BBNB/USD has suddenly emerged as the third largest cryptocurrency regarding overall value. Binance Coin has achieved extremely speculative fever the past week-and-a-half of trading as news surrounding its adaption within a decentralized cryptocurrency exchange using Binance technology has gotten publicity. Due to the news coverage within the digital currency world regarding Binance’s smart chain gaining favor, BBNB/USD has seen a trading surge in value.

BBNB/USD has certainly performed well since December of 2020, but the crux of its rocket move higher has happened this month. On the 14th of December, Binance Coin was trading a breath below the 25.0000 mark. On the 31st of January, BBNB/USD was near the 45.0000 juncture. The ability of the digital currency to jump higher was polite, taking into consideration the moves that Bitcoin and Ethereum enjoyed during the same calendar days. However, since the 16th of February BBNB/USD has climbed from nearly 131.0000 to its current price value.

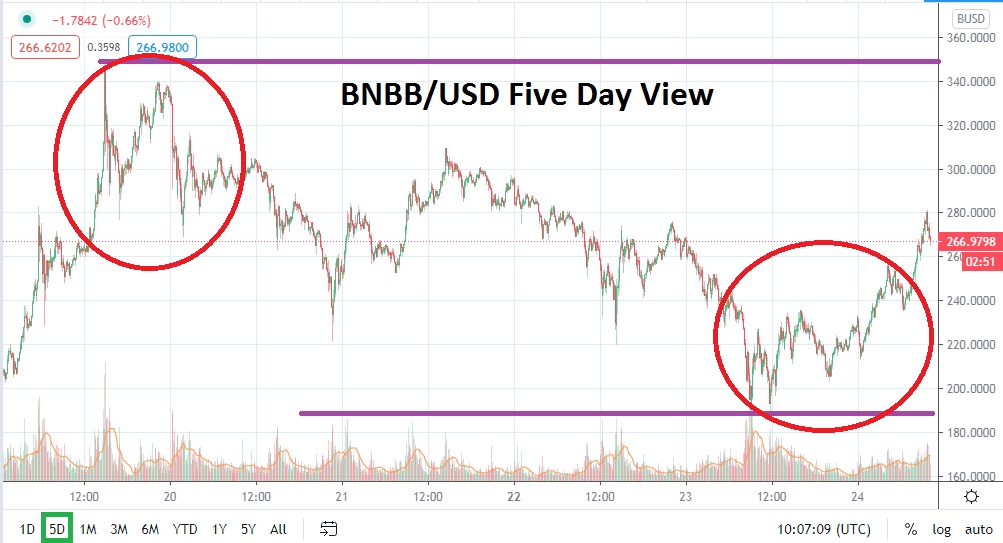

On the 19th of February, BBNB/USD hit a high price of approximately 344.0000. As of this writing, the digital currency is trading near 270.0000. Speculative fever within BBNB/USD has enjoyed a combination of favorable trading conditions in the cryptocurrency marketplace and the notion that Binance Coin technology is potentially going to advance due to greater usage of Binance technology makes it intriguing.

However, speculators should monitor support and resistance levels with a technical approach regarding BBNB/USD. If current support levels near the 236.0000 mark fail to prove adequate, a test of lower values could develop rapidly and try to engage the 200.0000 price juncture.

Trading within BBNB/USD has been volatile the past few days, but it has actually been more comfortable than the rampant surges seen early last week. BBNB/USD did trade below the 200.0000 mark yesterday for a short duration, but Binance Coin saw a swell of speculative buyers come into the market.

BBNB/USD is trading near its high for the day, and if resistance is approached near the 285.0000 level and proves vulnerable, Binance Coin may see another surge of buying ensue. Cautious speculators may want to consider buying positions on slight pullbacks with BBNB/USD if nearby support levels are tested. Trader should also use limit orders when speculating on Binance Coin to guard against the potential for volatility.

Binance Coin Short-Term Outlook:

Current Resistance: 285.0000

Current Support: 236.0000

High Target: 310.0000

Low Target: 204.0000