The West Texas Intermediate Crude Oil market fell a bit during the trading session on Tuesday as oil continues to look for direction. The market is likely to continue to see buyers underneath, but at this point it is interesting to see that we cannot move forward until we figure out multiple things that are out there influencing the pricing of most assets. This includes stimulus in the United States and Brexit. Markets are waiting to see whether or not these issues can get solved in order to drive up demand.

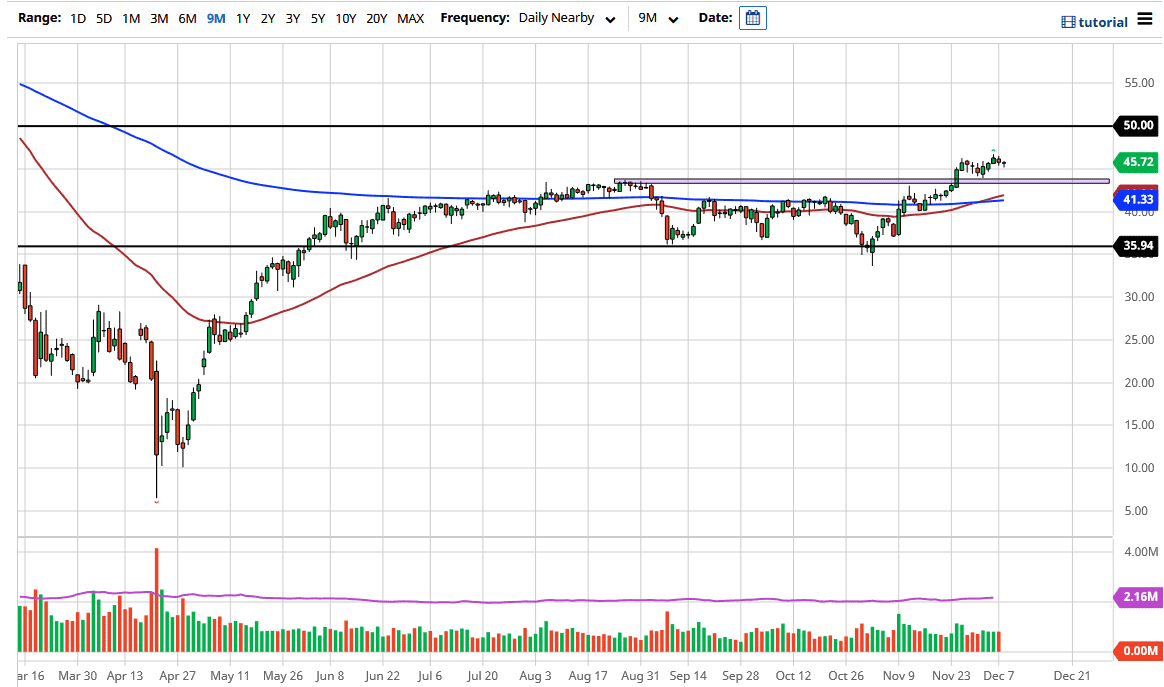

Looking at the chart, the $43.50 level was the scene of a major breakout and has been retested for support already. I think there are plenty of buyers underneath, and it is likely that we will continue to see value hunters come into the market as we drift towards that area. We probably have one more leg higher, as we have broken out but really have not done anything with it quite yet. The fact that we are simply killing time here suggests that although this market has shown itself to be bullish, it is not necessarily exploding to the upside. So although we have upward momentum, we are not necessarily going to launch into the stratosphere.

Recently, the 50-day EMA has broken above the 200-day EMA, the so-called “golden cross” which is a longer-term “buy-and-hold” type of indication. However, I do not think that it is going to stick; rather, it is just simply more of a move to the upside waiting to happen. The $50 level above should be the next psychological barrier, and we could get a move towards that level as soon as the stimulus, or even Brexit, is settled. You should also pay attention to the US Dollar Index because it does tend to move oil if it falls, since it takes more of those US dollars to buy a barrel of oil. Although I do not see this market taking off to the upside very rapidly, shorting crude oil right now will be next to impossible. You should probably look at short-term charts to buy dips and find value.