The US dollar has drifted a bit lower during the trading session on Wednesday as we test the 50-day EMA against the Brazilian real. This comes just 24 hours after the massive selloff on Tuesday, which formed a huge red candle. At this point, I would have to think that there will be some type of follow-through, and this may be one of those “sell the rallies” type of markets from a short-term perspective.

It is interesting to note that the US dollar was oversold, and this was seen in markets across the world. The Brazilian real took quite a hit initially due to the fact that emerging market currencies are much less liquid than some of the majors. Nonetheless, the greenback is now on its path of losing steam again, and money will start to look at places such as Brazil for an opportunity to pick up a little bit of value, in a world that is offering almost nothing when it comes to interest rates. After all, yield is one of the most important things that a currency and a country can offer. At present, the United States did see a bit of a gain in yields on the 10-year note, but not really anything to get overly excited about.

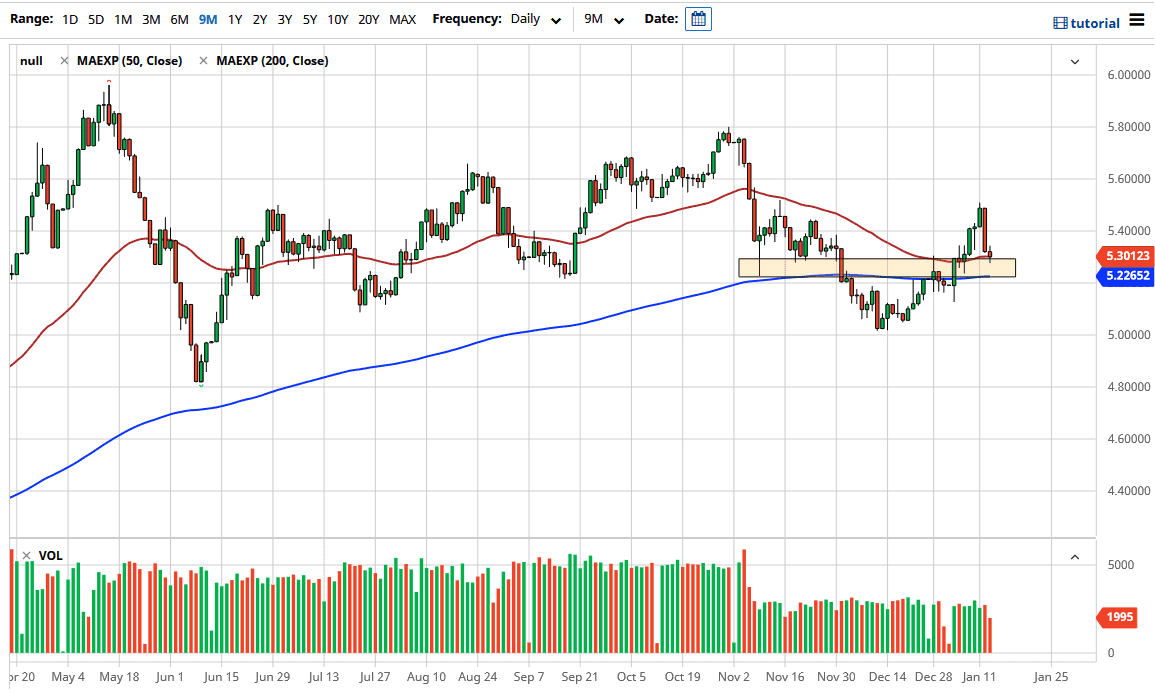

The 50-day EMA sits right here where the candlestick is, and I think that could be a bit of psychological support. Because of this, I would like to see the market break down below the zone that I have marked on the chart, meaning that we need to clear the 5.22 real level, as it would not only clear the structural support, but also break back below the 200-day EMA. Otherwise, if we rally towards the 5.40 real level and see signs of exhaustion, I would be a seller there as well. Remember, Brazil is a commodity-based currency, although unlike some of the others, it is based quite a bit on soft commodities. It also represents most of Latin America and the idea of emerging market growth. As long as we have this reflation trade going after the vaccine has been approved, then the long-term outlook for most of these countries, Brazil included, should be rather good.