The silver market rallied significantly during the trading session on Tuesday, ahead of the Federal Reserve's announcement on Wednesday. The market is waiting to see some quantitative easing or further action from of the Federal Reserve. Silver will continue to work against the value of the US dollar and move in a negative correlation to the US Dollar Index. The US dollar has been all over the place during the trading session on Tuesday, so it follows that we have seen a bit of volatility in the precious metal sector.

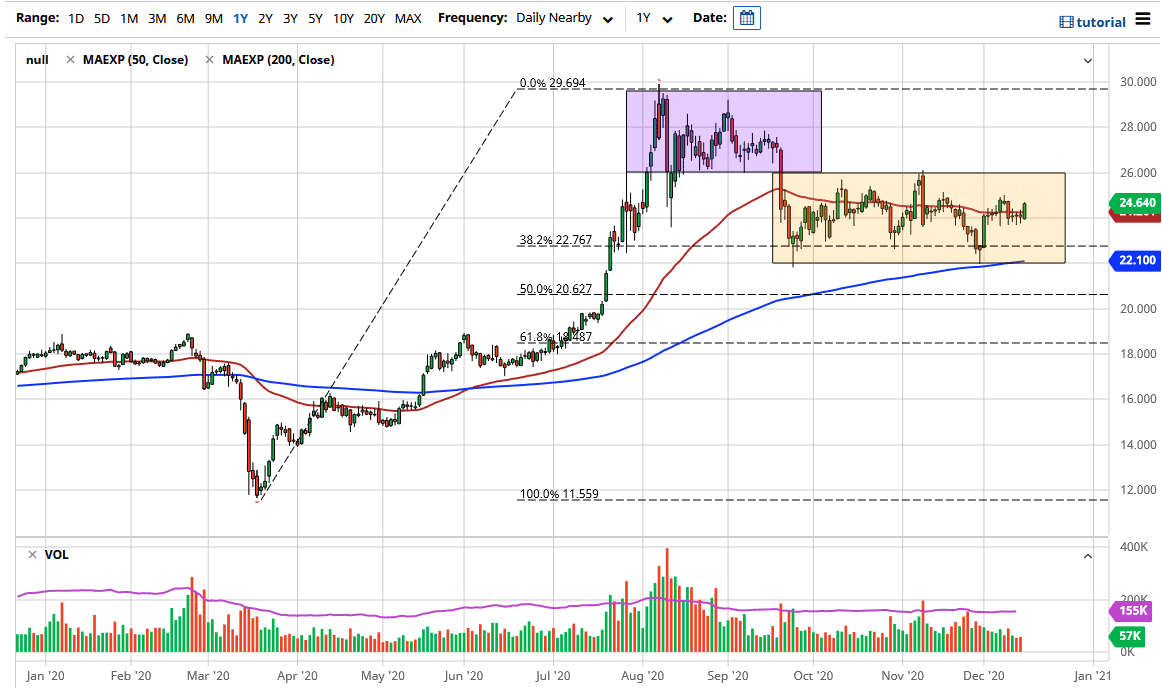

To the upside, the $25 level has offered slight resistance, but the $26 level is even more important, based on what we have seen over the last several months. If we break above the $26 level, then the market is likely to go looking towards the $28 level. It is obvious that the buyers come in every time we dip, so the Wednesday session will be interesting if we get some selling in this market, due to the fact that there would be value hunters out there.

Keep in mind that not only is the Federal Reserve looking to loosen monetary policy, but it is very likely that we will see several other central banks around the world continue to do more of the same. To the downside, the $22 level should be significant support, just as the 200-day EMA is crossing that level right now, suggesting that it could be a bit of a floor as well. We have plenty of room for value underneath so it is likely that we will see people trying to take advantage of any type of value it offers. If we were to break down below the 200-day EMA, the market will probably break down rather significantly. However, it is only a matter of time before we go higher. The $30 level above is a massive target for longer-term traders, and if we break above there the market could extend much further, perhaps even towards the $50 level, as we have attempted multiple times in the past.