Bullish case

Buy BTC/USD anywhere above 42,000.

Set a take-profit at 50,000 and stop-loss at 41,000.

Bearish case

Sell the current BTC/USD weakness.

Set a take-profit at $42,000 (previous high).

Add a stop-loss at 50,000.

The BTC/USD price erased some of its earlier gains as investors started to take profit. Bitcoin price is trading at $45,400, which is 6.5% below its all-time high of $48,225.

Bitcoin Price Rally Pauses

The BTC/USD price has been highly successful in the past few months. It has risen by more than 1,000% from its lowest level in 2020. This year alone, the price has risen by about 55%, outperforming the overall stock market.

This performance has been driven by low-interest rates in the United States, aggressive quantitative easing by the Fed, supersized stimulus packages by the US government, and the overall demand from institutional investors.

In the past few months, several high-profile companies have acquired the currency. For example, MicroStrategy, a relatively small software company has bought Bitcoin worth almost $1 billion. Square and MassMutual have also acquired the asset. And this week, Tesla revealed that it had bought BTC worth $1.5 billion.

Further, in its conference call to investors, Twitter’s Jack Dorsey said the firm could also convert some of his cash into the currency.

Therefore, the BTC/USD has risen because of the rising demand by investors and the fact that it has been validated as a leading alternative asset.

Also, the price has risen because of its rarity. Unlike gold, Bitcoin’s supply is capped at 21 million. Already, millions of coins have already been mined, and because of the recent halving, getting new coins has become relatively difficult. Therefore, analysts believe that the currency will become rare and thus pricey.

The BTC/USD has also gained support of some of the most recognized people in finance. For example, Cathy Wood, the founder of Ark Invest, has predicted that the price will soar to $400,000. Similarly, other well-known figures like Scott Minerd and Ray Dalio have also turned bullish.

BTC/USD Technical Outlook

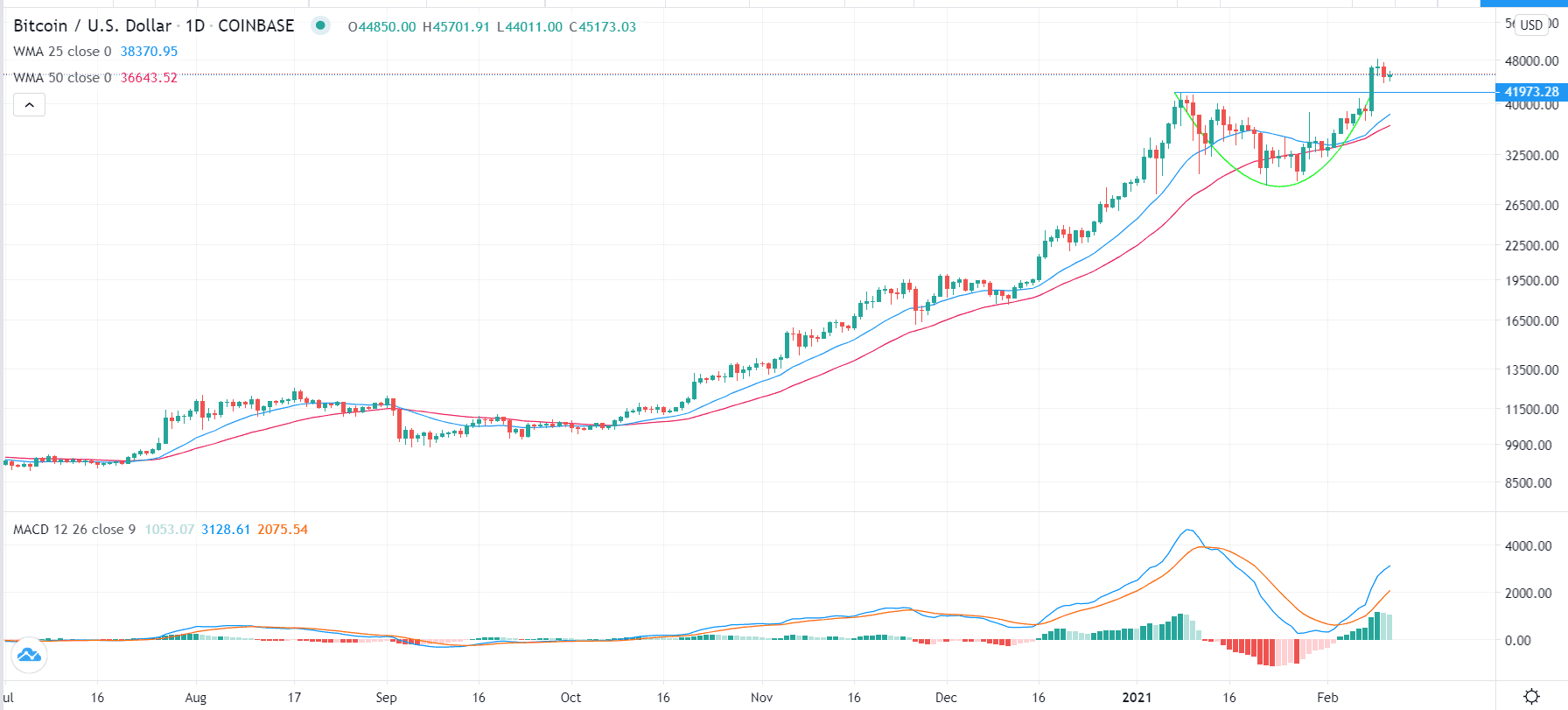

The daily chart shows that Bitcoin was forming a cup and handle pattern before the recent break-out. The price is still above the two upper sides of the cup. It is also above the 25-day and 50-day weighted moving averages while the MACD has continued rising. Therefore, the price will likely resume the uptrend as bulls target the psychological level of $50,000.