The S&P 500 has been bullish over the last month or so, although it has played second fiddle to the NASDAQ 100. This should not be a huge surprise, due to the fact that the NASDAQ 100 features a lot of the “stay-at-home” stocks, but the S&P 500 is made up of a much more varied swath of companies. Nonetheless, the S&P 500 will continue to enjoy massive amounts of liquidity being thrown into the marketplace, as the Federal Reserve has continued to pump Wall Street higher.

There is no real alternative when it comes to bonds, although it is worth noting that some movement higher in interest rates has been seen recently, but we are still quite some distance away from having interest rates high enough to cause a significant problem, so at this point we should continue to see plenty of buying on dips. In fact, I do not have a scenario in which I'm willing to short the S&P 500, but I recognize that we have seen a pretty significant acceleration to the upside that will probably lead towards a short-term pullback. For myself, I am going to stay long, but I also will buy the occasional put in order to protect my longer-term position.

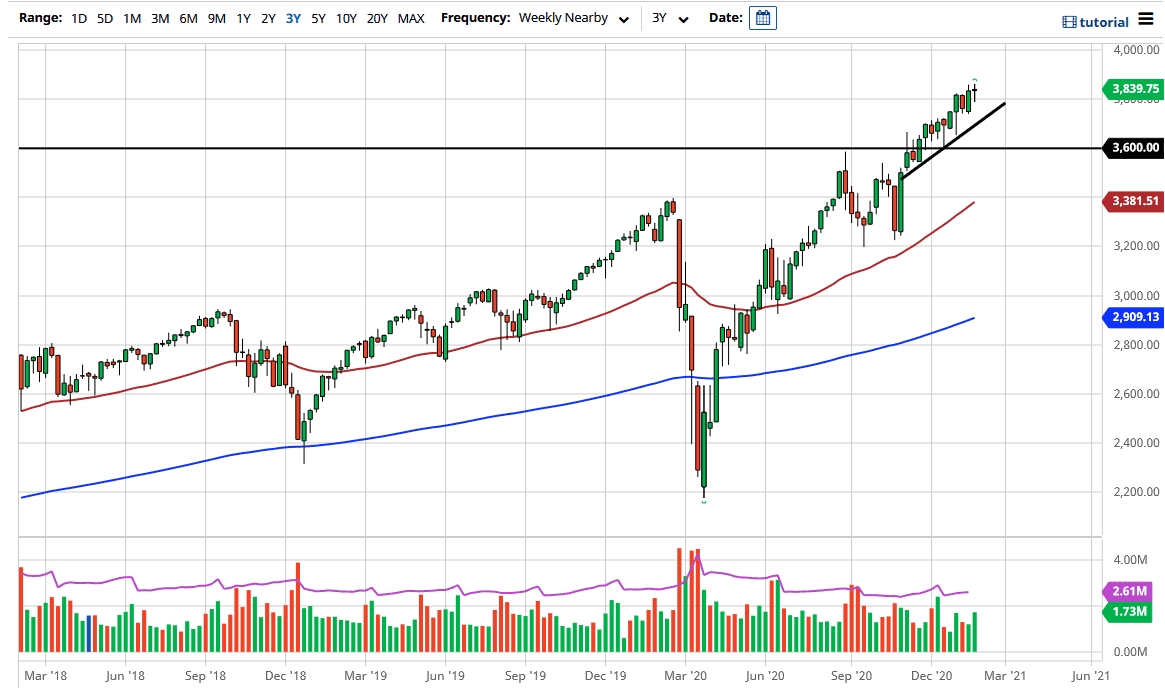

When you look at the previous consolidation area between 3200 on the bottom and 3600 on the top, it measures for a 400-point potential move on the breakout. Now that we have had the breakout, you extrapolate that from the 3600 level to get a target of 4000. I do think that we will reach 4000, but I do not know whether or not we can get there by the end of February. Nonetheless, even if we do break down a bit, I believe that the 3600 level should be supported, assuming that we can even break down below the uptrend line. We could see a bit of sideways action before we take off, but nonetheless, the overall longer-term direction is still to the upside and I do not see that changing anytime soon. Whether or not we can break above 4000 might be a completely different question, and I expect to see a lot of resistance in that area due to the fact that it is a large, round, psychologically significant figure, and an area where there will be a lot of options barriers put up.