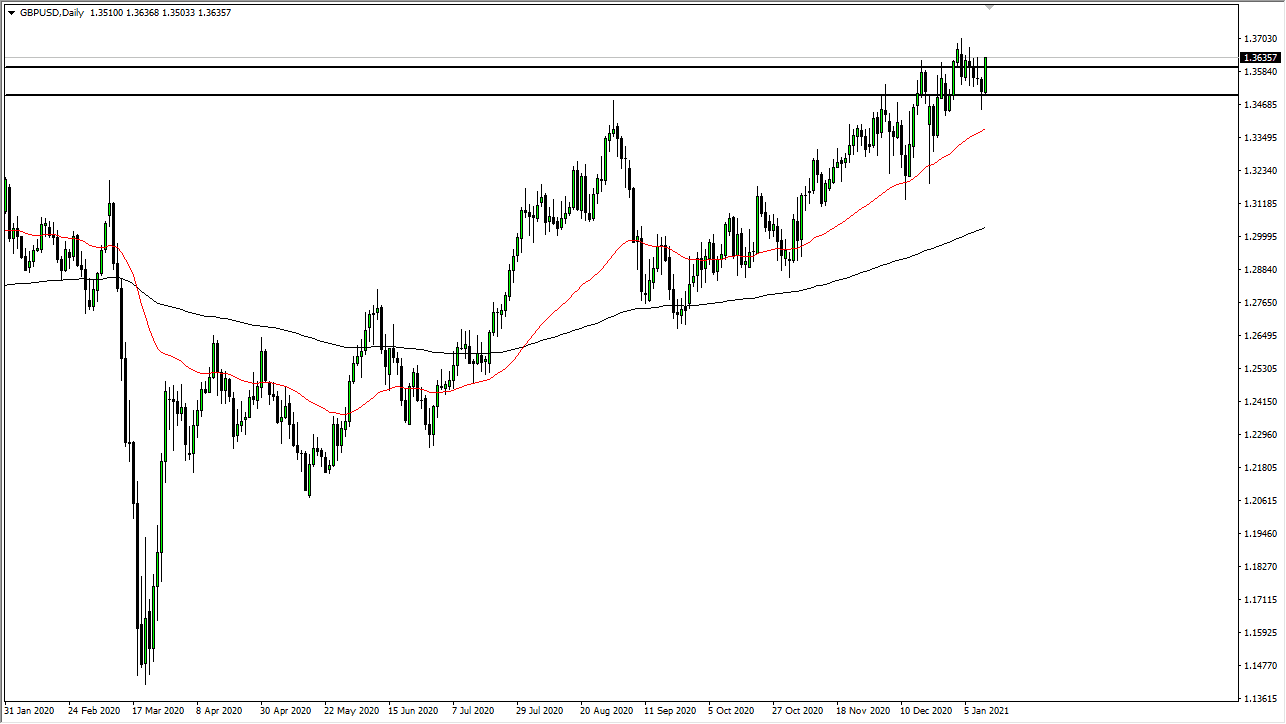

The British pound broke higher during the trading session on Tuesday to slice through the 1.36 handle. By doing so, the market looks very likely to continue going higher, especially as we are closing towards the top of the candlestick itself. This is a market that eventually will find a reason to get going to the upside, despite the lockdowns in the United Kingdom. The market seems to be looking past that, as we have coronavirus vaccines, which is the key to the entire “reflation trade.” That is typically bad for the US dollar, so it makes sense that we should continue to see the British pound rally, perhaps based upon the US dollar falling more than anything else.

Another thing to think about is the fact that the British pound is historically cheap, and I anticipate that there should be a lot of “value hunting” out there that could be a bit of a catalyst to go higher. The size of the candlestick does suggest that we will go higher, so it is likely that we will go to the upside, perhaps trying to take out the highs at the 1.37 level. Above there, I think that the 1.3750 level is an area that a lot of people will be watching, and an area that I think we will eventually break above. Once we do, that should continue to open up the possibility of a move to the 1.40 level. That area obviously is a large, round, psychologically significant figure and should cause a significant amount of interest.

Pullbacks should continue to be thought of as buying opportunities, all the way down to at least the 50-day EMA. The 1.34 level underneath should offer support, and if we do see a pullback, there will be many people willing to jump in and take advantage of it. I have no interest in shorting this pair, as I think the “sell the US dollar trade” has come back into play. We are in an uptrend, and that should continue to be the case going forward.