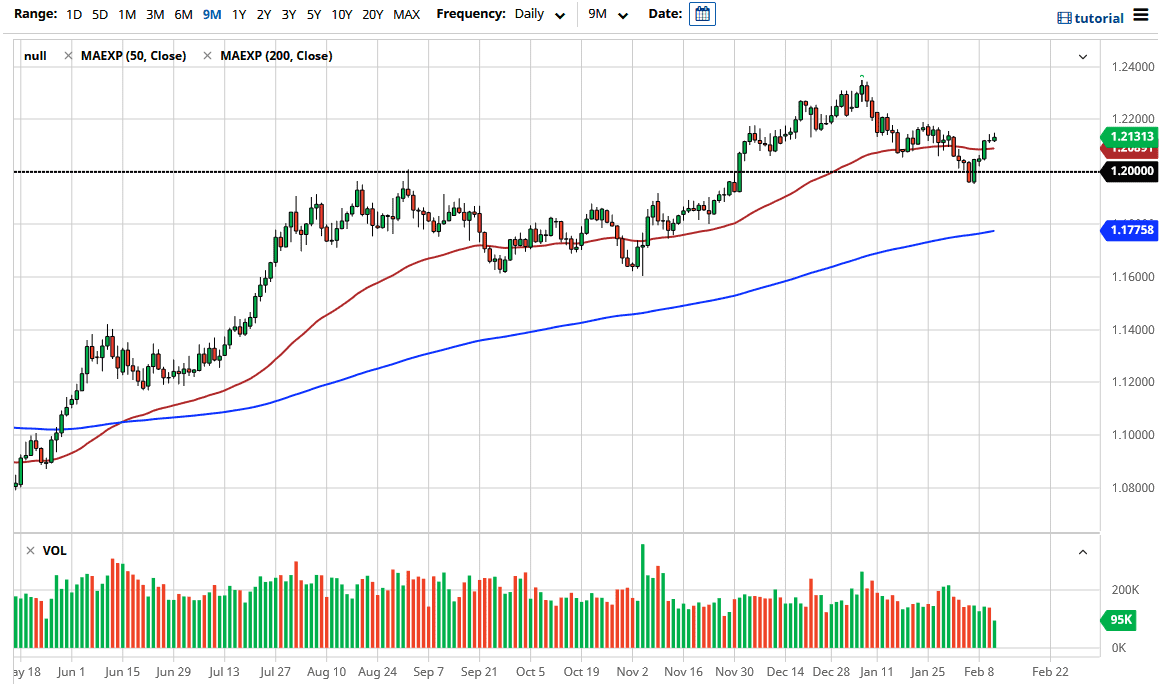

The Euro rallied initially during the trading session on Thursday but gave back the gains in order to form a bit of a shooting star. At this point, it looks as if the market is getting a bit exhausted, but it is also worth noting that we have bounced rather significantly from an area that should have offered support in the first place. The 1.20 level has been an area of interest in the past, and of course is a large, round, psychologically significant figure. It is worth noting that the support level extends all the way down to the 1.19 level, so I think at this more as a “region of support.”

To the upside, we see the 1.22 level as offering a bit of resistance, but not nearly as much as the 1.23 level seems to be offering. With this being the case, the market is likely to continue being noisy, and we could get a short-term pullback, but I think there are probably buyers waiting to get involved. With that being the case, I would look at any drift lower as a potential buying opportunity, at least until we can break down below the 1.19 level, something that I do not see happening in the short term, although there are a lot of concerns when it comes to the European Union and the lock down affecting its economy.

The European numbers have been a bit dismal as of late, so it would make a certain amount of sense that the Euro would struggle. However, stimulus and the “reflation trade” continues to be what a lot of traders are focusing on at the moment, and therefore all of that cheap money should continue to work against the value of the greenback. I do not think we can break out above the 1.23 level above though, so really at this point I am just looking at this market through the prism of it being very choppy, and perhaps offering short-term range bound trading opportunities more than anything else. If you are looking for something that is going to trend well, this is probably not the market for you right now. However, it is also worth pointing out that the 50 day EMA is flattening out, so that is yet another reason to think that we may have very lackluster trading in the short term.