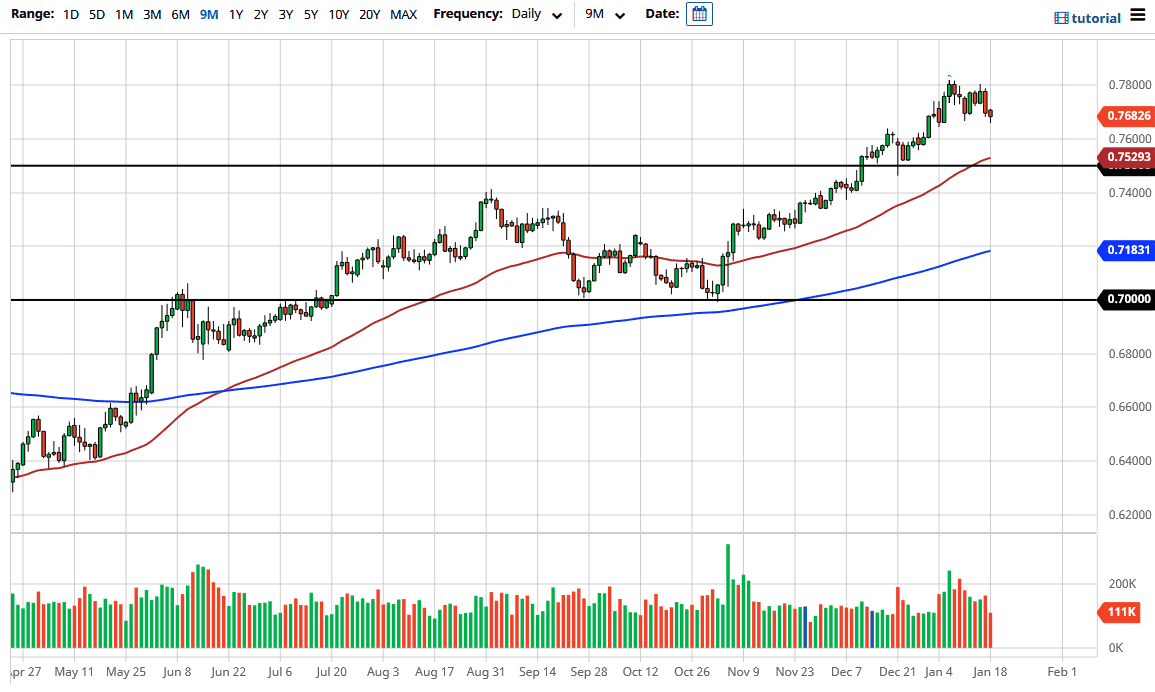

The Australian dollar fell a bit during the trading session on Monday but still continues to see a lot of upward pressure in general. The Monday session was a holiday in the United States, being Martin Luther King, Jr. Day, and it is likely that we did not see enough volume to read much into the candlestick. We did bounce a bit towards the end of the day, but that could have been day traders out of Europe closing out their positions more than anything else.

To the downside, the 50-day EMA underneath is sitting just above the 0.75 handle, which is a large, round, psychologically significant figure. The market is likely to see a reaction there, assuming that we even get that far. The Australian dollar is highly levered to the commodity markets in general, so it is going to follow the ebbs and flows of stimulus coming out the United States. There is still a significant amount of chatter when it comes to what the Congress will actually pass, so I would be a bit cautious at this point, but I think that somewhere near that 0.75 level there will be significant demand.

If we break down below that level, then it is likely we could go looking towards the 0.74 level next. I do believe that breaking down below there opens up the markets for an even more significant pullback, perhaps down to the 0.72 level. However, this is a very strong uptrend and it simply got a bit overdone. A pullback is healthy and should be exactly what the market needs to have happen in order for the uptrend to continue. I believe that the market will eventually go looking towards the 0.80 level above, but it may take a while to get there. This is a scenario in which the easy money has already been made. I believe in buying dips, but I believe in doing so in little bits and pieces, because when the market gets this overdone the corrections can be somewhat brutal. Pay close attention to the size of the stimulus package coming out of the United States, because that will be one of the leading drivers of what we see next.