have an agreement in January or February, etc.

In the meantime, the 50-day EMA is likely to offer a bit of psychological and technical support, but really we are moving on the latest headline, so it is very difficult to put a lot of money to work. There are a lot of very well-respected traders right now that simply refuse to trade the British pound, because it is so unpredictable and volatile, but not in a good way. Regardless, big positions are to be avoided at all costs.