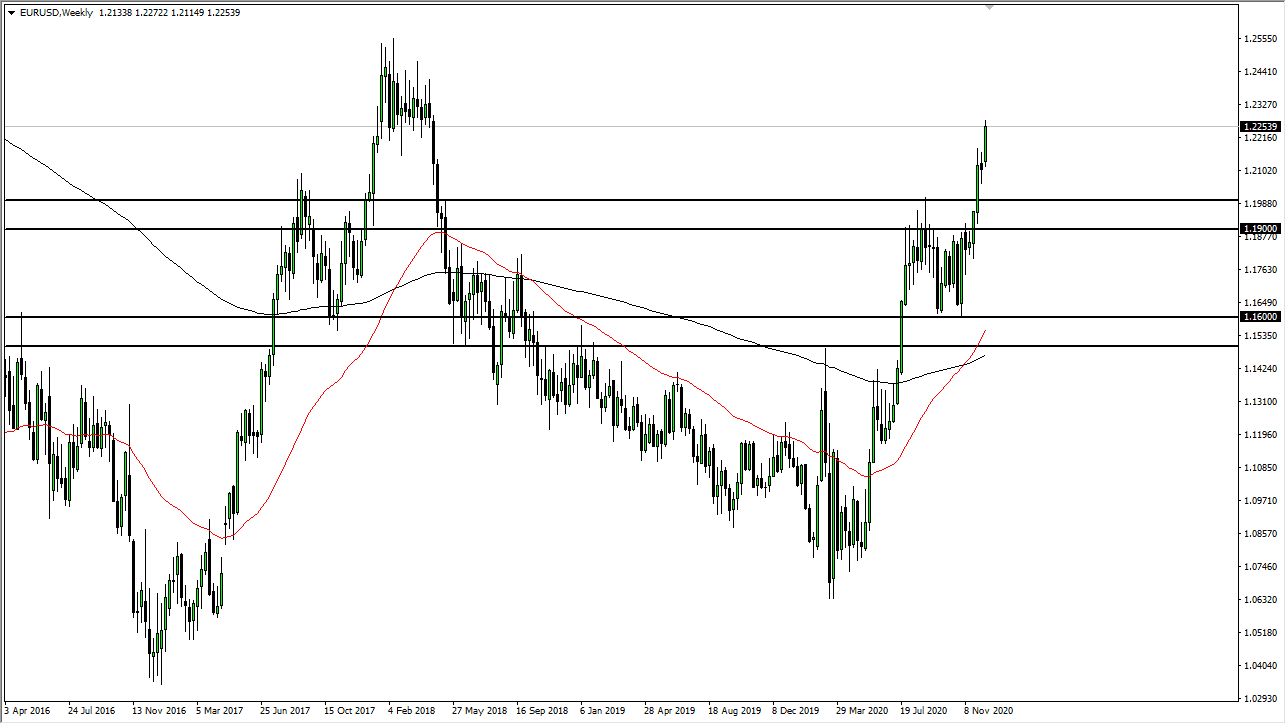

EUR/USD

The euro had another strong week as we head into the end of the year. This is going to be a very difficult week to trade, simply because there will not be much in the way of liquidity at times, and the occasional big order could move the market. Nonetheless, I fully anticipate that the euro is going to try to reach the 1.23 level given enough time, so I still look at short-term dips as short-term buying opportunities. Expect choppy and noisy conditions for most of the week.

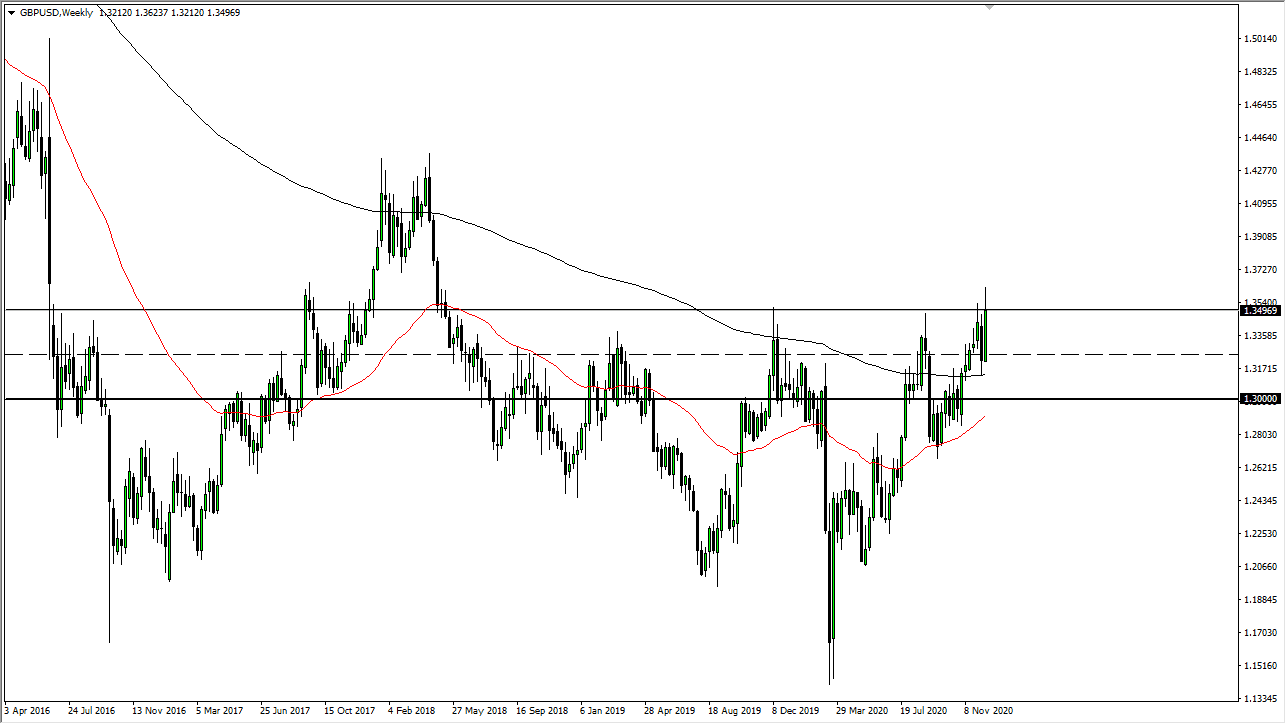

GBP/USD

The British pound continues to wait for politicians to get it together as far as the Brexit negotiations are concerned. We are getting closer to a deal it seems, and we are most certainly in “crunch time.” It is anticipated that the two sides will eventually get something going, as you can see based on the fact that the British pound refuses to fall for a significant amount of time. Every time it dips, traders come back in to buy it. I suspect that we will either see a gap higher on Monday due to a deal, or a pullback that eventually gets bought into, which we have seen multiple times in the past.

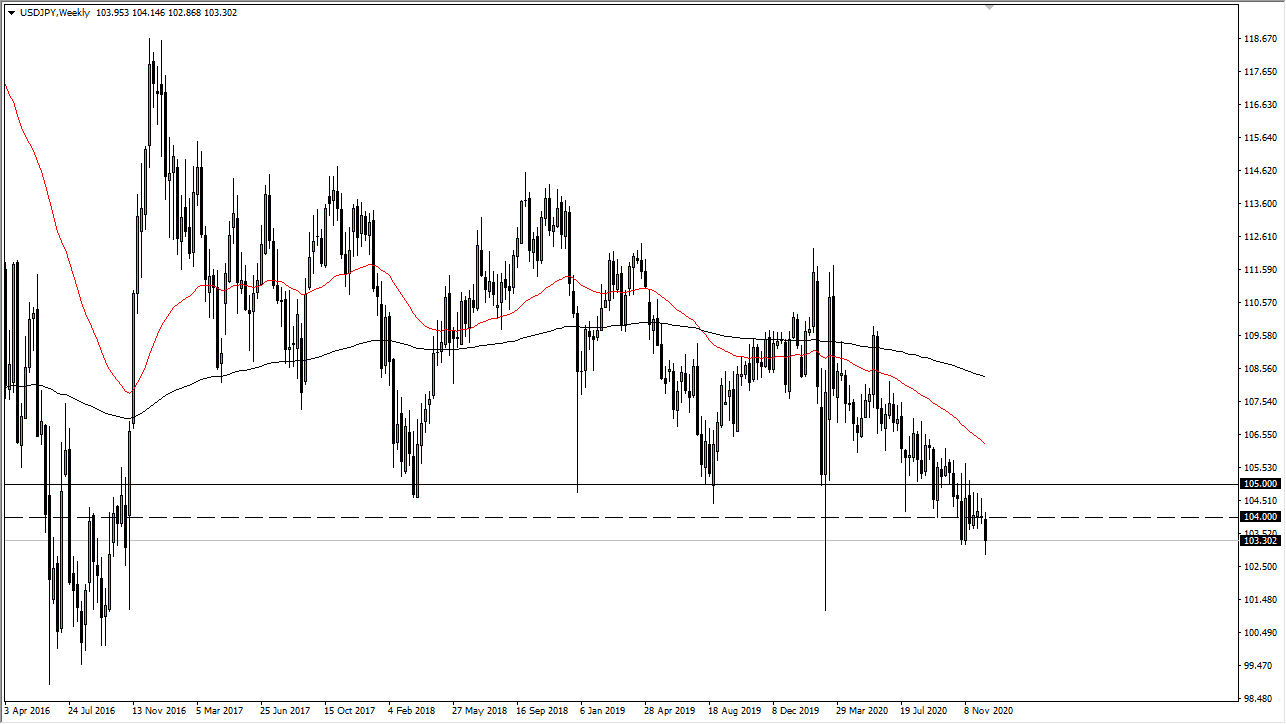

USD/JPY

The US dollar continues to fall against the Japanese yen, as it has been doing all year. This is based on stimulus, and perhaps even based on a little fear out there. What we are seeing is a simple continuation of what has been the case for so long. With that, we will find trading opportunities going forward if we simply just wait for short-term rallies to fade. Longer term, I believe that we are going to go looking towards the ¥102 level.

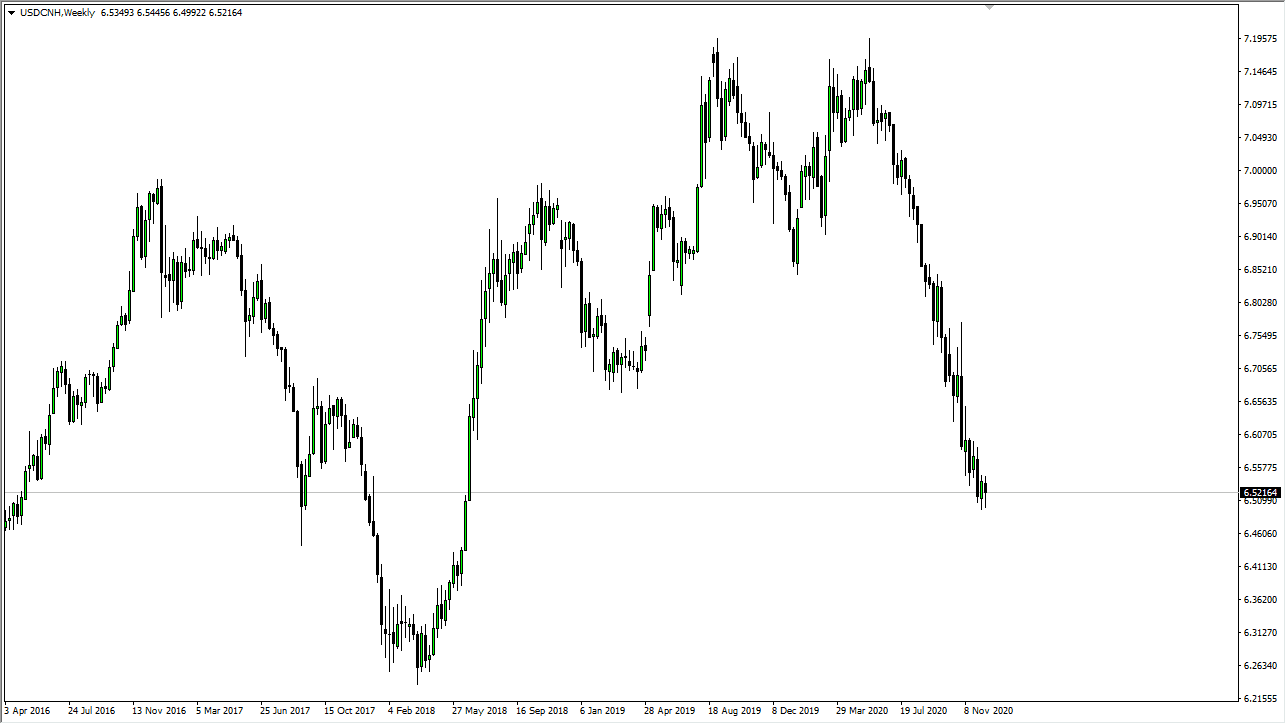

USD/CNH

The US dollar has fallen again for the week against the Chinese yuan, but it does suggest that there is a bit of support below at the psychologically important 6.50 level. After all, the weekly chart looks absolutely horrible and is almost certainly due for a bounce. However, stimulus coming out of the United States could be the reason we break down. While I do not necessarily trade this pair, I do look at it as an indicator as to where risk appetite is in relation to the US dollar.