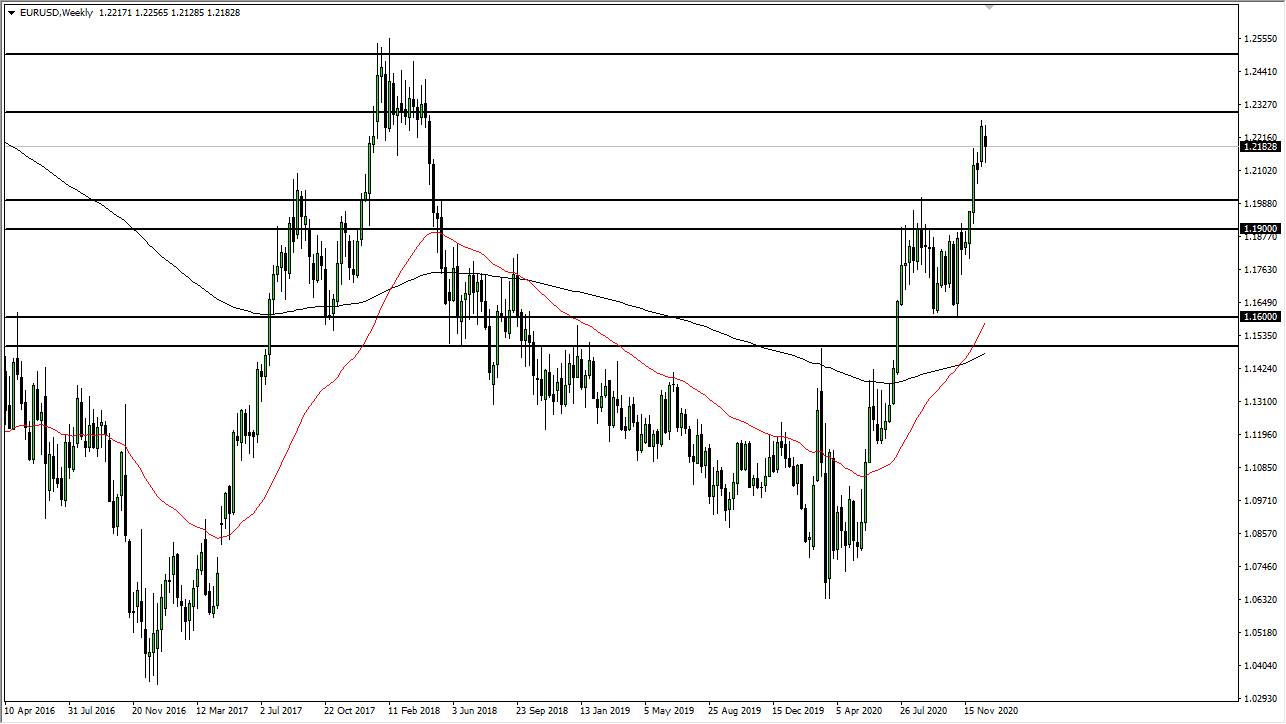

EUR/USD

The euro has been all over the place as we finally got through the Brexit talks. The 1.23 level above is a target, because it had previously been an important level. To the downside, the 1.20 level underneath is support, and at this point we will probably fluctuate in general. We are doing holiday trading, so this will work out in one of two ways: either we will go nowhere, or we will go all over the place. It is probably best to step away from this pair due to the fact that the Brexit deal still needs to be read, so the next week or two could be very noisy. I suspect that we will stay in this overall range.

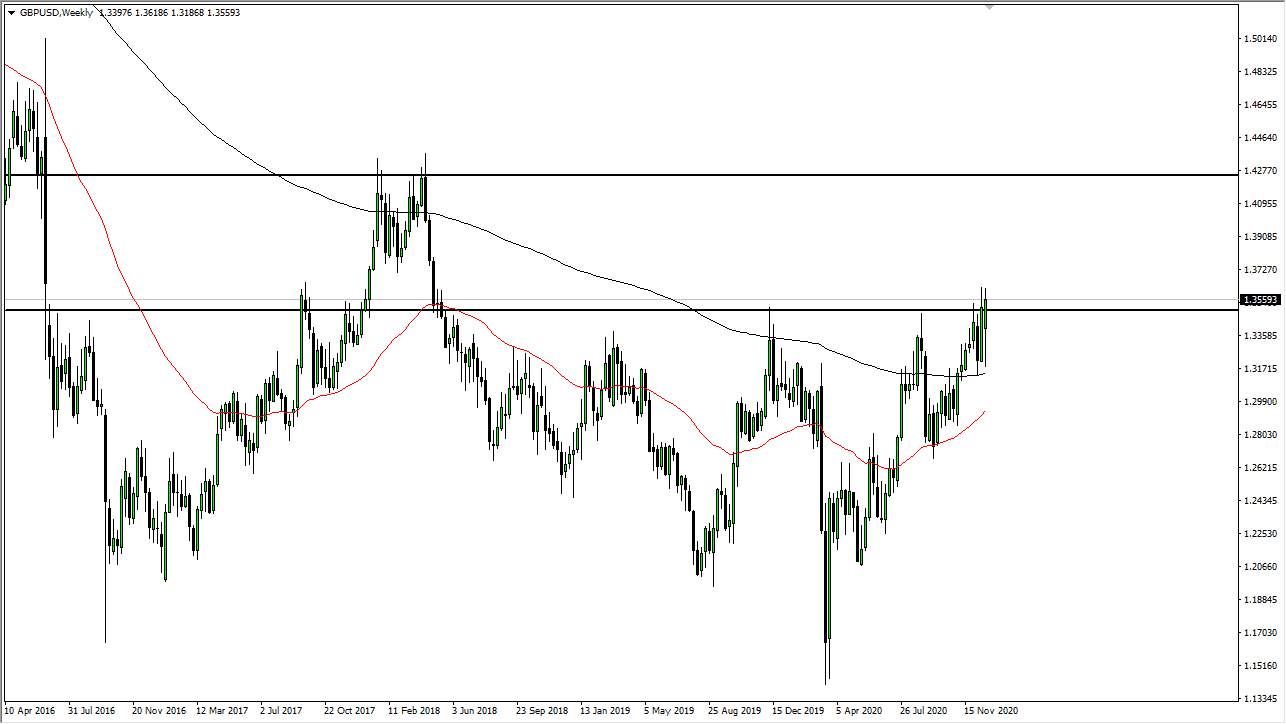

GBP/USD

The British pound initially fell during the week but then saw a lot of bullish pressure as the Brexit situation finally produced a deal. It is still in the early stages, though, and people are trying to figure out what it will end up doing to trade. Nonetheless, a deal is exactly what we have been waiting for. Now the question is going to be: “What do we focus on next?” After all, the British economy is going to suffer from the lockdown, so even if we do rally from here, I suspect that the upside is probably somewhat limited over the next month or two. I certainly would not be a seller, and you are probably better off waiting for short-term pullbacks to use to your advantage.

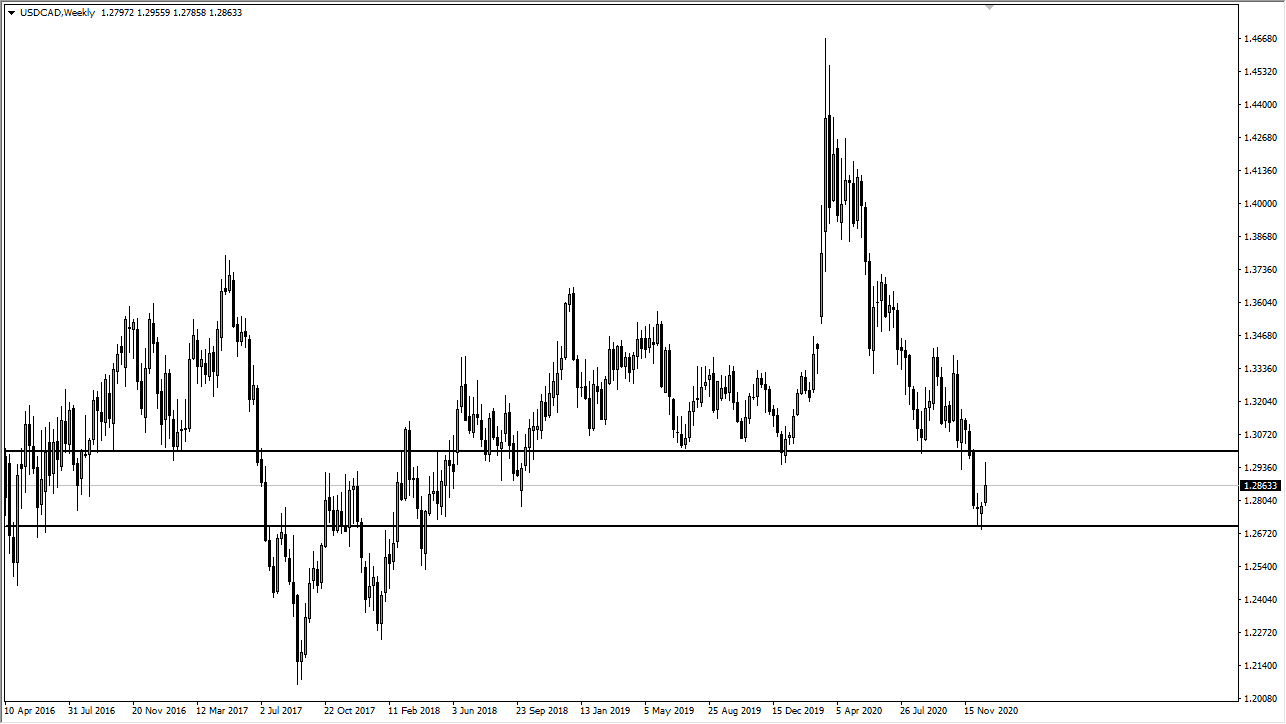

USD/CAD

The US dollar rallied significantly against the Canadian dollar in the beginning of the week, but gave back the gains later on as we started to focus on Christmas. The 1.30 level above is a large, round, psychologically significant figure and an area that could cause some issues. We recently saw some relatively better-than-anticipated Canadian economic figures, which helps the loonie as well. If we do get a breakout above the $50 level in the West Texas Intermediate Crude Oil market, that probably will send this pair back towards the 1.27 level, especially when combined with stimulus coming out of the US.

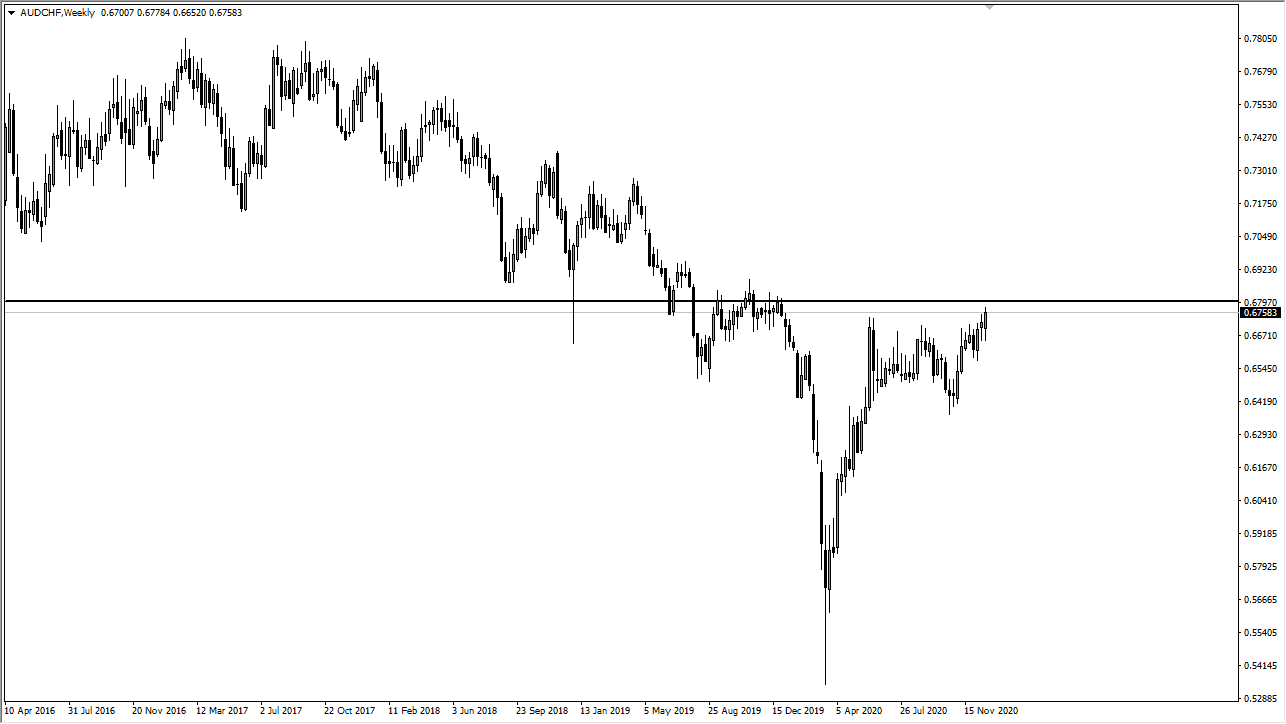

AUD/CHF

The Australian dollar initially fell during the course of the week against the Swiss franc, but then took off to the upside. That is a good sign for the Aussie. It is worth noting that this is a great barometer of risk appetite, as the Australian dollar is considered to be a “risk on currency”, while the Swiss franc is considered to be a “safety currency.” If we can break above the 0.68 level, it is likely that we could go looking towards the 0.69 level, followed by the 0.70 level. On the other hand, if we do get a lot of people concerned in the markets overall, that will send this market down to the 0.66 handle.