Sweden opted for a controversial approach during the first wave of the COVID-19 pandemic. Its economy tanked, and the death toll was above that of its neighbors. As the second wave accelerates, Cecilia Skingsley, the First Deputy Governor of the Riksbank, warned that a delay in vaccinating Sweden would harm the economy up to SEK40 billion monthly. The USD/SEK remains under breakdown pressures inside its support zone.

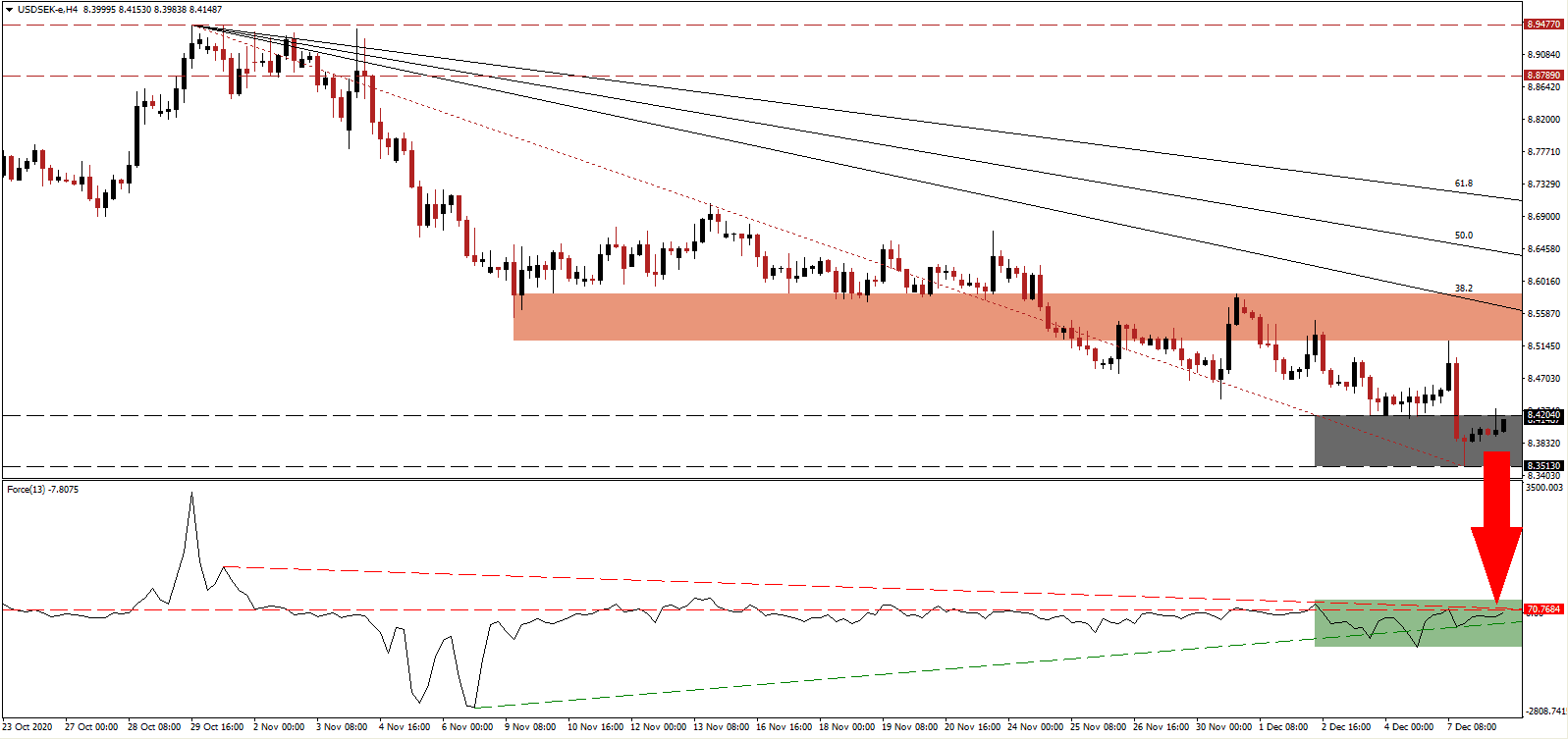

The Force Index, a next-generation technical indicator, recovered from the breakdown below its ascending support level, as marked by the green rectangle, but remains below its horizontal resistance level. Magnifying bearish momentum is the descending resistance level. With this technical indicator below the 0 center-line, bears maintain control over price action in the USD/SEK.

HSBC remains bullish on the economic potential of Sweden and Norway, suggesting that both countries will outperform the developed world in 2021. Sweden opted to tighten restrictions, which will harm GDP in the fourth quarter, after surprising to the upside in the third quarter. The breakdown in the USD/SEK below its resistance zone between 8.5216 and 8.5845, as marked by the red rectangle, spiked breakdown pressures.

Stefan Ingves, the Governor of the Riksbank, warned that the Swedish economy is worse off than economic data suggests. He added that it remains unknown how long the negative impacts will last. With the descending Fibonacci Retracement Fan sequence keeping the bearish chart pattern intact, the USD/SEK can correct through its support zone between 8.3513 and 8.4204, as identified by the grey rectangle. Price action will challenge the next one between 8.0521 and 8.1450.

USD/SEK Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 8.4000

Take Profit @ 8.0500

Stop Loss @ 8.5000

Downside Potential: 3,500 pips

Upside Risk: 1,000 pips

Risk/Reward Ratio: 3.50

In case the ascending support level pressures the Force Index higher, the USD/SEK may attempt a breakout. While the outlook for Sweden remains notably more bullish than that of the US, Forex traders should sell any rallies. The upside potential remains confined to its 50.0 Fibonacci Retracement Fan Resistance Level.

USD/SEK Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 8.5600

Take Profit @ 8.6300

Stop Loss @ 8.5000

Upside Potential: 700 pips

Downside Risk: 600 pips

Risk/Reward Ratio: 1.17