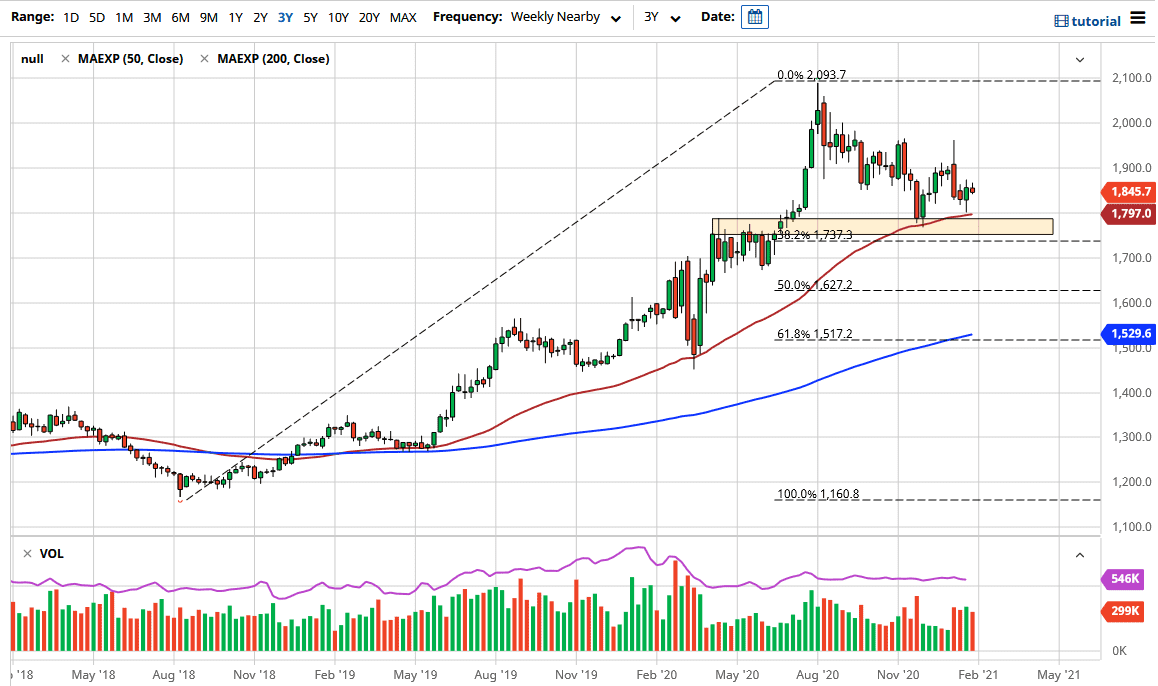

Gold markets have been somewhat quiet during the month of January, as we have continued the slow decline since the market tried to break above the 2100 level earlier this year. It should be noted that the market has been reasonably steady on the way down, and it certainly has been a relatively calm pullback. I do think that given enough time, it is likely that we will see some buying pressure, and it is worth noting that the market did bounce a bit from the $1800 level towards the end of the month of January. The weekly hammer in that general vicinity does bode well, and the 50-week EMA is sitting right around the same level also.

While we have dropped $300, the reality is that it has taken six months to do that. This is hardly a meltdown, and we are getting relatively close to a time where gold should start to shine again. After all, stimulus and loose monetary policy around the world will continue to be the norm, and as a result, there will be people out there looking to protect their wealth and trade against those fiat currencies.

The one thing that has worked against Bitcoin more than anything else as of late has been rising rates in the 10 year note, which means that there is a return for parking money with the US Treasury. Some people have taken to buying Bitcoin as well, which has given the gold markets a bit of competition. Gone are the days when people simply jumped into gold; there are multiple assets that people have been using as of late. Nonetheless, the longer-term trend is still very bullish, and the six months of sideways-to slightly-lower action shows that there has not been a rush to get out. ,I think that by the time we get through the month of February we should start to see the market break above the $1900, and perhaps try to make a move towards the $2000 level. Dips during the month of February will more than likely be buying opportunities in multiple gold markets, not just against the US dollar.