The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

It is a good time to be trading markets right now, as there are many valid strong trends in favor of stocks and riskier assets.

Big Picture 24th January 2021

In my previous piece last week, I saw the most attractive trade opportunity as short of the EUR/GBP currency cross following a daily close below the support level identified at 0.8866, provided that daily close was within the bottom third of the day’s range.

This was enough to keep out of trouble, as although the EUR/GBP currency cross made two daily closes below 0.8866, neither close was in the bottom third of the day’s range.

Last week’s Forex market saw the strongest rise in the relative value of the New Zealand dollar and the strongest fall in the relative value of the U.S. dollar. There is still a valid, long-term, strong trend against the U.S. dollar, meaning it is an attractive time to be trading Forex, as the greenback is the prime driver of the Forex market.

Fundamental Analysis & Market Sentiment

The headline takeaway is that we are seeing a resumption of risk sentiment and a flow out of safe havens such as the U.S. dollar, although there are increasing concerns over global speed and effectiveness of the coronavirus vaccine rollout. The two countries with the most advanced progress of inoculating their populations, Israel and the U.A.E., are seeing their stock markets outperform the global market since the start of 2021.

Last week saw President Biden assume office and make several executive orders, although none of them have really impacted financial markets. The longer-term effect of Biden’s economic policy of delivering a massive additional $2 trillion stimulus is likely to see continuing weakness in the U.S. dollar in line with its existing long-term trend.

Last week again saw a lower level of volatility in the Forex market compared to the previous week, although there were major central bank policy releases from the European Central Bank, the Bank of Japan, and the Bank of Canada. These releases had little effect on the markets.

Global stock markets remain broadly bullish with several indices making new all-time highs last week. The three major U.S. indices, the S&P 500, the NASDAQ 100 and the Dow Jones 30 all reached new highs.

This week is likely to be dominated by U.S. advance GDP data and the FOMC statement, due on Thursday and Wednesday, respectively.

Last week saw the global number of confirmed coronavirus cases and deaths drop very slightly. However, numbers remain relatively high, and there are concerns that new mutations of the virus may be spreading which are more deadly and possibly resistant to the first generation of vaccines which are being rolled out. Many countries are looking to impose additional travel restrictions, notably Israel, which is likely to seal its border for at least two weeks.

The strongest growth in new confirmed cases is happening in Albania, Andorra, Argentina, Bahrain, Bolivia, Brazil, Chile, Costa Rica, Czech Republic, Estonia, Finland, France, Germany, Guatemala, Honduras, Indonesia, Jamaica, Kazakhstan, Kosovo, Kuwait, Latvia, Lithuania, Malaysia, Mexico, Nigeria, Paraguay, Peru, Portugal, Senegal, Slovakia, Slovenia, Spain, Sri Lanka, Sweden, Switzerland, Tunisia, the U.A.E., Uruguay, and Venezuela.

Several countries have begun vaccination programs. Israel has vaccinated over 27% of its population (including 80% of over-60s) with a first dose of the Pfizer vaccine, and over 10% with a second and final dose. The U.A.E. is next with over 24 doses given per 100 people so far.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that the U.S. Dollar Index printed a bearish inside candlestick last week. This suggests that the dollar may now be due a resumption of movement in line with the strong, long-term bearish trend – although the pace of this trend has slowed over recent weeks. Overall, next week’s price movement in the U.S. dollar looks marginally likely to be downwards. For this reason, it will probably be wise to take only short USD trades over the coming week.

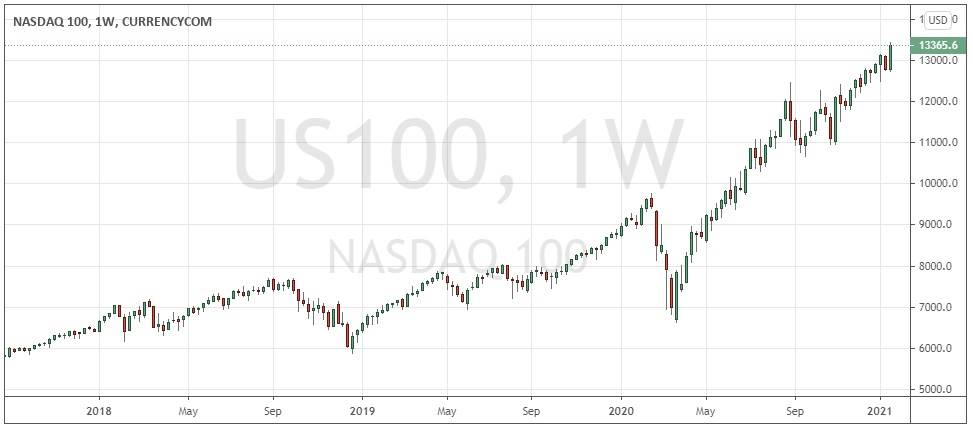

NASDAQ 100 Index

Many stock market indices had a good week last week, especially in the U.S.A. where all the major indices hit new all-time highs as a new president was inaugurated. Tech stocks, represented within the NASDAQ, advanced especially strongly. The week ended with a close near the top of the week’s range and on above-average volatility, suggesting that the index is likely to rise further over the coming week.

GBP/USD

Although the U.S. dollar is weak, there are few currencies which are advancing strongly against it. The most well-established trend against the greenback is expressed now in the British pound. However, the trend is slow and subject to deep but short pullbacks. This trend is probably best traded by waiting for a new 50-day high closing price, and then for a down day the next day, at which point a long trade entry might be made profitably from the dip. An alternative method would be to identify key support levels and trade bullish reversals at such levels on intraday time frames.

Bottom Line

I see the best likely opportunities in the financial markets this week as being long of the NASDAQ 100 Index, and in looking for short-term long trades in the GBP/USD currency pair following a down day right after a new 50-day high daily (New York) closing price is made.