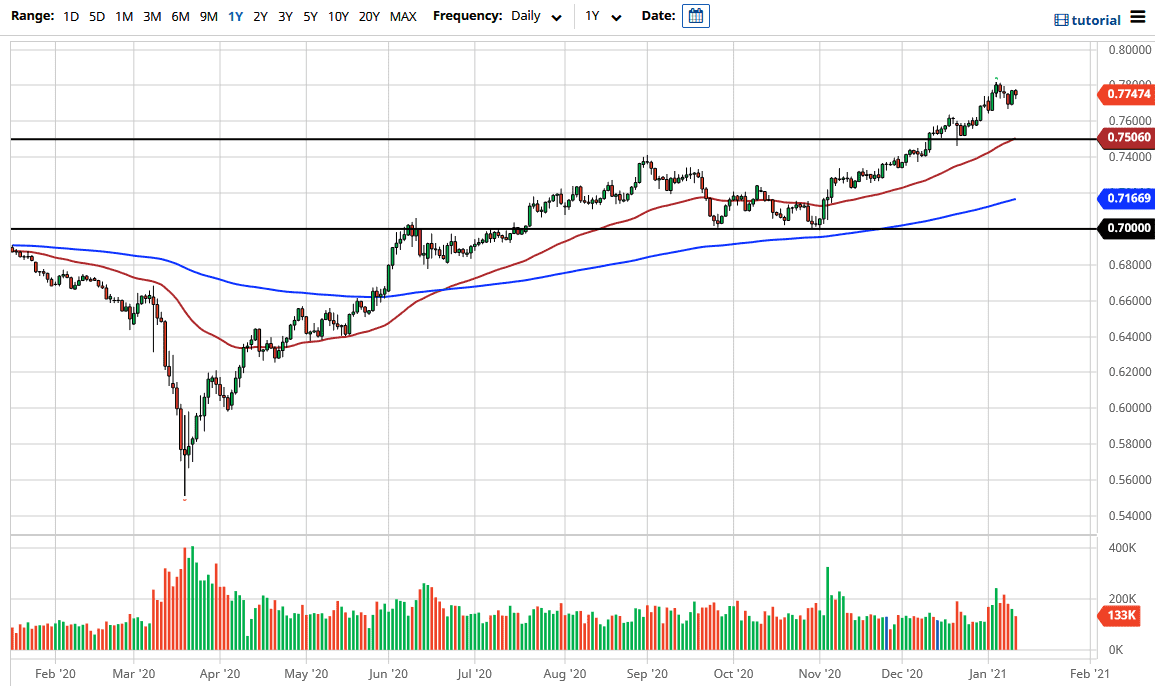

The Australian dollar fell a bit during the trading session on Wednesday, but still looks very bullish overall. After all, we did recover some of the initial losses, which suggests that perhaps momentum is building to the upside, based upon US dollar weakness and the entire “reflation trade”, as money flows into economies. Furthermore, even though we had a rather strong candlestick during the trading session on Tuesday, this would suggest that there should be follow-through.

To the upside, the 0.78 level is an area that will continue to attract a certain amount of attention, if for no other reason than the fact that it is a large, round, psychologically significant figure. However, it should be noted that the area holds no long-term specific value - just that it is a big figure. Long term, I do believe that we will slice through the 0.78 level and go looking towards the 0.80 level above, which has a much more historically important aspect to it.

At this point, the trade is essentially all about the US dollar, and what is going on with it. It has been shrinking a bit over time, but the last couple of days have seen the markets trying to get a grip on themselves, as they may have gotten far ahead of themselves when it comes to shorting the greenback. Long term, stimulus and a multitude of other reflationary reasons will have people looking to pick up the Aussie, as demand for copper, iron, aluminum and gold will all pick up.

The market has massive support below at the 0.75 level, so I consider that to be the “floor in the market” as things currently stand. Not only is that an area that should be structurally important, but it is also an area where we have the 50-day EMA crossing at the moment. That tells me that long-term traders will continue to look at it as a potential support level, and I think that any pullback towards that area will more than likely be thought of as “a gift” by most traders. I have no interest in shorting this market, at least not unless something drastic happens from a macroeconomic standpoint.