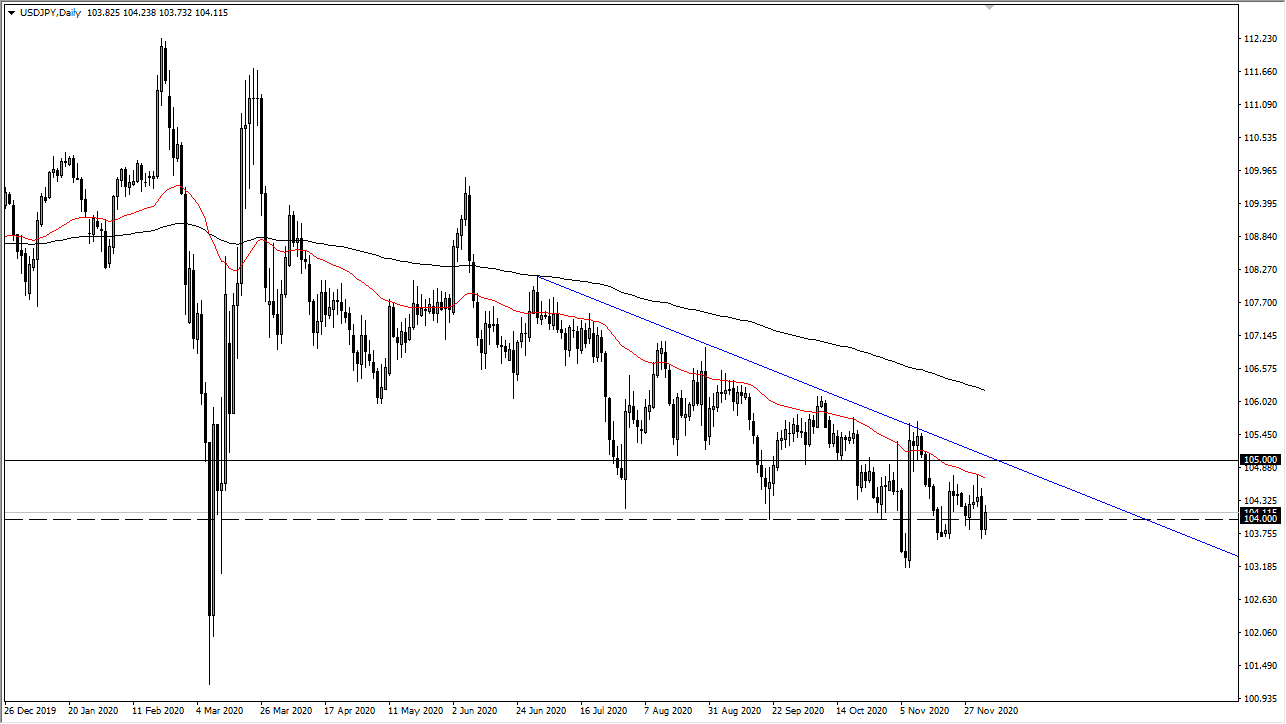

The US dollar bounced a bit during the trading session on Friday to recapture the ¥104 level. This area has offered both support and resistance, and the fact that we continue to see the market bounce back and forth from that region tells me that there is a lot of confusion here. Furthermore, you can make an argument for a symmetrical triangle, which shows indecision. Longer term, however, this is a massive downtrend that we are in, so it makes sense to continue to look for selling opportunities as they present themselves.

Just above, we have the 50-day EMA, which is an indicator that a lot of people pay attention to and has shown itself to be resistance more than once. We have seen resistance above there, all the way to the 200-day EMA, so I do not really have a scenario in which I'm willing to buy this pair. I like the idea of fading short-term rallies, as it has been profitable for some time. I do not think that we have a major move ahead of us in the short term though, so I would be cautious about putting a ton of money to work, and I certainly would be quick to take profits if I were so inclined to trade this pair.

Another use for this market is to determine relative strength for the Japanese yen. What I mean by this is that you should pay attention to other currencies that are doing well, such as the euro or the Australian dollar. On the other hand, if we see the Japanese yen lose strength against the US dollar, then you should be buying the AUD/JPY pair, the EUR/JPY pair, etc. This is because they have more room to move to the upside and it shows Japanese weakness over here. After all, most currencies are heavily influenced by how they perform against the greenback, so this is a great way to figure out what some of the other cross currencies may do until we get some clarity in this market. If we do break down below the ¥103.25 level, then the market is likely to go looking towards the ¥102 level. That is my best case scenario, but I think it is probably more or less going to be a “fade the rallies” situation.