With new COVID-19 infections continuing to increase, South Africa needs a united government to navigate the second wave of the pandemic more than ever. President Cyril Ramaphosa’s acknowledgment that the ruling African National Congress (ANC) remains divided adds to an uncertain future. The USD/ZAR remains inside of its support zone, but dominant bearish momentum can result in a new breakdown.

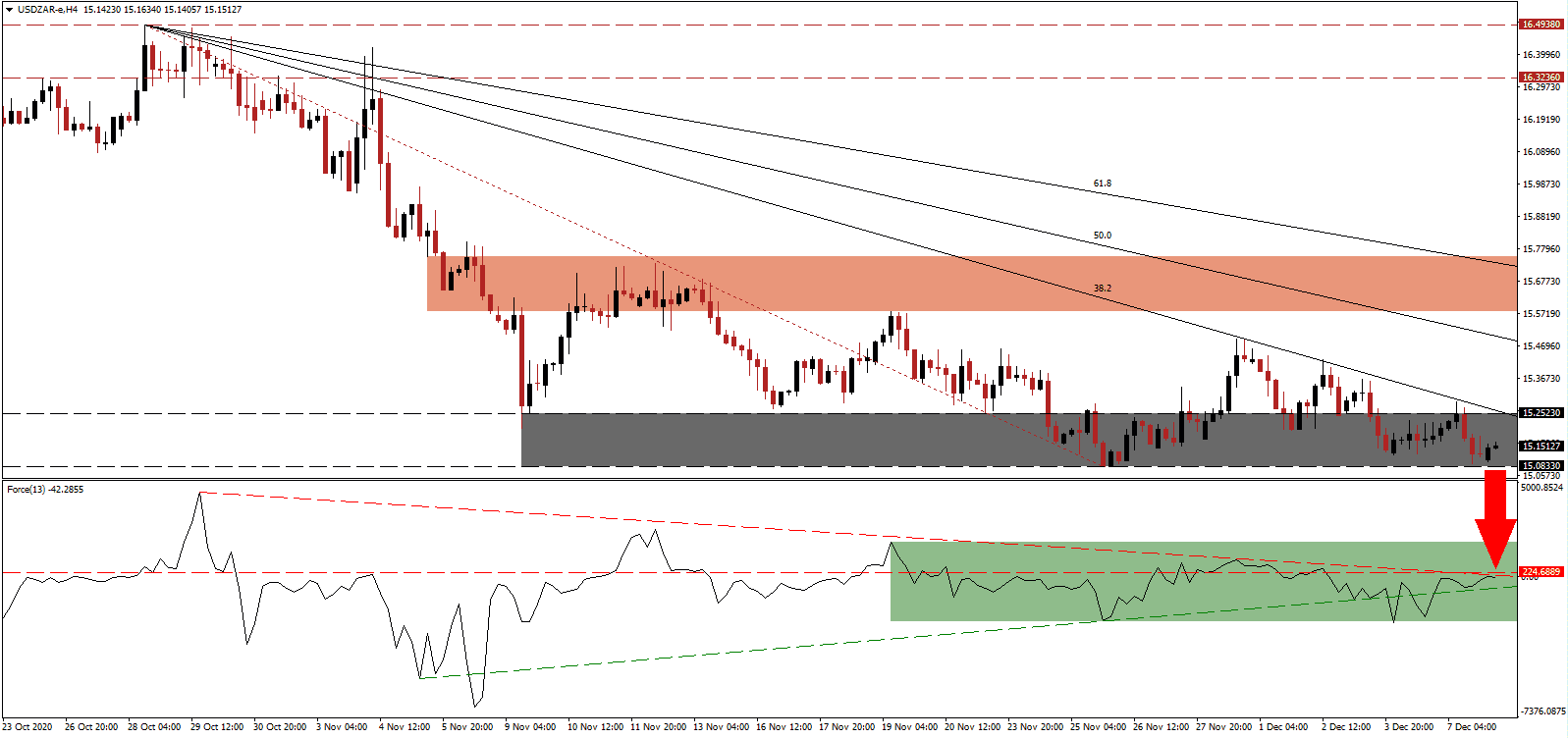

The Force Index, a next-generation technical indicator, recovered above its ascending support level, but it remains below its horizontal resistance level in negative territory. Adding to downside pressure is the descending resistance level, as marked by the green rectangle. With this technical indicator below the 0 center-line, bears remain in control over the USD/ZAR.

South African politicians are known to present their plans well but to act little. President Ramaphosa continues to repeat the message that the post-COVID-19 economy must include all. Cas Coovadia, the CEO of Business Unity South Africa, cautioned against an economic and fiscal crisis. A series of lower lows in the USD/ZAR below its short-term resistance zone between 15.5805 and 15.7539, as identified by the red rectangle, suggests more selling.

Highly-indebted and struggling utility Eskom, partially blamed for pre-COVID-19 economic issues, faces more problems. Steel and Engineering Industries Federation of Southern Africa (SEIFSA) lobbies for a moratorium on electricity tariff hikes to support the recovery. The descending Fibonacci Retracement Fan threatens a breakdown in the USD/ZAR through its support zone between 15.0833 and 15.2523, as marked by the grey rectangle. The next one awaits between 14.5932 and 14.7294.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 15.1500

Take Profit @ 14.6000

Stop Loss @ 15.3000

Downside Potential: 5,500 pips

Upside Risk: 1,500 pips

Risk/Reward Ratio: 3.67

Should the ascending support level pressure the Force Index higher, the USD/ZAR may attempt a breakout and partially retrace its sell-off. Forex traders should consider this a secondary selling opportunity amid deteriorating conditions in the US with a bleak outlook. The upside potential remains limited to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 15.4500

Take Profit @ 15.6500

Stop Loss @ 15.3000

Upside Potential: 2,000 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.33