Although the GBP/USD pair fell to the support level of 1.3572 and stabilized around 1.3590 at the beginning of this week's trading, the outlook is still bullish. The rise in the value of the US dollar coincides with the decline in global stock markets, which confirms the tendency of the US currency to perform well when investors sell stocks. Accordingly, analysts say that the recovery in the US dollar is coming after a continuous decline over several weeks, so it is not necessarily a more significant shift in the tide. Francesco Bisol, Forex strategist at ING, said: "We expect the dollar's bearish trend to take a break during a week full of risk events."

Derek Halbene, Head of Research at MUFG, says the dollar's rebound could go further. "After the sell-off of the US dollar at the end of 2020, the dollar is now retreating from this weakness and the history indicates a strong seasonal pattern that indicates the possibility of more strength in the near term."

Manuel Olivieri, a Forex strategist at Credit Agricole, said: "We now think a less bearish stance in the US dollar is justified in the near term, to the extent that a stronger fiscal stimulus gives the US economic outlook in the near term a more significant boost. Both US stocks and weak bond yields are pushing up.”

The US dollar surged before the weekend amid a downward turn in the markets, reacting to Thursday's announcement by President-elect Joe Biden regarding a stimulus package close to $2 trillion. Chris Beauchamp, Senior Market Analyst at IG, commented: “The announcement of Biden's stimulus plan and the arrival of the earnings season seemed to signal investors to start reducing their equity allocations, and after such a strong rally since late October, no one can really blame them.” However, there is more than just the "risk/reward" driver of the dollar at play, in the form of the US bond market.

The US dollar actually benefited last week after the yield on US bonds rose; the dollar tends to interact with the yields of the two-year bonds in particular.

One of the topics that has captured the attention of market participants recently is the possibility of a further spike in inflation in 2021 due to expectations of an economic recovery from the coronavirus crisis. Inflation expectations have only risen higher in the wake of Biden’s proposal to give an additional $2,000 to individuals.

Higher inflation expectations tend to raise bond yields as investors demand a greater return on their bond investment if they believe their investment will be eroded by higher prices.

The UK government plans to offer a first dose of the COVID-19 vaccine to every adult by September as the country's healthcare system battles the worst crisis in 72 years. In this regard, Foreign Minister Dominic Raab said Sunday that the government will soon begin experimenting with injections around the clock in some sites, while continuing to add more vaccination sites to increase the pace of delivery. The National Health Service opened a mass vaccination center on Saturday in the historic Salisbury cathedral, and he told Sky News: "Our goal by September is to provide a first dose to all adults. If we can do it faster than that, that's great, but that's the roadmap."

Britain has more than 51 million adults in its population of 67.5 million.

The increase in the number of British infections has pushed the number of people hospitalized with the COVID-19 virus to a record 37,475 people, 73% higher than the first peak of the epidemic in April. Britain has reported 88,747 coronavirus-related deaths, more than any other country in Europe and the fifth highest in the world. Therefore, on January 2, British Prime Minister Boris Johnson ordered England to lock down for the third time, in an attempt to slow the spread of the virus and protect the National Health Services, which now has about 50,000 employees out of work due to COVID-19 infections and quarantines.

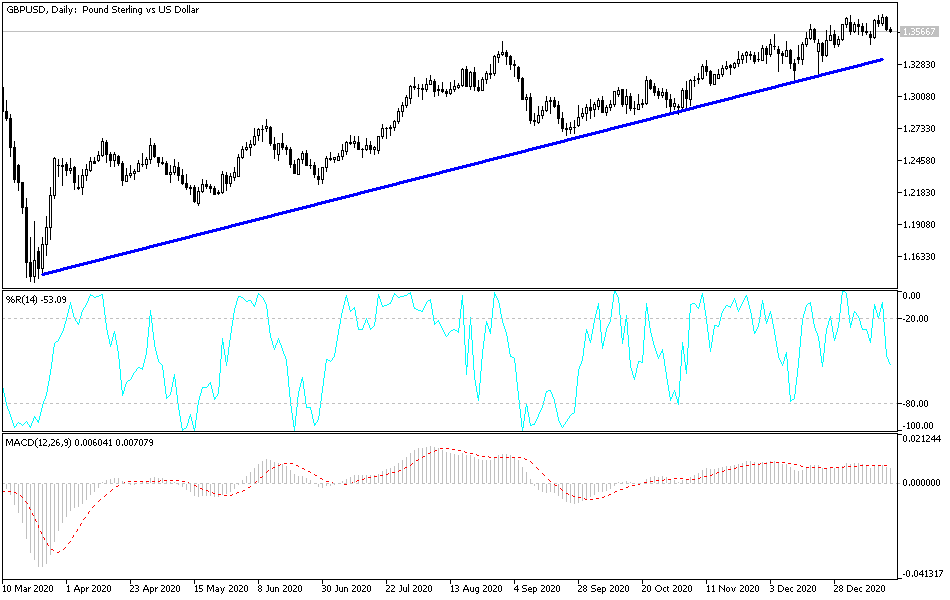

Technical analysis of the pair:

According to the performance on the daily chart, the general trend of the GBP/USD remains bullish, and its stability around and above the resistance 1.3600 still indicates the strength of the bullish momentum and preparation for testing higher levels. The closest ones are currently 1.3665, 1.3720 and 1.3800. A trend reversal would happen if the currency pair breached the 1.3430 and 1.3300 levels. The currency pair will continue to interact with British efforts to eliminate COVID-19 and the economic performance of the country, as well as US and UK stimulus plans to counter the effects of the pandemic.

As today is a US holiday, focus will be on the Bank of England governor's comments.