For several trading sessions in a row, and in a process that extended for more than a month, the USD/JPY price has been moving under downward pressure. The support level at 103.67 remained a barrier to the bears' control as technical indicators rushed into strong oversold areas. However, attempts to rebound to the top remained very limited throughout that period, as the currency pair did not cross the 104.75 resistance and closed last week's trading around the 104.03 level, after a downward rally on Friday to the 103.82 support. This technically boring performance warns that a price explosion may occur in the near future, and all expectations may be for a rebound to the upside. Technical indicators have reached strong oversold areas and Forex traders are waiting for a buying opportunity more than an opportunity to sell from recent losses.

The Michigan Preliminary Consumer Confidence Index for December beat expectations of 76.5 with a reading of 81.4. On the other hand, the US PPI reading excluding food and energy for the month of November was below expectations of 1.5%, with a change of 1.4%. On a monthly basis, a change of 0.1% was recorded and expectations were of a reading at 0.2%. In contrast, the previous US Consumer Price Index for food and energy for November surpassed expectations (monthly) at 0.1% with 0.2% and, on an annual basis, it came as expected at 1.6%. On Thursday, it was announced that the number of Americans seeking unemployment benefits jumped last week to 853,000, the largest number of unemployment claims since last September. The increase in unemployment claims indicated that many US companies are still laying off workers as states re-enforce company closures and consumers avoid shopping, traveling or eating out.

Japanese GDP growth for the third quarter beat expectations (QoQ) of 5% with a change of 5.3%. On an annual basis, GDP growth exceeded expectations by 21.5%, recording 22.9%. On the other hand, total household spending for October missed the expected change of 2.5% with a change of 1.9% year-on-year. Today, the industrial TANKAN reading will be announced from the Japanese central bank, then the industrial production rate will be announced, and there is no important US economic data expected today.

The US Federal Reserve will meet this week, and they are expected to provide more detailed guidance on how long they will continue their bond-buying program, which may reassure financial markets that purchases will not end anytime soon. Therefore, the Fed could announce other moves, such as shifting more of its purchases to long-term bonds to try to reduce long-term borrowing rates and encourage spending. But most analysts believe the Fed will keep the move in reserve.

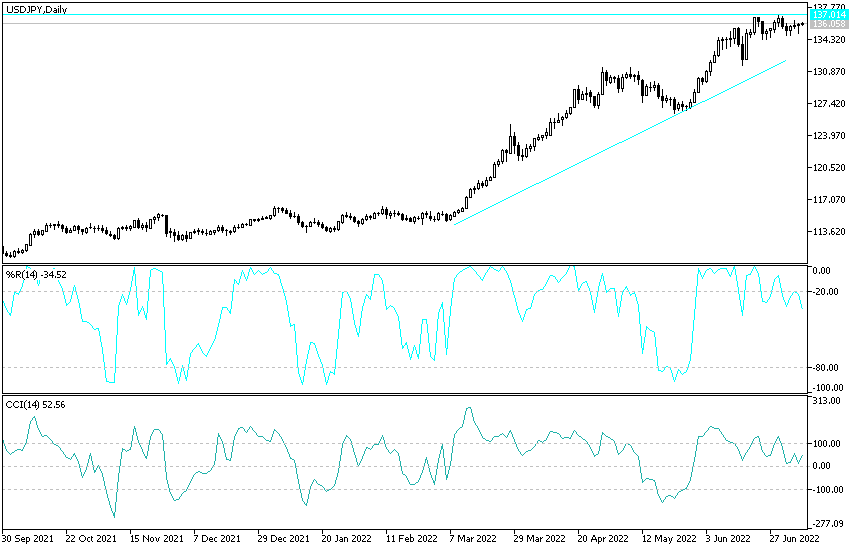

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the USD/JPY is trading within a downward channel. This indicates a slight short-term bearish bias in market sentiment. It is also closer to oversold levels in the 14-hour RSI. Accordingly, bulls will target short-term bounce gains around 104.31 or higher at 104.69. Bears will be looking for short-term gains around 103.68 or lower at 103.29.

In the long term, and according to the performance on the daily chart, it appears that the USD/JPY is trading within a sharp downtrend channel. This indicates a strong long-term downward trend in market sentiment. The pair has now retreated near the 76.40% Fibonacci level. Accordingly, bears will look to extend the current bearish move towards the support at 102.61 or less to the 100% Fibonacci level at 101.17. On the other hand, the bulls will target profits at 61.80% and 50% Fibonacci at 105.17 and 106.41, respectively.