The US dollar initially tried to rally on Tuesday to break above the 15.50 rand level again, but just as we had seen on Monday, there was more than enough selling pressure above to keep the attempt under wraps. The market has wiped out the entirety of the Monday candlestick and it should continue to pressure the greenback to the downside. After all, there is a massive stimulus coming out of the United States soon, which will weigh upon the value of the dollar in general.

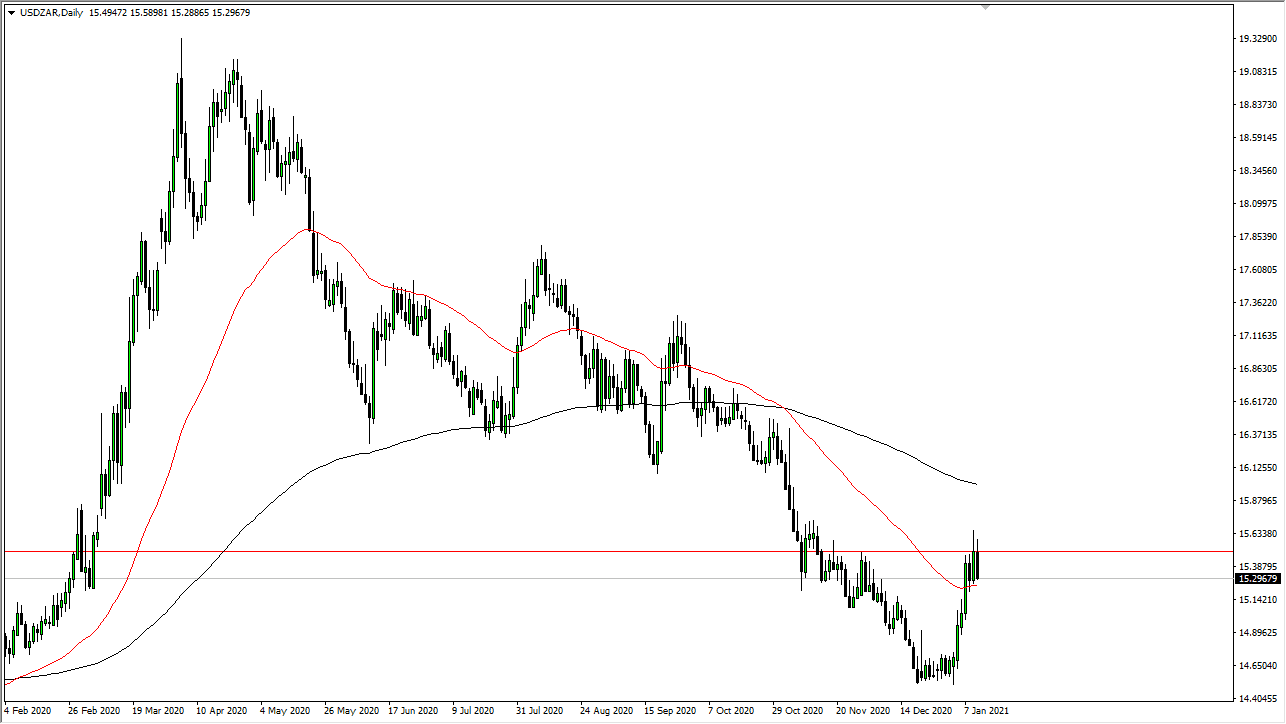

Looking at the chart, you can see that the 50-day EMA sits just underneath the past couple of candlesticks. But at the end of the day, it is an arbitrary support or resistance area, simply suggesting where it could be, not necessarily where it will be. Furthermore, we have already broken down below the 50-day EMA, so it would not be a huge shock to the system to be below it again. However, the 15.50 rand level has been aggressively important more than once, so that is the level that means more than anything else.

The most important thing to pay attention to is the fact that we have been in a downtrend for some time, and the fundamentals for the US dollar are not exactly great. The massive amount of stimulus suggests that we are about to enter the “reflation trade”, meaning that a lot of money will be flowing towards commodities, of which South Africa has a lot. Beyond that, you also have the interest rate differential coming into play, so that is a nice set up for the rand to continue appreciating for the longer term. It should be noted that this most recent bounce was rather strong, but really, when you look at the totality of the move lower, it is rather inconsequential, so I would not be overly concerned about the ferocity of it. The fact that we could not slice through the 15.50 rand level is probably the most telling indicator on the chart, and it looks like we may have gotten the oversold bounce out of the way. If that is the case, this market could reach towards the lows again, perhaps even taking them out given enough time. I have no interest in buying this pair anytime soon.