A new, more contagious strain of the coronavirus and new restrictions on global economic activities ahead of the holiday season led to new investor flight from risk and the beginning of new gains for safe havens. The two elements of the USD/JPY are among the most important and profitable safe havens throughout 2020. The new mutation of the virus, originating in Britain, may impede the world's current vaccination efforts to eliminate the disease, which negatively affects the recent optimism for 2021. The USD/JPY is recovering to the 103.53 level, after sharp losses last week pushed it towards the 102.88 support level, the lowest for the pair since last March. That was when we witnessed the collapse of global financial markets due to liquidity, forcing global governments and central banks at the time to present trillion dollar plans to save the global economy.

The Bank of Japan decided to keep the key interest rate unchanged at -0.1%. Prior to that, the Japanese National Consumer Price Index excluding food and energy for November was announced at 0.3% (year-on-year) compared to a decrease of 0.2% in the previous period. The National Fresh Food Consumer Price Index decreased by 0.9% (year-on-year) in line with expectations, compared to a decline of -0.7% in the previous period. The National General Consumer Price Index also decreased by 0.9% versus a decline of 0.4% previously.

US retail sales for the month of November fell less than expected, with a change of -0.5% against expectations of 0.2%. General retail sales for the period also came in below expectations (MoM) of -0.3% with a change of -1.1%. Excluding auto, retail sales missed expectations (MoM) of 0.1% with a change of -0.9% (MoM). Then the US jobless claims for the week ending December 11th came below expectations of 800K, with a record 885K. On the other hand, ongoing claims for the previous week exceeded 5.598 million, recording 5.508 million. Building permits and housing starts also exceeded expectations.

Before the beginning of trading this week, top Capitol Hill negotiators reached an agreement on an economic relief package for COVID-19 worth $900 billion, providings long-awaited assistance to businesses and individuals, as well as the provision of funds for vaccines. Therefore, the package is expected to attract votes in Congress on Monday, creating a temporary jobless supplement of $300 a week and a direct stimulus payment of $600 for most Americans, along with a new round of subsidies for hard-hit businesses and money for schools and health, where caregivers and renters face eviction.

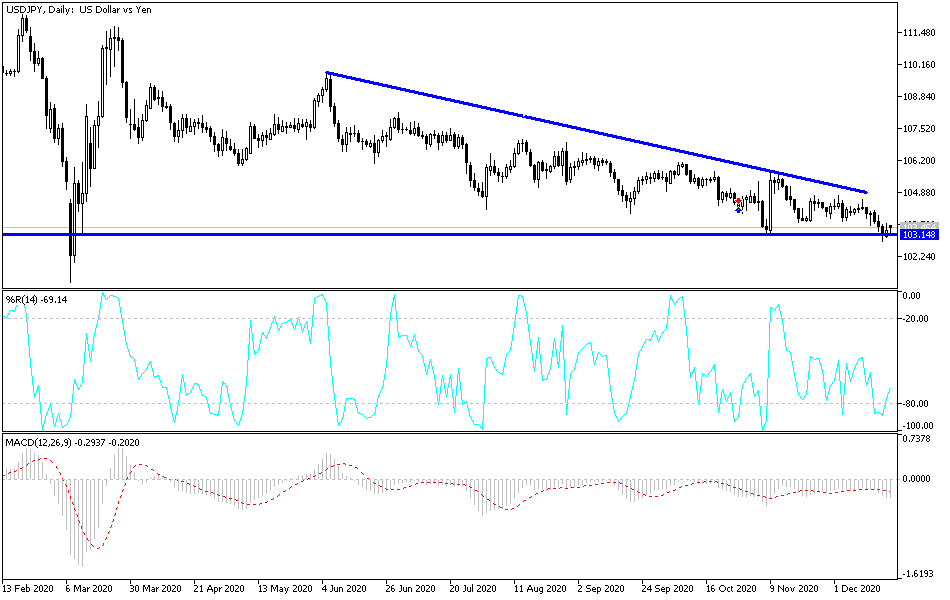

Technical analysis of the pair:

In the short term, and according to the performance on the hourly chart, it appears that the USD/JPY is trading within a descending channel formation. This indicates a slight downward trend in market sentiment. Accordingly, the bulls will target short-term gains around 103.57, or higher at 104.00. On the other hand, the bears will be looking for profits at a pullback down around 102.912 or below at 102.510.

In the long term, and based on the performance on the daily chart, it appears that the USD/JPY is trading within a downward channel formation. This indicates a significant long-term bearish bias in market sentiment. Therefore, the bears will look to extend the current downtrend towards the support level at 102.34 or less to the 100% Fibonacci level at 101.18. On the other hand, the bulls will target long-term gains at around 61.80% and 50% Fibonacci at 105.17 and 106.41, respectively.

The currency pair is not expecting any important and influential economic data from the United States or Japan during today's trading session. Investor’s risk appetite will have the biggest impact.