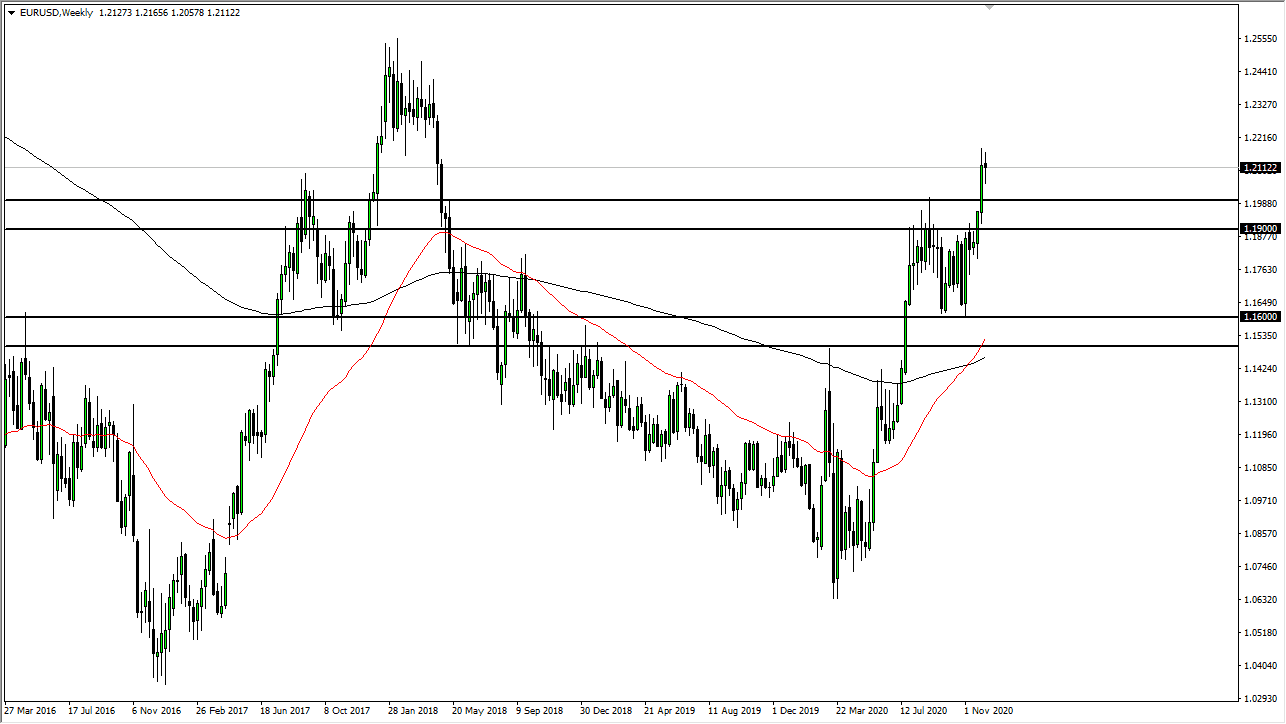

EUR/USD

The euro fluctuated during the course of the week, showing signs of indecision. As we pull back towards the 1.20 level, it should offer a lot of interest for people to go long. I have no interest in shorting the euro, especially as stimulus is almost certainly coming soon. It is likely that people will try to pick up value as it occurs. To the upside, the 1.23 level is the target. As long as stimulus does come through in the United States, this is a pair that should climb.

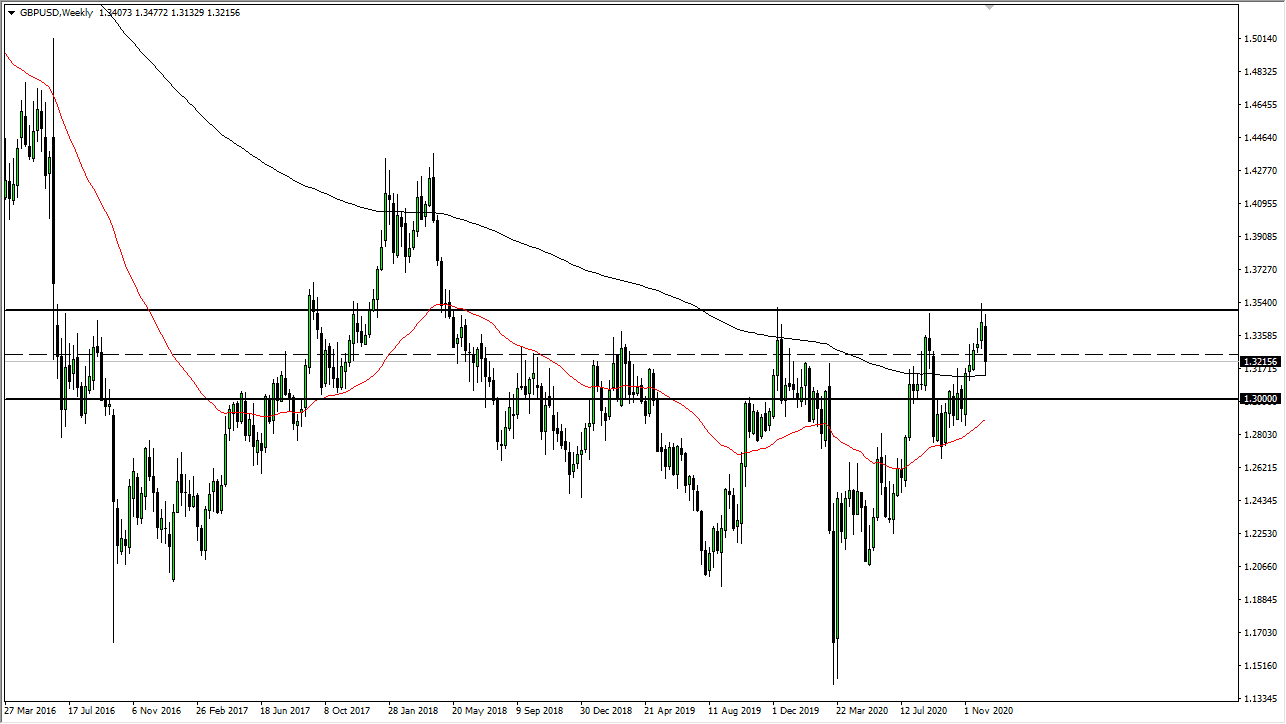

GBP/USD

Unfortunately, the British pound continues to have a lot of noise around it, due to the fact that we are still trying to figure out what is going to happen with the Brexit situation. Both the EU and the UK have suggested that a “no-deal Brexit” is the most likely of outcomes. However, they both suggested that they would come up with a new time to talk sometime by Sunday. This is a market that continues to find buyers on dips, but I would consider this more of a range-bound market between the 1.30 level and the 1.35 level at the moment.

AUD/USD

The Australian dollar has broken above the 0.70 level, which is a very bullish sign. It looks like pullbacks will continue to be bought into, especially if we get stimulus coming out of the US. The bigger the stimulus package, that more likely we are to see the Australian dollar take off. There should be plenty of support all the way down to the 0.74 handle, so we are getting ready to make a bigger move. It does not mean that we will do this within the next couple of days, but clearly we are breaking to the upside.

USD/CAD

The US dollar fluctuated against the Canadian dollar as we broke down below the 1.28 level. The resulting weekly candlestick is a bit of a hesitation after a massive breakdown during the previous week. We could get a bounce, but I think it will be sold into, especially near the 1.30 level. Otherwise, if we were to break down below the bottom of the weekly candlestick, then we will continue to grind towards the 1.26 handle. Pay attention to oil, which is trying to break higher and therefore could bring downward pressure on this market.