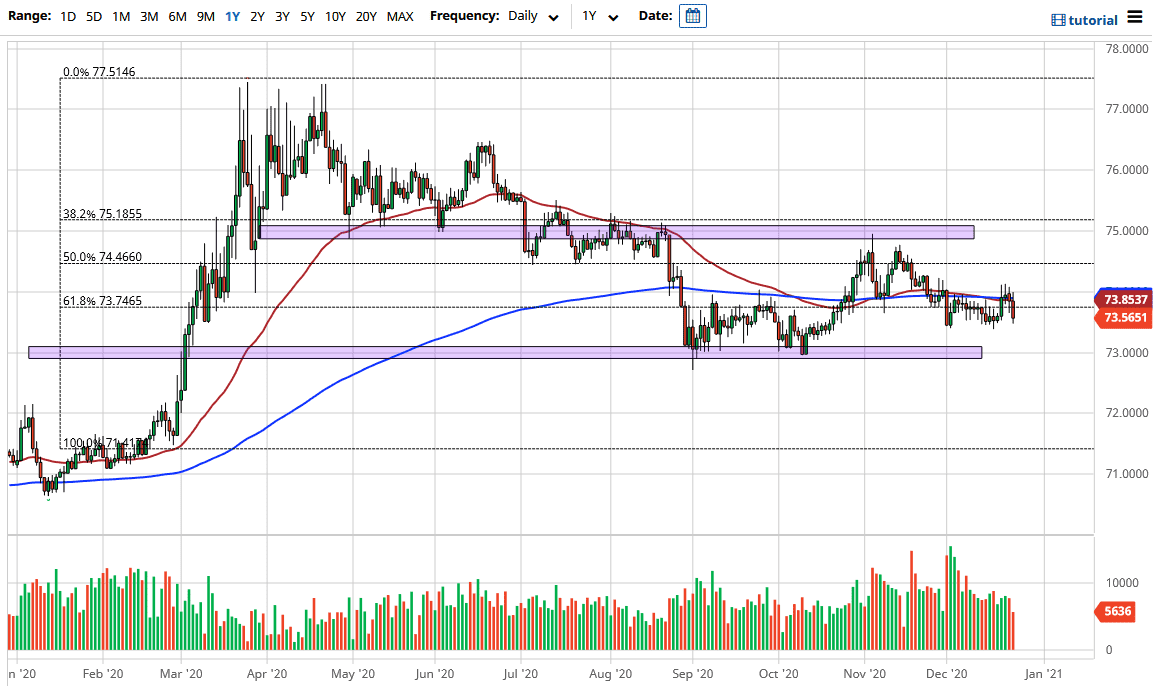

The Indian rupee rallied against the US dollar during the trading session on Thursday. However, you can only read so much into the candlestick given that it was very thin volume, which could have played quite a bit of influence into the market. The ₹73.50 level has offered support again as it has over the last couple of weeks. If we break down below there, it is likely that the market could go looking towards the ₹73 level. That is an area in which we have seen buyers more than once, so traders will be looking at this as an opportunity for a target, and perhaps a retest of the major level.

If we were to break down below the ₹73 level, then it is likely that the market will go down to the ₹72 level. Every time the market rallies it should be a selling opportunity, due to the fact that the US dollar continues to get hammered by stimulus. Furthermore, we have the “back to normal trade” that a lot of people will be paying attention to. That means that we could have traders out there looking for growth in more explosive markets than the United States. Granted, the candlestick is rather negative, but again, you can only read so much into the Thursday candlestick itself.

I believe there is significant resistance all the way to the ₹75 level, which is essentially the “ceiling” in the market right now. If we were to turn around and break above there, it would probably be due to the market pricing in something very ugly. There is a high likelihood of the market having a major meltdown as far as risk appetite is concerned, not only here but in other places. Nonetheless, that is not what is going on right now, and it certainly looks as if all roads lead to a cheaper US dollar in general. As the Indian rupee is a major emerging market currency, I suspect that this market will not be any different.