The British pound initially fell during the trading session on Monday, and then started to really sell off as sour headlines came out regarding Brexit talks. This is a market that has much going on at the same time, but it certainly wants to send the British pound higher. There is still a lot of momentum out there for buyers, so the fact that we have rallied the way we have after Boris Johnson announced that he was going to Brussels on Wednesday tells you just how much optimism there is built into the marketplace.

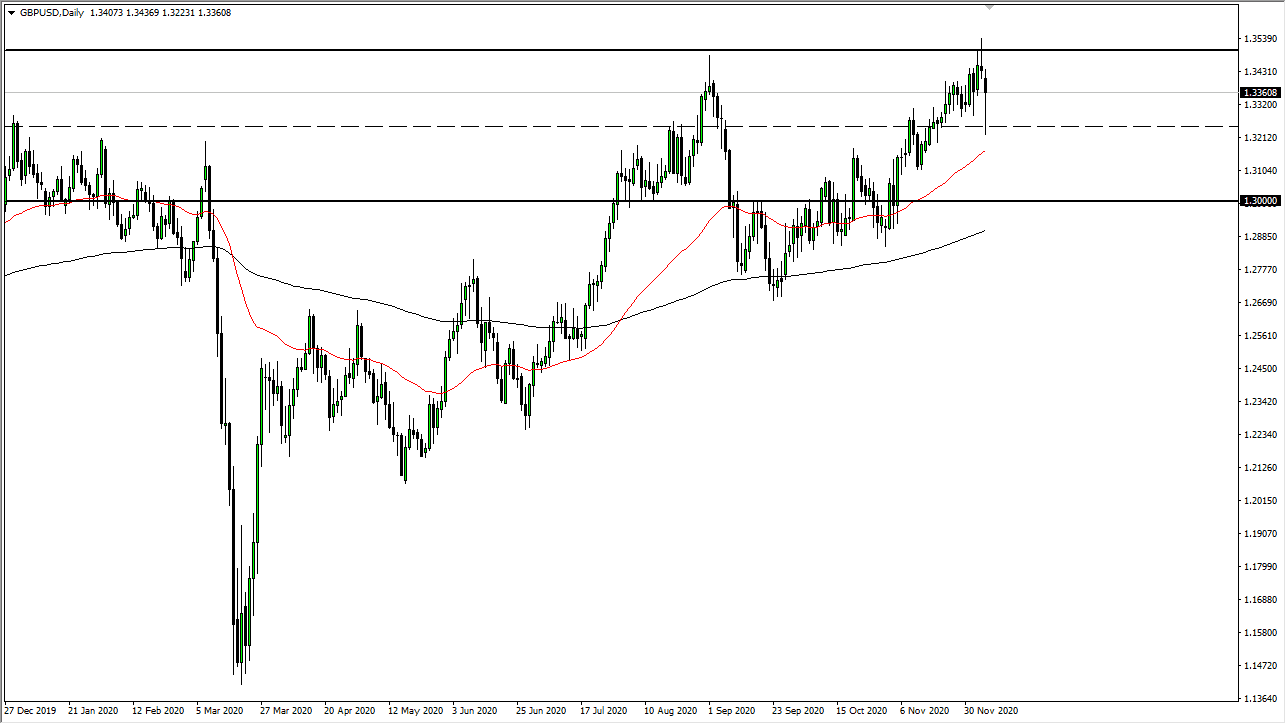

It appears that algorithms went a bit haywire when the negative headlines came out, only to be reversed once Johnson announced he was heading to Europe. You can see that the 1.3250 level has offered support, and it now looks as if the market is probably going to continue to favor buying the dips, and that we will be looking at the 1.35 handle with great interest. If we can finally close above the 1.35 handle, it is likely that we will go much higher, perhaps reaching towards the 1.3750 level. After all, breaking above the 1.35 level would be considered to be a very strong move, and would attract a lot of attention.

To the downside, we have the obvious support at the 1.3250 level that was reiterated during the trading session on Monday, and now the 50-day EMA sits just below there. Because of this, the market is likely to see buyers on those dips, as we have seen during Monday's trading session. The 1.30 level will be massive support also. The market breaking below the 1.30 level would be a huge turn of events, almost certainly based on the idea of Brexit falling apart completely. While I do not think that is the most likely of outcomes, you need to keep in the back your mind that it is still a possibility considering all of the rhetoric that we have seen over the last couple of days. The shape of the candlestick is very bullish, so it appears that the buyers are going to continue to be rather relentless.