Brazil remains the third-most infected country with COVID-19 with the second-highest death toll. Latin America remains one of the worst-infected regions with the pandemic, and Joao Doria, the Governor of São Paulo, confirmed that demand for the Chinese vaccine by Sinovac Biotech remains elevated. The Butantan Institute aims to produce 1,000,000 doses per day. A pending breakdown in the USD/BRL can extend the correction.

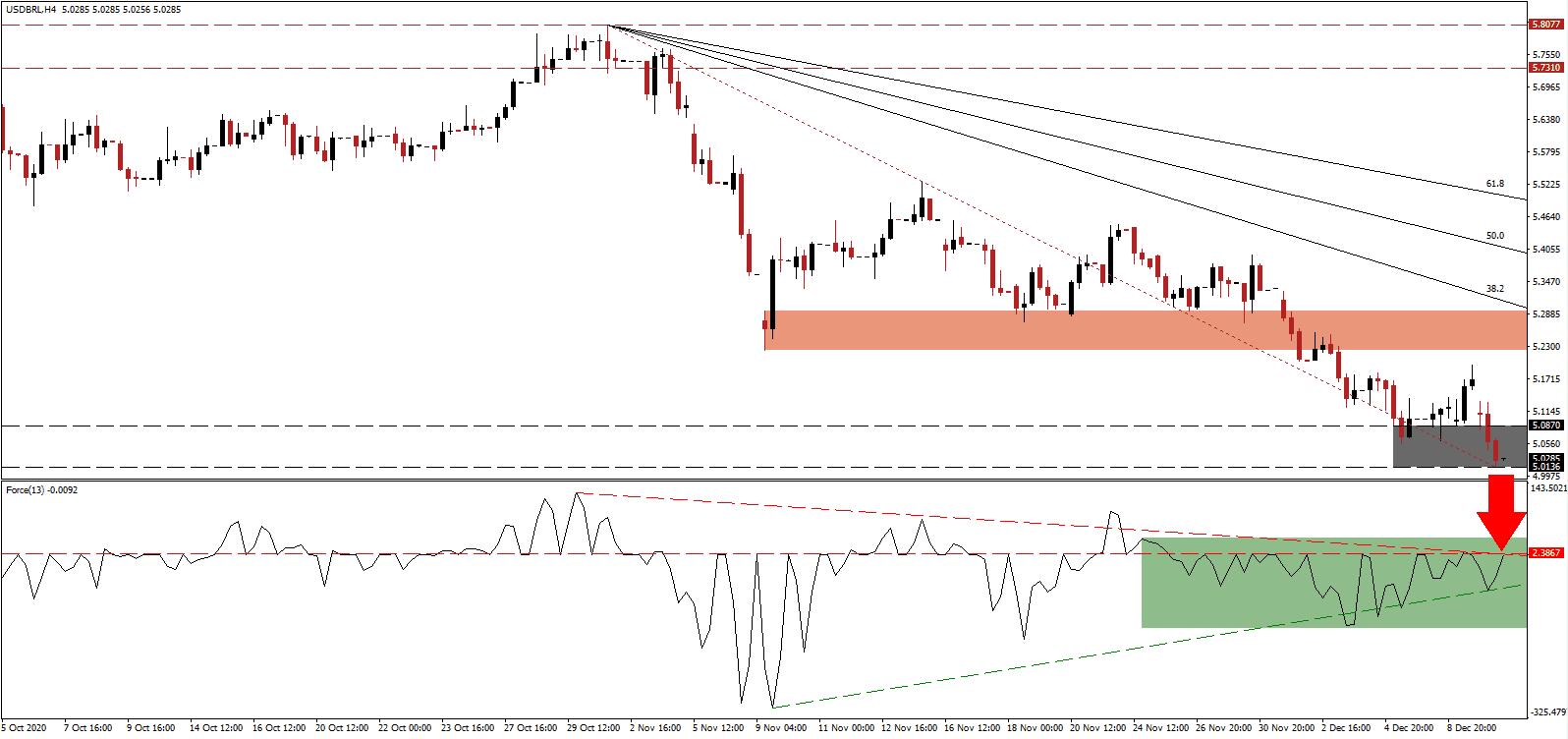

The Force Index, a next-generation technical indicator, recovered from a multi-week low, and the ascending support level pressured it into its horizontal resistance level, as marked by the green rectangle. Magnifying bearish momentum is the descending resistance level, favored to reverse recent gains. With this technical indicator below the 0 center-line, bears extend their dominance over the USD/BRL.

October retail sales expanded by 0.9% for the sixth consecutive monthly expansion, per data from the Instituto Brasileiro de Geografia e Estatística (IBGE). It confirms the recovery continues, but 2020 GDP forecasts call for a drop of 4.4%, a milder contraction than in most other countries. Bearish pressures on the USD/BRL expanded following the breakdown below its short-term resistance zone between 5.2229 and 5.2941, as marked by the red rectangle.

Adding to ongoing bullishness for the Brazilian real was the Banco Central do Brasil, which kept interest rates unchanged at 2.00%. Inflationary pressures continue to accumulate, making a reduction in interest rates unlikely. With the descending Fibonacci Retracement Fan sequence keeping the bearish chart pattern intact, a breakdown in the USD/BRL below its support zone between 5.0136 and 5.0870, as identified by the grey rectangle, is likely. The next one awaits between 4.5134 and 4.6418.

USD/BRL Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 5.0300

Take Profit @ 4.5300

Stop Loss @ 5.1800

Downside Potential: 5,000 pips

Upside Risk: 1,500 pips

Risk/Reward Ratio: 3.33

In case the ascending support level pushes the Force Index higher, a short-covering rally in the USD/BRL may follow. It will offer Forex traders a secondary selling opportunity as the outlook for the US dollar remains bearish. The upside potential remains limited to its 38.2 Fibonacci Retracement Fan Resistance Level.

USD/BRL Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 5.2200

Take Profit @ 5.2900

Stop Loss @ 5.1800

Upside Potential: 700 pips

Downside Risk: 500 pips

Risk/Reward Ratio: 1.40