With the UK starting to vaccinate its population against COVID-19, global optimism continues to increase, and the debt burden of 2020 remains ignored. UK lender Barclays Bank upgraded Mexico’s 2021 GDP forecast from a previously reported estimate of a 3.5% expansion to 4.5%. Mexico refused to take on debt to bail out companies. The USD/MXN is well-positioned to breakdown from current levels and accelerate its correction.

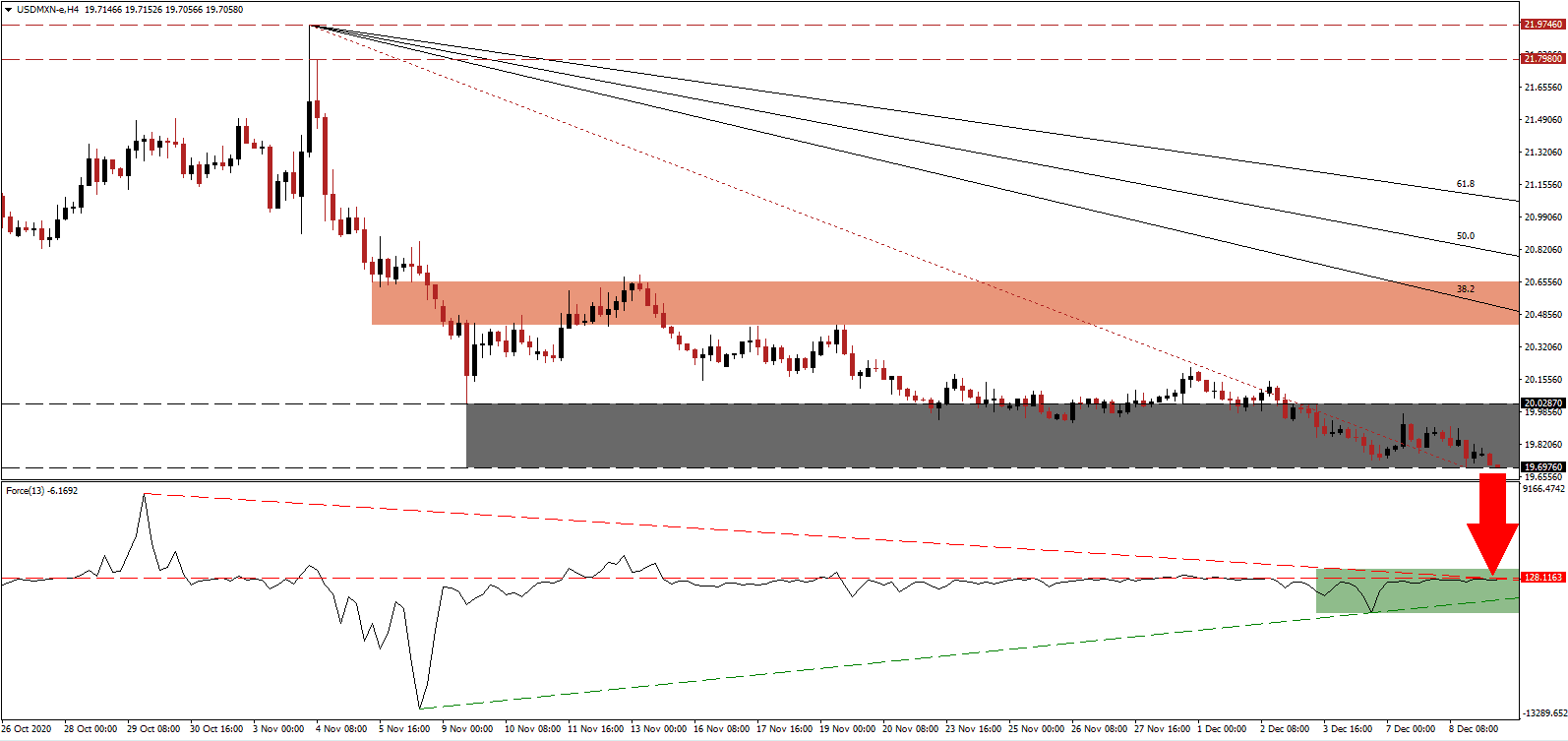

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level in negative territory, as marked by the green rectangle. Magnifying bearish pressures is the descending resistance level, favored to pressure the Force Index through its ascending support levels. Bears retain complete control over price action in the USD/MXN with this technical indicator below the 0 center-line.

Mexican President López Obrador announced plans for a new bill to tighten restrictions on foreign agents operating on Mexican soil. He added that no legal framework exists for US counter-narcotics agents conducting cross-border actions. A series of lower highs following the breakdown in the USD/MXN below its short-term resistance zone between 20.4297 and 20.6548, as marked by the red rectangle, strengthened the bearish chart pattern.

A pending vote in the Mexican Senate to force the Banco de México to purchase US dollars from local banks derived from remittances and tourism rattled the central bank. With the descending Fibonacci Retracement Fan enforcing the bearish chart pattern, the USD/MXN can correct below its support zone between 19.7408 and 20.0287, as identified by the red rectangle, and into its next one between 18.9748 and 19.2602.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 19.7000

Take Profit @ 18.9700

Stop Loss @ 19.9100

Downside Potential: 7,300 pips

Upside Risk: 2,100 pips

Risk/Reward Ratio: 3.48

In case the Force Index advances, driven by its ascending support level, the USD/MXN may attempt a breakout. With the outlook for the US economy bearish and conditions for the US dollar deteriorating, the upside potential remains limited to its 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders should consider it as a secondary selling opportunity.

USD/MXN Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 20.1200

Take Profit @ 20.4300

Stop Loss @ 19.9100

Upside Potential: 3,100 pips

Downside Risk: 2,100 pips

Risk/Reward Ratio: 1.48