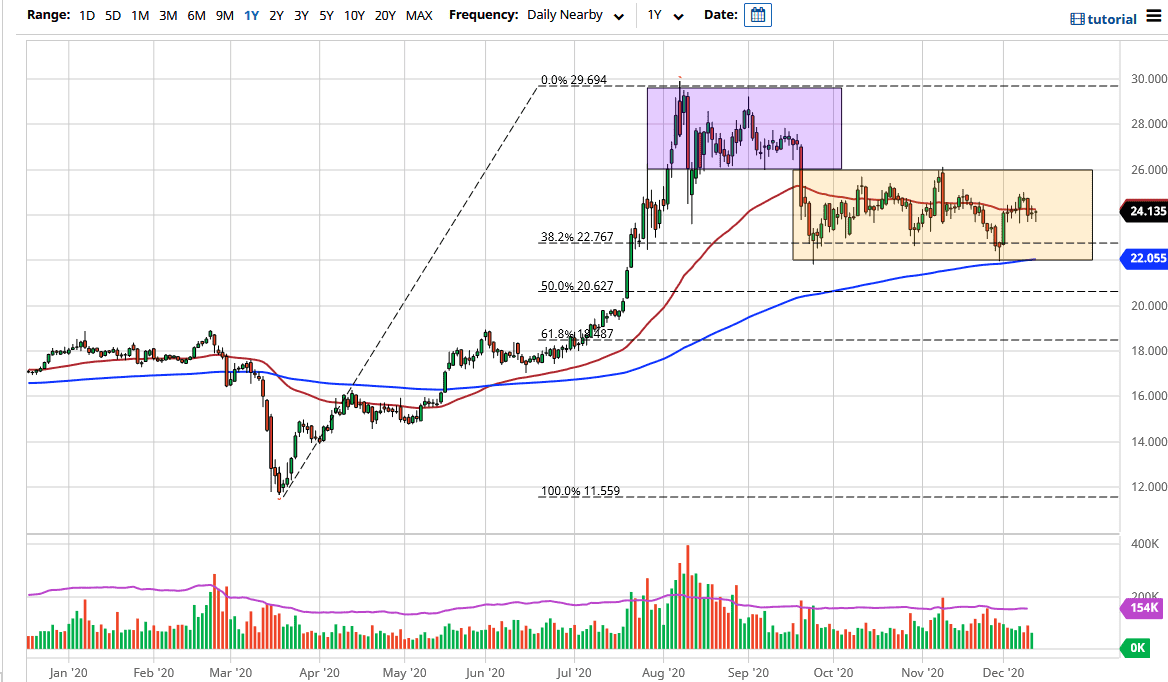

Silver markets fell initially during the trading session on Friday, reaching down towards the $23.50 level, but turned around to show signs of support again. This is an area that has shown a lot of proclivity for buying pressure, and even beyond that, we have support underneath that extends all the way down to the $22 level. The 200-day EMA sits in that area, and which is the beginning of a significant turnaround. I believe the market is likely to go towards the $26 level and the end term.

One unfortunate truth is that we have to worry about stimulus talks. After all, they are going nowhere fast, but we should ultimately get a stimulus agreement. The bigger the stimulus package, the bigger the move in silver will be to the upside. Silver is highly sensitive to the reflation trade, something that stimulus will kick off in a huge way. The 200-day EMA underneath sits at the $22 level, which is the bottom of the overall consolidation area, and, we will simply bounce around between the $22 and $26 level. A break above the $26 level allows for a move towards the $27 level, $28 level, and then eventually the $30 level. I think it will happen in time, but the reality is that we are simply digesting the massive gains that we had from before. After all, the market did shoot straight from the $12 level to the $30 level a few months back.

If we can somehow break above the $30 level longer term, it is likely that we will go to the $50 level. Right now we will just fluctuate based on the latest whims of politicians, which makes trading difficult. Because of this, you need to keep your position size relatively small.