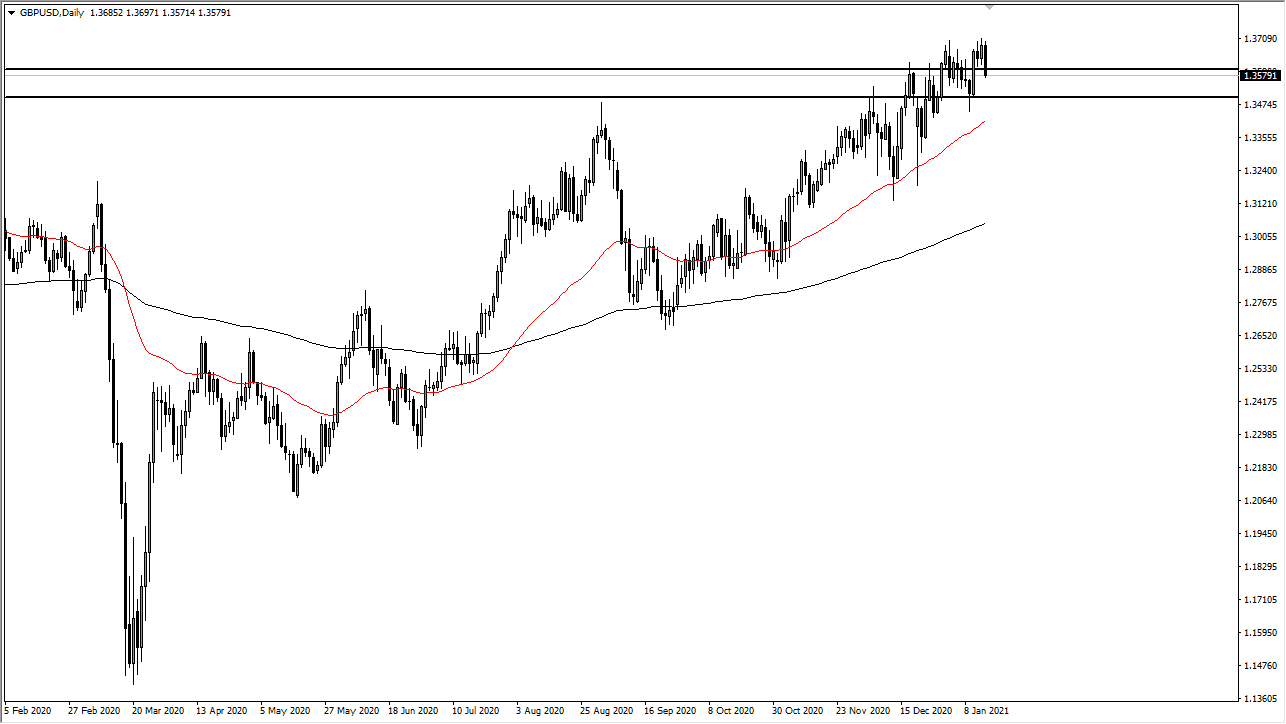

The British pound has pulled back a bit during the trading session on Friday to show signs of exhaustion. That being said, the market is likely to continue to see buyers underneath, so I think this is only going to end up being a buying opportunity before it is all said and done. I like the idea of looking for value underneath, especially near the 50 day EMA or the 1.35 handle. When you look at the size of the candlestick, it shows that there was serious selling pressure but in the big scheme of things it really is not anything other than a blip on the radar.

Part of the pullback was due to the fact that people are concerned that stimulus will be less than originally thought, as Joe Biden is very unlikely to get $1.9 trillion worth of stimulus through Congress. If that is going to be the case, then the US dollar may have been sold off a bit prematurely. Nonetheless, over the longer term the US government is planning on spending drastically, and that of course will weigh upon the currency. The British pound on the other hand is relatively cheap by historical standards, although the United Kingdom certainly has its own issues.

Speaking of Great Britain, the lockdowns of course have slowed down the economy, and perhaps will throw a bit of a monkey wrench into the entire situation, but at the end of the day markets tend to look ahead and past all of that. I think that is essentially what they are doing now. The UK economy will be playing catch-up eventually, and therefore I think that we will continue to see longer-term British pound strength. This is especially true if we see massive stimulus in the United States, but one major blip on the radar has been that interest rates in America rose a bit during the course of the week, as people started to demand more yield to live the US government borrow. That in and of itself can make the US dollar a bit attractive. This is probably a short-term phenomenon though, and therefore we should continue to see this pair find buyers. The 50 day EMA is at roughly 1.34, and I think by the time the price and the 50 day EMA converge, we will probably see a bit of a turnaround.