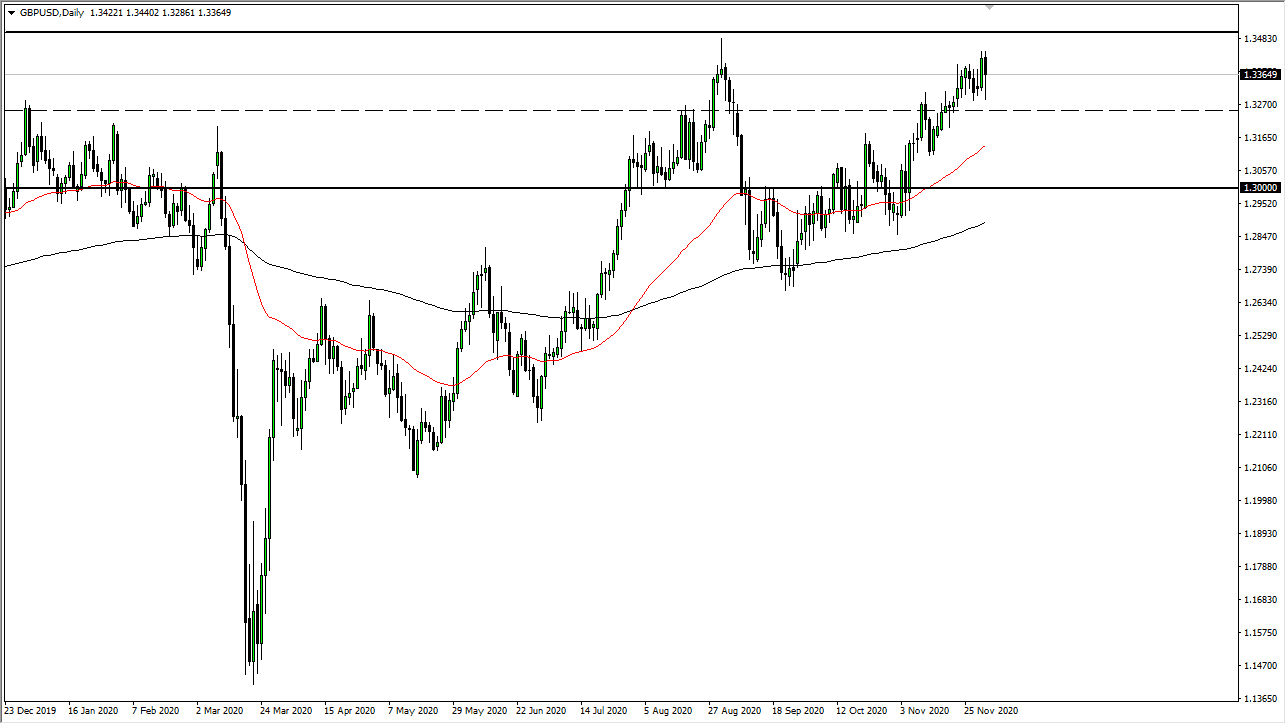

The British pound fell rather hard during the course of the trading session on Wednesday based on comments coming out of the Brexit negotiations. After all, anytime there is hesitancy by the two sides suggests that there is progress being made, and the British pound gets hammered. Nonetheless, this is a market that looks likely to continue to see a lot of volatility, but the most important thing that we see here is the fact that the British pound continues to see plenty of buyers underneath. Therefore, the market is likely to continue to buy the dips, just as we saw during the day on Wednesday.

The 1.3250 level has been showing signs of support over the last couple of sessions, so it is going to be a temporary floor in this market. Furthermore, the 50-day EMA is starting to turn towards that level as well and should attract some attention. Every time we pull back, people will be looking at picking up bits and pieces of value, so it is likely that we will see value hunters coming in.

Eventually, the British pound should break above the 1.35 level, but I think this is going to take a Brexit deal. If we can break above there, then the market is likely to go much, much higher due to the fact that the British pound is massively undervalued from a long-term perspective. This is a scenario in which we will eventually get a resolution and, when we do, the market will look towards much higher levels and shoot through this like a beach ball that has been held underwater for far too long.

However, the market would collapse if we found some type of no-deal Brexit, which would be the nightmare scenario for this currency pair. If that happens, the market will continue to see the 1.30 level targeted, and perhaps even lower than that, as all of the recovery over the last year or so would be completely wiped out eventually. However, that is the least likely of scenarios, and currency traders are pricing in about an 80% chance of some type of deal between the two entities.