The NASDAQ 100 has been grinding higher for a while, and the index shows no signs of slowing down. We are a bit stretched by the time we get to the month of February, but the reality is that the NASDAQ 100 is not an equal-weighted index, so the fact that Facebook, Microsoft, Netflix, and a few other of the giants out there continue to strengthen suggests that the index will follow right along with it.

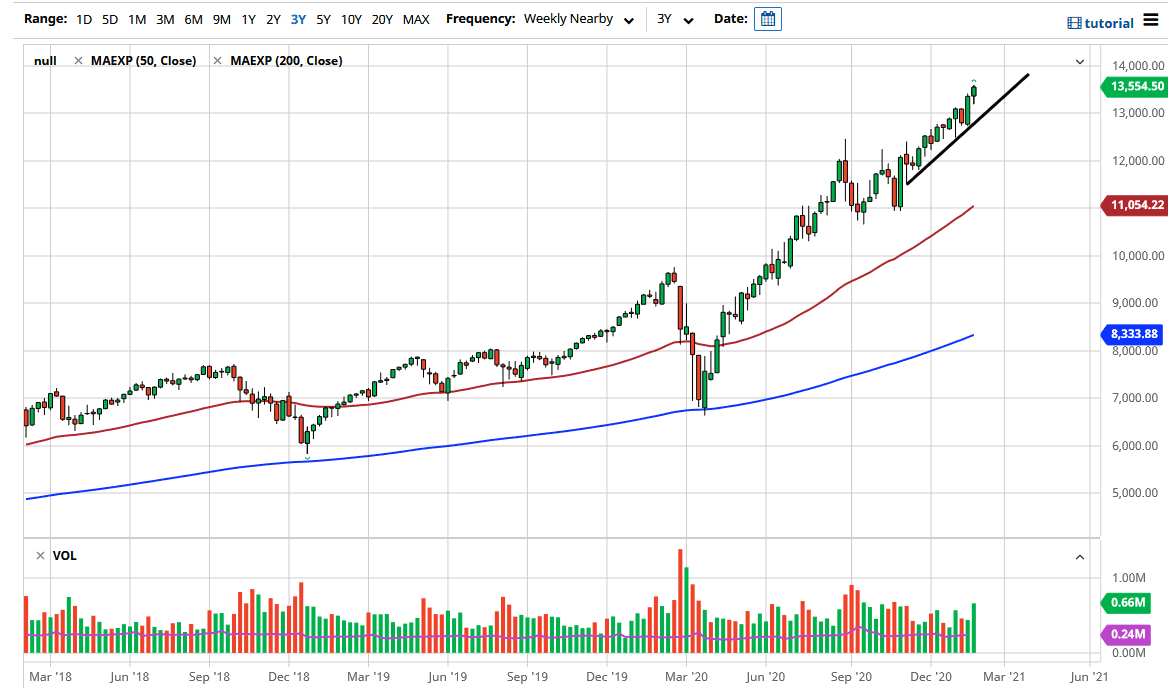

The NASDAQ 100 has been slightly overbought over the last month or two, but the reality is that even if we do get some type of sell-off during February, there should be plenty of buyers underneath. There is a trendline that I have marked on the chart, which would be the first line of defense for the bullish traders out there. After that, we would be looking at the 12,000 level, which was a major breakout point and previous consolidation. Speaking of the consolidation, based upon that trading, it measures for a potential move to the 14,000 level, which I certainly think we will see sooner rather than later.

Jerome Powell and the Federal Reserve will do what they can to pump up asset prices again, just as they have done for the last 13 years. It is because of this that Wall Street has been trained to “buy the dips”, and that should continue to be how this market behaves. The first serious concern I would have would be if we somehow broke down below the 50-week EMA, which would be a massive sell-off from where we currently sit. With this being the case, the market is likely to see more of the same behavior that it has featured for quite some time. There is a real argument to be made for a short-term breakdown during the month of February, but that will more than likely continue to be thought of as value coming back into the market. Having said that, the month of February may be a timeframe in which you may wish to have protection in the form of puts when trading this index. You certainly will not want to be shorting this market, because it will rip right back to the upside suddenly every time it does sell off.