The USD/JPY's performance will likely continue to falter throughout the last trading hours of 2020 in a bullish correction. Trading will remain limited and liquidity is lower during this week's trading because global financial markets are subject to holidays and investors' reluctance to trade. Throughout last week’s trading, the currency pair stabilized in a limited range between the support level at 103.03 and the resistance level at 103.88, and stabilized around 103.67 at the beginning of this week’s trading. The pair has not benefited at all from the pace of investor’s risk appetite.

The number of Americans seeking unemployment benefits decreased by 89,000 last week to 803,000, and despite that, the number is still high, which is evidence that the labour market is still under pressure nine months after the outbreak of the coronavirus that pushed the US economy into recession and caused millions to be laid off.

The latest number of claims shows that many employers are still cutting jobs as the pandemic tightens work restrictions and leads many consumers to stay home. Before the virus spread, the number of unemployed claims was around 225,000 a week before it reached 6.9 million in early spring when the COVID-19 virus - and efforts to contain it - calmed the economy. The pace of layoffs has slowed since then but remains historically high in the face of a resurgence of COVID-19 cases.

The latest data on unemployment claims came as the government announced that consumer spending - the main driver of the US economy - fell in November for the first time since April. The 0.4% decline, which came during the crucial holiday shopping season, heightened concerns that weak consumer spending will slow down the US economy in the coming months. So, economists have suggested that the pandemic crisis, combined with lower incomes and cold weather, will likely push Americans back in November.

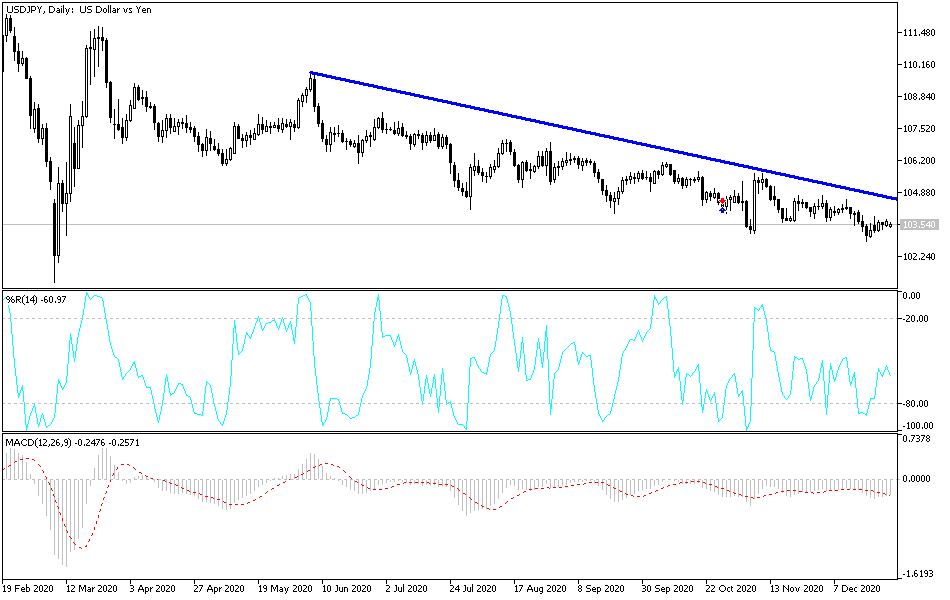

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the USD/JPY currency pair has recently made a bullish breakout from the descending channel formation. It is now trading inside a compact triangle, which might lead to another breakout. Accordingly, the bulls will target short-term bullish breakouts around 104.11 or higher at 104.50. On the other hand, the bears will target short-term breakouts around 103.24 or below at 102.86.

In the long term, and based on the performance on the daily chart, it appears that the USD/JPY is trading within a downward channel formation. This indicates a significant long-term bearish bias in market sentiment. Accordingly, the bears will target long-term gains around 102.34 or below at the 100% Fibonacci level at 101.18. On the other hand, the bulls will be looking for extinction around 61.80% and 50% Fibonacci retracement levels at 105.17 and 106.41, respectively.