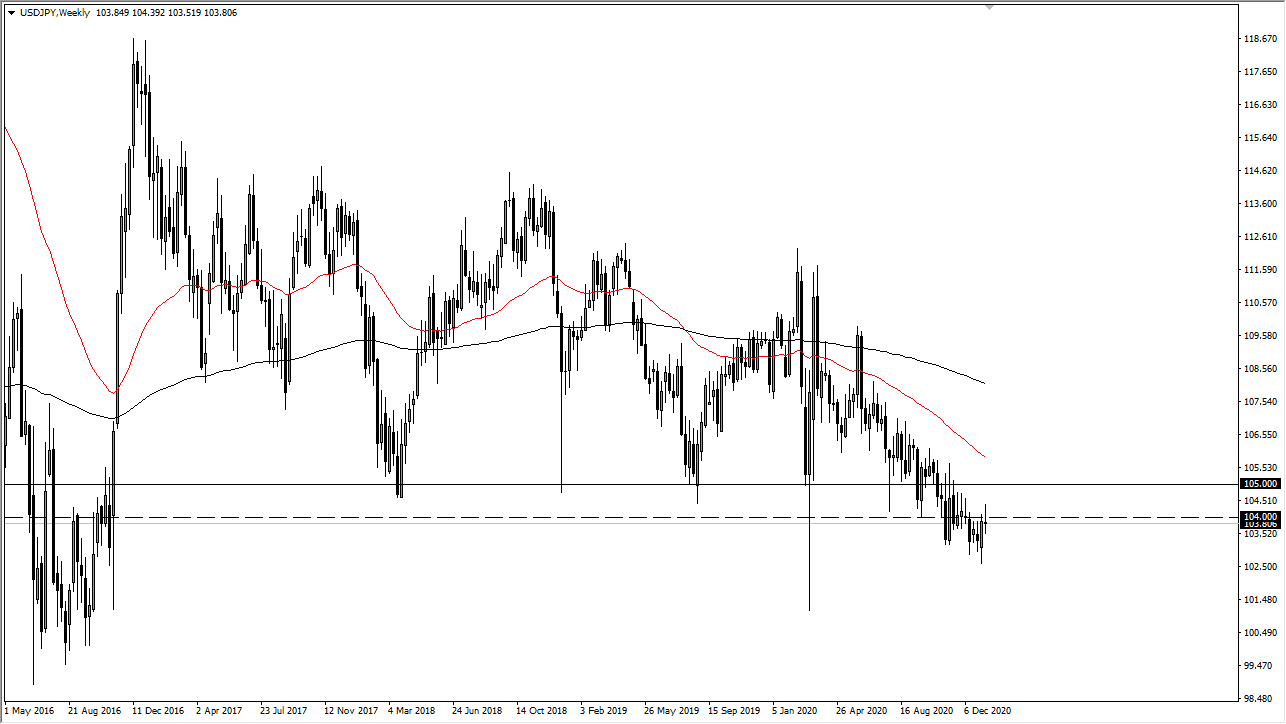

USD/JPY

The US dollar initially rallied during the course of the week but gave back the gains above the ¥104 level. By doing so, the market just looks as if it cannot hang on to any type of gains, and I think that every time we break above the ¥104 level, sellers will come back into this market to push it towards the ¥103 level. I think the noisy and choppy behaviors that we have seen over the course of the last couple of weeks will continue into this one as well.

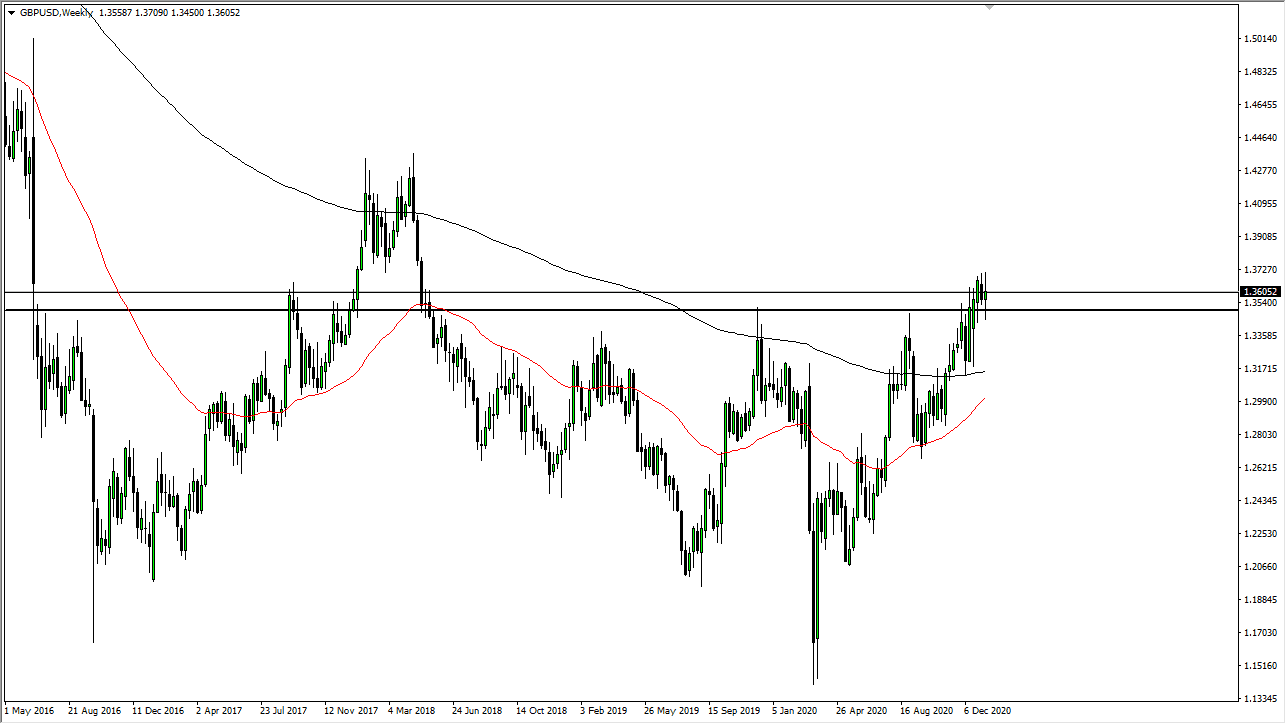

GBP/USD

The British pound has shown itself to be very noisy during the course of the week as we continue to bounce around the 1.36 handle. This is a market that needs to kill a bit of time in this area, due to the fact that it had gotten choppy, yet parabolic. At this point, pullbacks offer plenty of buying opportunities, and value hunting will probably be the way we go moving forward. I have no idea about shorting this market, but would have to re-evaluate things below the 1.3350 level.

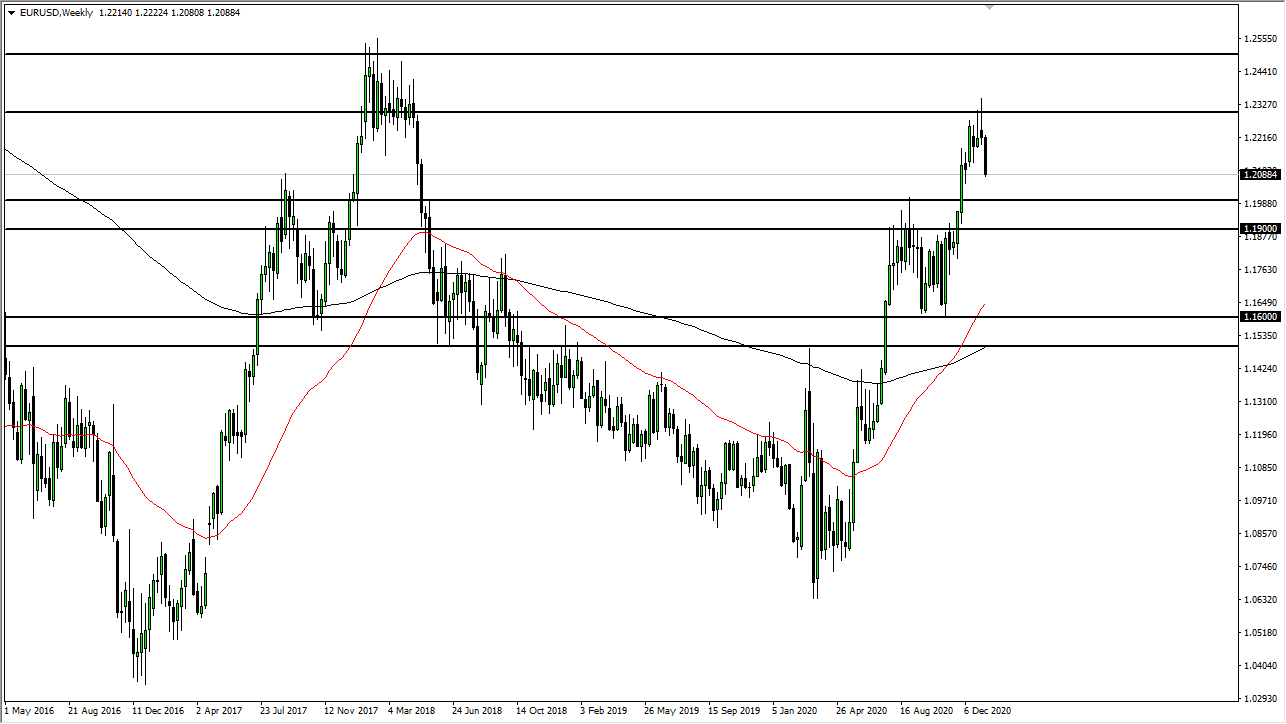

EUR/USD

The euro has broken down significantly during the course of the week to pierce the 1.21 level. At this point, I think we will start to see support extending all the way down to the 1.20 level, so I would not be surprised at all to see a bit of continuation to the downside, only to see this market bounce yet again. To the upside, the 1.23 level continues to be massive resistance, so you have to look at this as a market that is in a relatively small range. I have no interest in trying to catch a falling knife, but given enough time, we should get a signal.

GBP/JPY

The British pound initially shot higher during the course of the week but has given back all of the gains to turn things around and form a shooting star. This is preceded by a hammer, so it is suggesting that we we will go back and forth. At this juncture, I think that the ¥140 level will attract a certain amount of pressure to the upside, just as the ¥142.50 level continues to be resistance.