The British pound was all over the place during the trading session on Wednesday, awaiting the results of the meeting between Boris Johnson and Ursula von der Leyen during dinner time. They are supposed to be talking about the potential of moving forward with the Brexit agreement, and obviously every little headline and rumor that comes out has been causing volatility in this pair. It actually seems to come down to whether or not politicians can pull it together, which is something in which I have very little faith. The one thing that you should take away from the British pound is that it seemingly is always bought on dips, and unless we get a decisive “no-deal” outcome, there are always people out there who are willing to buy pullbacks. In fact, we have already seen that during the trading session.

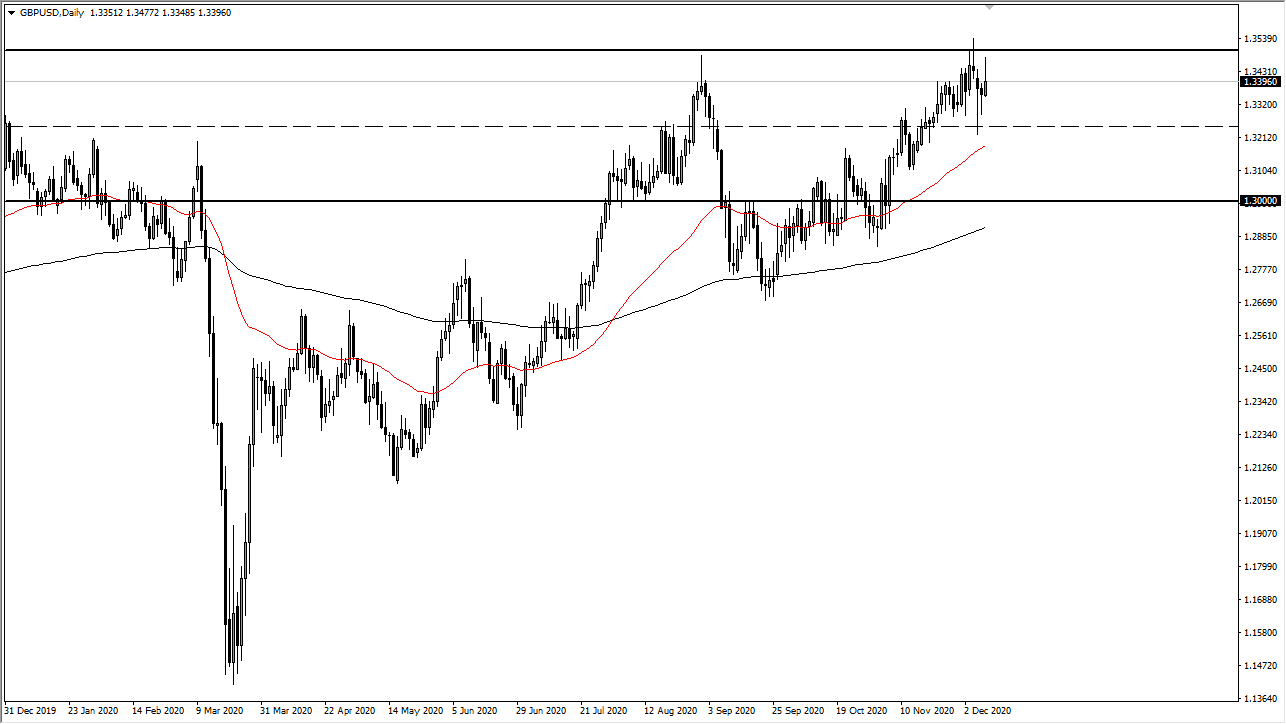

This candlestick is a shooting star, but it also has a couple of hammers preceding it. That shows confusion, which makes sense considering we are waiting on the results of the Brexit negotiations like we have been for four years. We are getting close to “crunch time”, so it has become a bit more pronounced as to whether or not we have good or bad news. Nonetheless, I like the idea of buying dips and I believe that the 50-day EMA underneath should continue to offer support. It currently sits just below the 1.3250 level, which adds even more credence to that level being important, as it has been recently.

As far as selling is concerned, I do not have any interest in doing so until we get a definitive “no-deal” outcome, which I do not think we will. Even if they do not come up with a deal in the next 24 hours, they will almost certainly state that they can get together after New Year’s Day to produce something and simply revert to the WTO rules that are already in place. In other words, we might be in for more of this nonsense going forward, which has made trading the sterling a real headache for various times over the last four years.