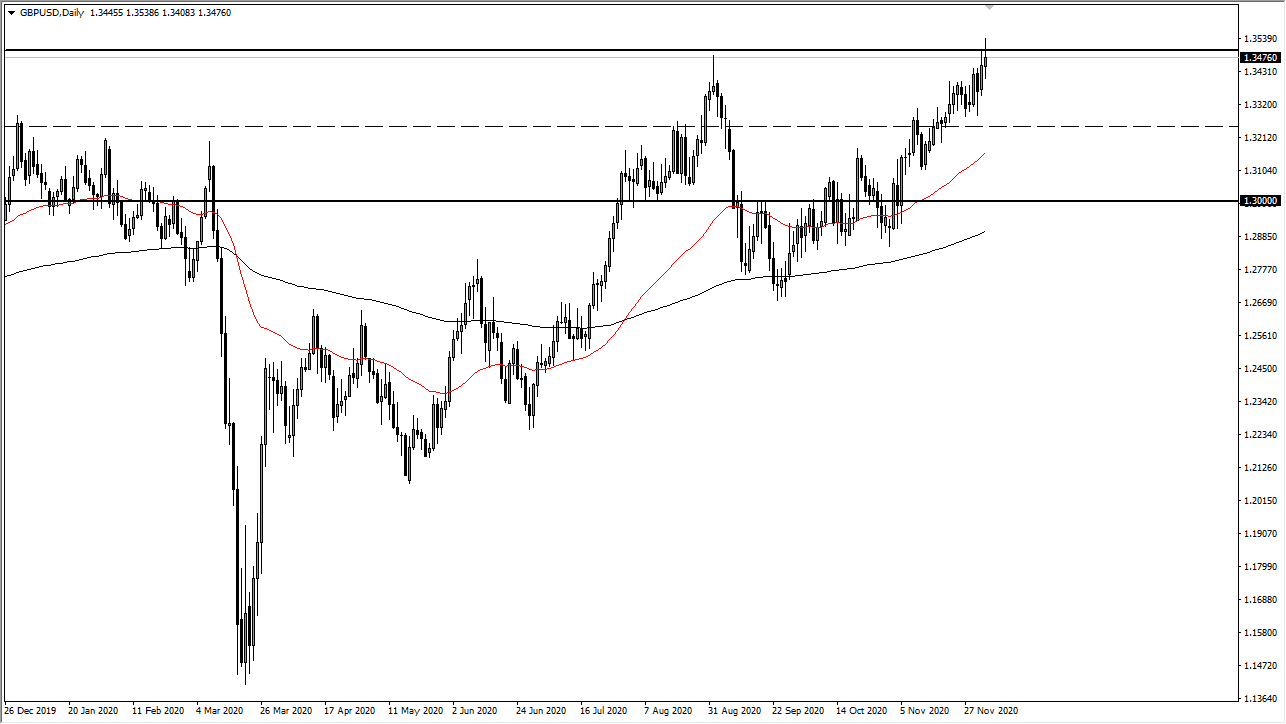

The British pound fluctuated quite wildly during the trading session on Friday, as traders tried to jump ahead of a Brexit announcement. However, we have gotten a whirlwind of statements that are both positive and negative, and it looks like the markets are going to have to wait for a negotiated settlement. It is difficult to see where we will go, but the market still thinks that we will get an agreement. If things get markedly worse, that could be very negative for the British pound.

On the other hand, if we get a decent agreement between the EU and the UK, that should send the market above the top of the shooting star-shaped candlestick for the trading session on Friday, opening up the door to a much higher move. At that point, I would anticipate that the market could go to the 1.3750 level.

The market has been relentlessly bullish over the last couple of weeks, but it has also been very choppy. I suspect the one thing that the market has accomplished over the last couple of weeks has been the destruction of trading accounts. The US dollar has been losing a lot of value against other currencies, which is one of the things that has been pushing the British pound higher. Unfortunately, the market is being held hostage by the latest nonsense coming out of the mouths of politicians, and one thing that you can probably count on is that there will be headlines that will throw this all over the place. I do suspect that by the time we open on Monday, there will be a major gap, but I cannot tell you in which direction. We have a couple of levels to pay attention to, mainly the highs of the trading session on Friday, or perhaps a break down below the 50-day EMA.