Singapore remains in firm control over the second wave of COVID-19 infections but remains cautious and vigilant over rising cases across Southeast Asia. It announced the delay of the much-anticipated air travel bubble (ATB) with fellow Asian financial center Hong Kong. It was a joint decision and marked the second delay after Hong Kong asked for one amid a rise in COVID-19 infections. The USD/SGD paused its breakdown, but more downside is likely.

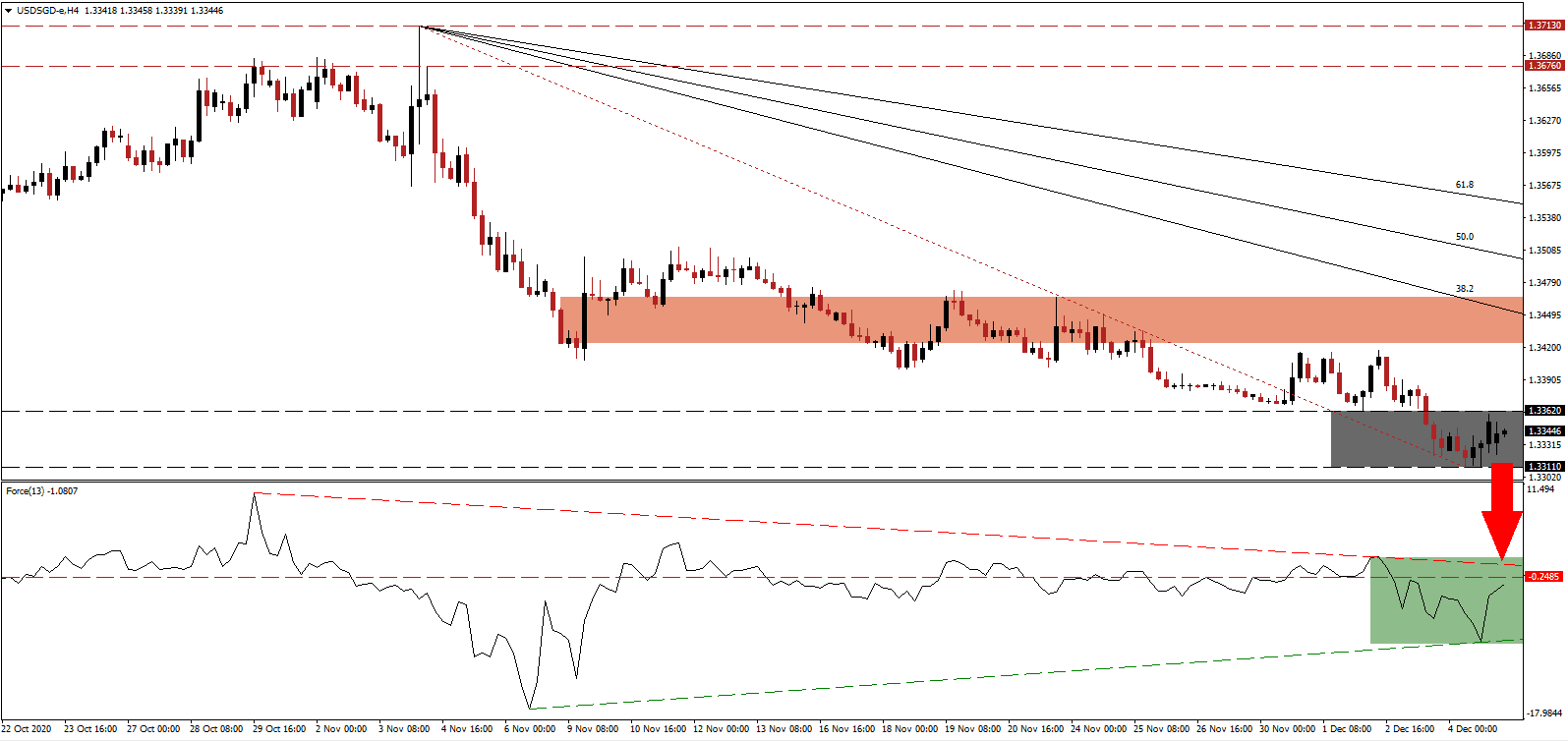

The Force Index, a next-generation technical indicator, reversed from a one-month low, which resulted in an adjustment to its ascending support level, but remains below its horizontal resistance level. Adding to breakdown pressures is the descending resistance level, as marked by the green rectangle. Bears remain in control over the USD/SGD with this technical indicator below the 0 center-line.

With the low infection rate across Singapore, hope for Phase 3 of the economic reopening before the end of 2020 increased. The multi-ministry task force cautioned that 70% of the population must use the COVID-19 tracer app TraceTogether before considering an easing of restrictions. The short-term resistance zone was revised down to between 1.3424 and 1.3466, as identified by the red rectangle, after the ongoing sell-off in the USD/SGD.

Six members of ASEAN remain eligible for vaccine funding assistance under the COVID-19 Vaccine Global Access (COVAX) mechanism. Singapore announced it would contribute $5 million to ensure that low-income and low-middle-income countries can afford the vaccine. The descending Fibonacci Retracement Fan sequence is well-positioned to force the USD/SGD through its support zone between 1.3311 and 1.3362, as marked by the grey rectangle, into its next one that awaits between 1.3213 and 1.3285.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.3345

Take Profit @ 1.3215

Stop Loss @ 1.3385

Downside Potential: 130 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 3.25

A breakout in the Force Index above its descending resistance level can spark a short-covering rally in the USD/SGD. Forex traders should consider it a selling opportunity with the COVID-19 pandemic out of control across the US. The upside potential remains reduced to its 50.0 Fibonacci Retracement Fan Resistance Level.

USD/SGD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.3420

Take Profit @ 1.3510

Stop Loss @ 1.3490

Upside Potential: 70 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.00