Concern over a difficult Brexit future added to pressure on the pound’s direction against the rest of major currencies. Accordingly, the GBP/USD pair did not enjoy the gains from the UK's initiation of coronavirus vaccination. The rebound in the middle of last week's trading was towards the 1.3477 resistance, but the faltering trade agreement negotiations between Britain and the European Union increased selling operations on the pair, pushing it towards the 1.3133 support by the end of the week’s trading, before closing trades around 1.3230.

Before the beginning of this week’s trading, the slightly positive tone of the post-Brexit negotiations meant that the market was likely to push the British pound price higher. In this regard, the President of the European Union Commission, Ursula von der Leyen, said in a statement issued last Tuesday: “Despite the exhaustion after nearly a year of negotiations, and even though the deadlines have been repeatedly crossed, we believe that it is responsible at this stage to make an extra effort.” The statement followed a conversation between von der Leyen and Johnson, which von der Leyen described as constructive and beneficial.

Notably, von der Leyen has not proposed any new deadlines that support the desire to see a deal close. As long as the two sides engage in discussions, a deal is likely to be reached, and the talks will go to December 31, 2020 when the transition period ends, although it is more likely that it will happen sometime this week.

Also, numerous media reports indicate that some progress has been made between the negotiators of both sides.

The worst-case scenario outcome from the GBP exchange rate perspective was that the two sides decided to end the talks on Sunday, which could lead to a chaotic start to the week. The best scenario is for the two sides to agree to continue the discussion. If a deal is secured in the coming days, it is likely that the British pound will gain significantly, given that the British currency has suffered some noticeable declines in recent days.

British industrial production for October was reported to beat expectations (monthly) of 0.3% with a change of 1.7%. On an annual basis, it was stronger than the expected change of -8.4%, with a reading of -7.1%. The manufacturing production for the same period outperformed the expected change on a monthly basis by 0.3% with a reading of 1.3%. Also, UK GDP growth for October matched expectations of 0.4% month-on-month.

The preliminary Michigan Consumer Confidence Index for December beat expectations of 76.5, with a reading of 81.4. On the other hand, the US PPI reading excluding food and energy for the month of November was below expectations of 1.5%, with a change of 1.4%. On a monthly basis, a change of 0.1% was recorded and expectations were of 0.2%. In contrast, the previous US Consumer Price Index for food and energy for November surpassed expectations (monthly) at 0.1% with 0.2%, and on an annual basis, it came as expected by 1.6%.

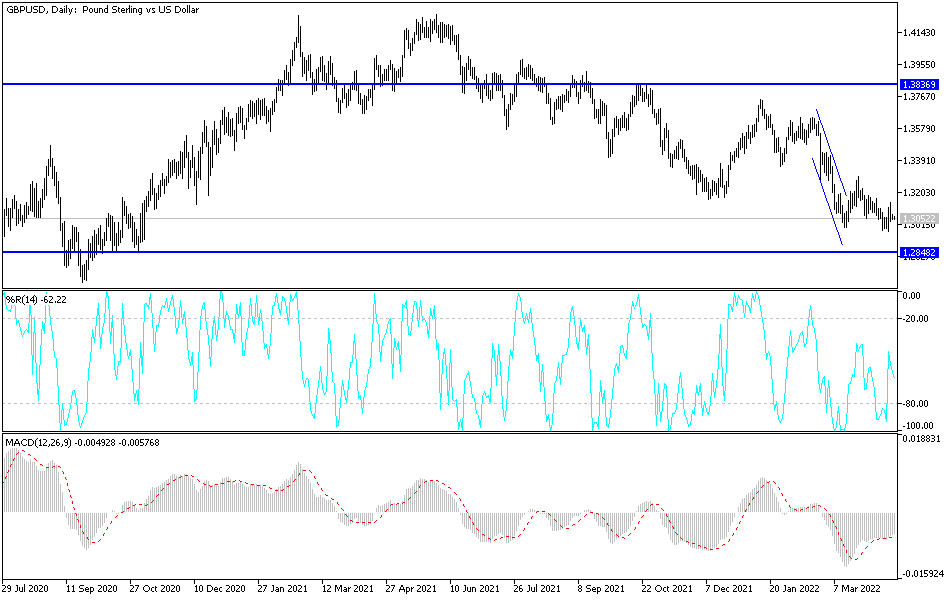

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the GBP/USD pair is trading within an upward channel. This indicates a significant short-term bullish bias in market sentiment. Accordingly, bulls will target short-term gains around 1.3300 or higher at 1.3380. On the other hand, bears will be looking to pull in for short-term pullback gains around 1.3144 or below at 1.3071.

In the long term, and based on the performance on the daily chart, it appears that the GBP/USD has recently completed the XABCD double bottom reversal pattern. This indicates that the bulls are trying to dominate the pair in the long run. Accordingly, they will look to extend the current bullish trend towards the 1.3447 resistance or higher to the 1.3660 resistance. On the other hand, bears will be looking to pounce on long-term pullbacks around 1.2994 or below at 1.2806.