You have to love the markets. Nowhere are you more likely to read one headline on Monday and the opposite headline on Tuesday. So, to bring you up to speed, the US dollar has been taking a bit of a tumble lately. At its lows, it touched 89 on December 17. A bounce saw it rallying to 91, followed by a drop back down to the 90 level. To put this into context, earlier this year, the DXY went from around 90 to 102 as the world locked down and industry ground to a halt. It has since been losing ground as economies fire up again and vaccine distribution ramps up.

You have to love the markets. Nowhere are you more likely to read one headline on Monday and the opposite headline on Tuesday. So, to bring you up to speed, the US dollar has been taking a bit of a tumble lately. At its lows, it touched 89 on December 17. A bounce saw it rallying to 91, followed by a drop back down to the 90 level. To put this into context, earlier this year, the DXY went from around 90 to 102 as the world locked down and industry ground to a halt. It has since been losing ground as economies fire up again and vaccine distribution ramps up.

Short Term

Now, on to those headlines. As you may already know, there’s a mutated strain of coronavirus prevalent in the UK. On December 20, we saw a CNBC headline stating, “U.S. dollar rises versus most currencies on new virus strain,” accompanying the rally to 91. Then, on December 21, we saw a Reuters headline stating “U.S. dollar slides as new virus strain concerns ease,” referring to the drop back down to the 90 level after an announcement from the WHO stating that existing vaccines should be able to handle the new strain. In other words, the USD went up one day and down the next.

The news items attributed to these moves are regarding anything that puts recovery in jeopardy (rush to the greenback) or, anything that allays fears (exit from the greenback). The new strain was a recent headline belonging to the former camp, while the WHO announcement belongs to the latter camp. Expect to see more chop as we jump from fear to relief, with economies across the world still trying to keep cases from overloading their local hospital systems and daily news regarding the vaccines and their efficacy in easing the crisis. Okay, so that’s the short-term picture.

Long Term

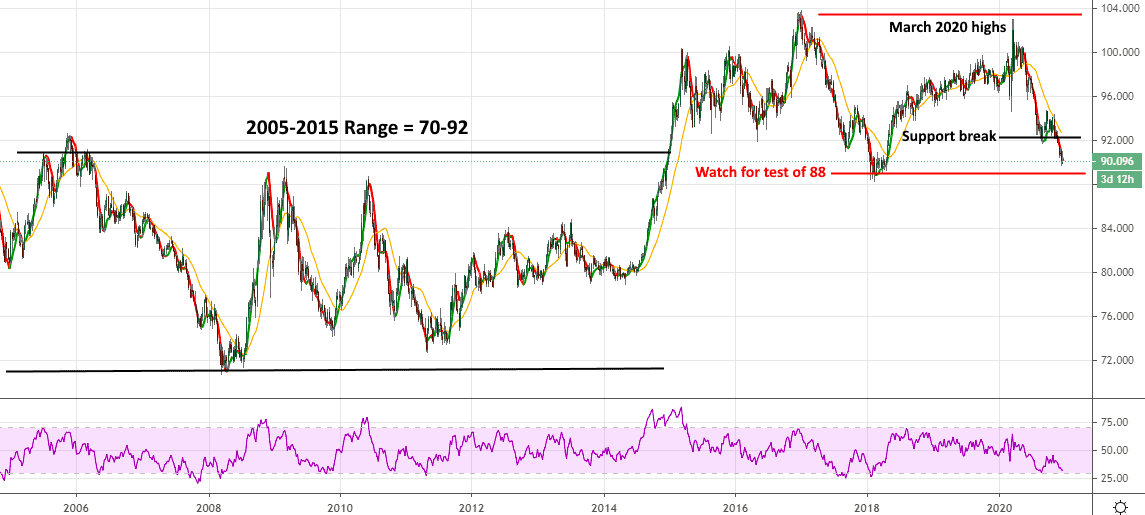

Zooming out a little, we see that the US dollar has historically traded much lower than these current levels. A multi-year view reveals that decade-long currency swings are the norm. For instance, between the end of 2005 and the end of 2015, the DXY traded between 70 and 92. Now, keeping in mind that the DXY is weighted mostly against EUR, the question here is whether Europe is currently in a position to sustain such a high currency value against the dollar and, if not, are we looking at a competitive devaluation?

Both economic powers are keeping the printing presses running and some analysts are expecting US interest rates to join Europe’s and Japan’s rates in negative territory in 2021. These are the issues bubbling away beneath the coronavirus headlines. Recently, we’ve had the $900 billion coronavirus package that was being debated by US Congress and has only just been approved, and we’ve already seen a €1.8 trillion stimulus deal agreed in the EU.

As you can see, using the EUR in a play on USD weakness is more complicated than it may seem on the surface. Aside from short-term flips in the EURUSD exchange rate, there are potentially more interesting longer-term plays to be found elsewhere. The commodity cycle, for instance, is an important piece of this particular puzzle.

Regardless of what the US dollar does against the euro, we’re seeing that commodities are rising convincingly against it. Whether you’re looking at oil, copper, gold, or bitcoin, all of them seem to be benefiting from a weaker dollar. At HYCM we’ve been seeing increased interest in commodities throughout the quarter. And this is also reflected in commodity-based currencies such as AUD, CAD and NZD. The US dollar did extremely well against these currencies during the height of COVID fears earlier this year but has dipped significantly against them in recent months. It also pays to remember that we tend to get commodity bull markets when the dollar is down in the dumps.

Things to Keep an Eye On

As we see the DXY coming down to test support levels that go back to 2018, the question is whether Europe’s economy can sustain a higher euro that would cause the DXY to break support. The most likely scenario, especially given recent COVID-19 responses from both the US and EU central banks, is that we’re in some stage of a competitive devaluation, so any EURUSD trade is a view on which of the two will drop further.

This leads to an environment where the higher conviction trades may not be which currency will win out between EUR and USD, but in both scenarios, we may be looking at more pricey commodities across the board. So, if this dollar slump is longer-lasting than just the short-term spasms we’ve seen recently with COVID-driven news, and if the DXY dips and stays below the 88 level, this could be a broader macro shift where the real action for longer is to be found in commodities and in the commodity currencies.

About HYCM

HYCM is the global brand name of Henyep Capital Markets (UK) Limited, HYCM (Europe) Ltd, Henyep Capital Markets (DIFC) Ltd and HYCM Limited, all individual entities under Henyep Capital Markets Group, a global corporation founded in 1977, operating in Asia, Europe, and the Middle East.

High Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

References:

https://www.cnbc.com/2020/12/21/forex-markets-coronavirus-british-pound.html