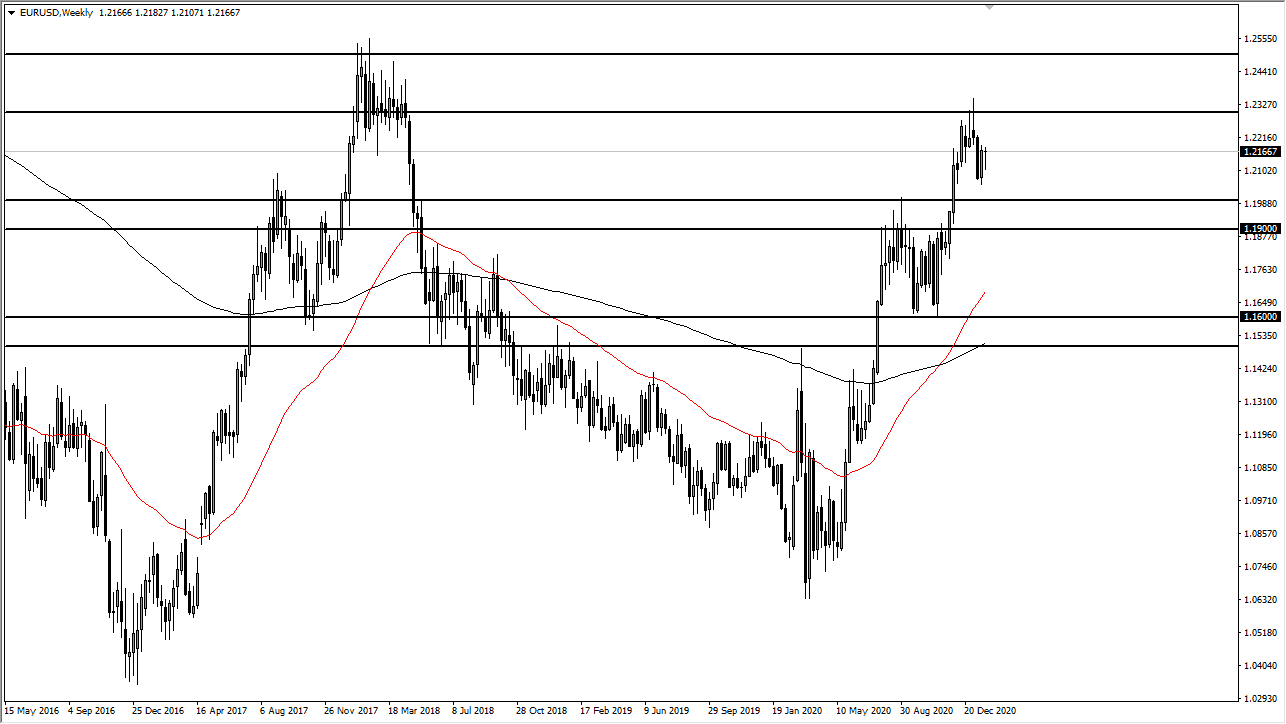

The euro has been bullish against the US dollar over the last couple of months, but the month of January left a lot to be desired. We have not had much in the way of clarity when it comes to momentum, as we initially smashed into the 1.23 level, only to turn around and fall again. I believe that is what we are looking at here: more consolidation.

While I do think that eventually the US dollar will get sold off, I do not necessarily believe that the euro is going to be your first choice to short the dollar against. The European Union has its own plethora of issues, not the least of which is deteriorating business confidence in Germany, and the very slow coronavirus vaccine rollouts that have been nothing short of abysmal. In fact, it is very likely at this point that Spain is going to enter another recession, and while Spain is not necessarily the bulk of the European economy, it certainly does not bode well for many other economies. At this point, we are getting rather close to Christine Largarde doing something to protect the European economy. It is because of this that although I do think there will be a certain amount of upward momentum, it is going to be very difficult to break above the 1.25 level during the month of February.

There are some other things to pay attention to across the pond as well. For example, the stimulus that was going to eviscerate the US dollar may not be as big as initially thought. If that is going to be the case, then the momentum and rate of change will obviously be affected. To the downside, I believe that the 1.20 level is rather supportive and extends down to the 1.19 level. If we break down below there, then we have a lot of noise between 1.19 and 1.16 to contend with. During the bulk of the month though, I fully anticipate that this pair will stay between 1.20 and 1.23 and, unless something drastically changes. If the Federal Reserve gets extraordinarily dovish again, that might be a catalyst, but the upward momentum in this pair will be dwarfed by other markets such as the Australian dollar/US dollar, New Zealand dollar/US dollar, and other commodity based currencies.