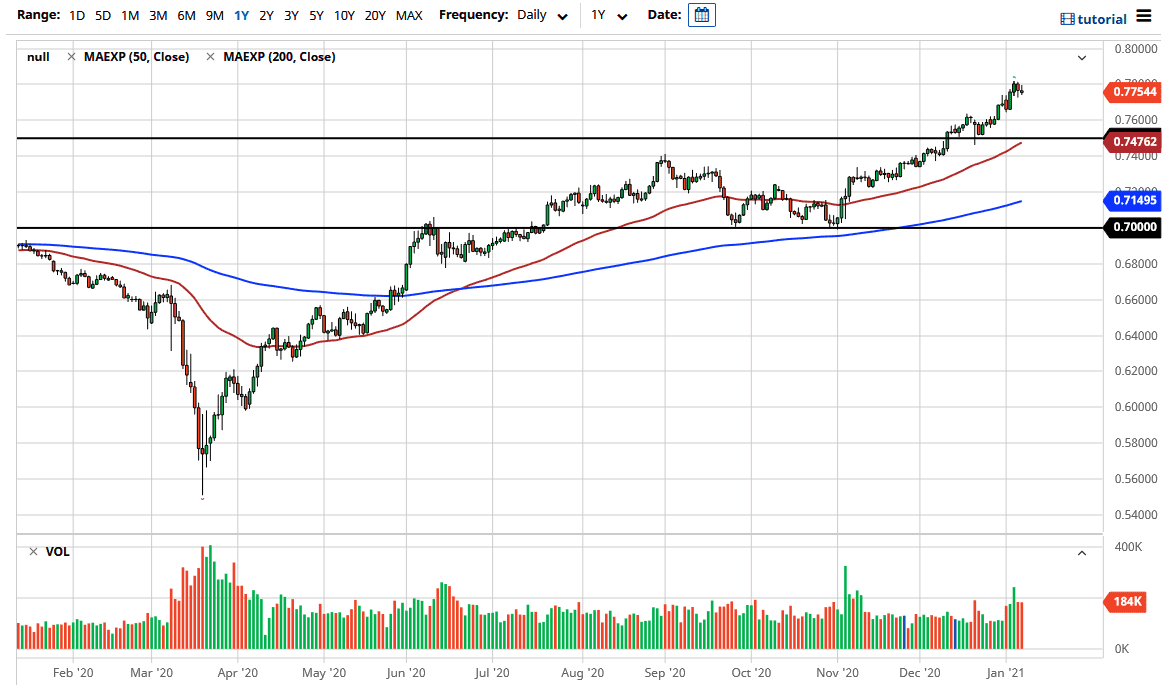

The Australian dollar pulled back a bit from the 0.78 level, but now looks likely to go lower to find value. The candlestick for the day looks rather anemic, but one of the biggest drivers of what is going on is the fact that the 10-year interest rate has started to climb. That has a bit of US dollar strength in what probably would have been thought of as a relatively quiet day otherwise. Yes, it was non-farm payroll Friday, but at the end of the day, there was not a whole lot in the way of action outside of the bond market that really moved anything.

To the downside, I believe the 0.76 level is the beginning of significant support down to the 0.75 level. The 50-day EMA is starting to get to that area as well, and it is sloping higher. It is likely that market participants will continue to see buyers try to take advantage of value as it appears. The Australian dollar is obviously tied to the stimulus package in the United States, as the Aussie economy is highly levered to commodities. There will be plenty of value hunters underneath, so if you are patient enough, you might get a nice buying opportunity. Long term, I think that the Aussie dollar has further to go, as the US dollar certainly is going to struggle.

Having said that, with the interest rates in America rising in the short term, it is very likely that we will see US dollar strength. However, this is a short-term phenomenon, so I would be looking for signs of support underneath and willing to take advantage of it. To the upside, the 0.80 level is a psychologically important figure, so it is only a matter of time before we try to get there. The market will continue to be noisy, but at this point, it is best to simply trade with the overall trend, which is to the upside. A little bit of patience could offer a nice buying opportunity. I would not be wanting to jump in right away in this type of environment.