The British pound has been quietly positive during most of January, but at this point we are on the verge of a breakout. The month of February should be rather good for the British pound, or at the very least, somewhat negative for the US dollar.

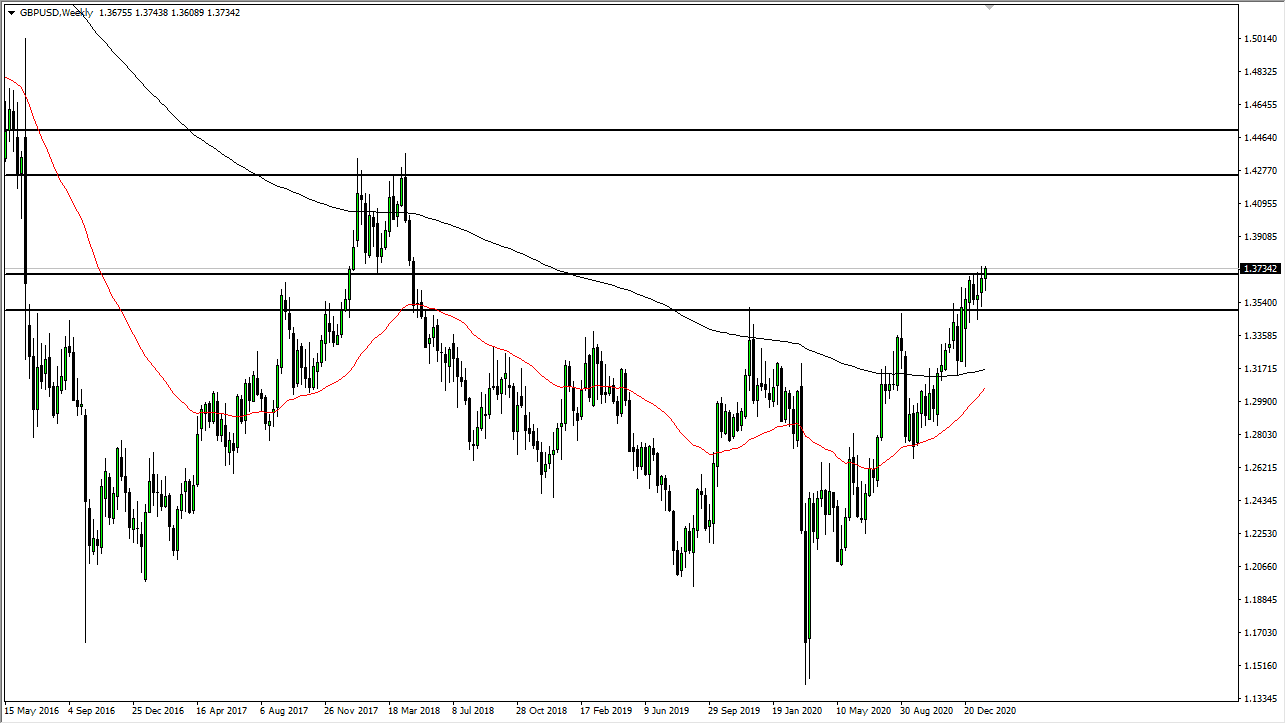

As I write this, the market is trying to break above the 1.3750 level, an area that has been important more than once in this pair. If we can get above there - and I do believe that Jerome Powell will do whatever he can to make that happen - it is likely that the British pound will continue its upward trajectory yet again. Luckily, we have a couple of very obvious supporting resistance levels from which to trade if we do get the breakout.

To the upside, I believe that the market will eventually go looking towards 1.45 level, which is more in line with historical norms when it comes to this pair. However, there is a significant amount of resistance in the form of the 1.4250 level between here and there, so I think that 250-point range is going to be your overall longer-term resistance. To the downside, I see plenty of support extending down to at least the 1.35 handle, which is a large, round, psychologically significant figure. In other words, I think that eventually we will break out, but we may have a little bit of back-and-forth between now and the move higher. Regardless, I have no interest in shorting the British pound, despite the fact that the economic outlook for Great Britain is probably a bit shaky at best.

A lot of what we are seeing here is simple US dollar weakness, compounded by the fact that we finally got through Brexit. Beyond that, we also have the historical charts suggesting a “reversion to the mean” higher. As loose as the Fed is going to be going forward, I fully anticipate that we will continue to see the US dollar suffer. However, the upward trajectory of the British pound is somewhat limited by the 1.45 handle over the next several months. Commodities will probably be where a lot of money flows to, which suggests commodity currencies as well.