The EUR/USD had a bearish start to the week as it plummeted to the 1.2058 support level, the same level tested last week, with 1.2000 as the next target. The euro was negatively affected by statements made by the European Central Bank and the vaccine crisis in Brussels, which contributed to investors avoiding the euro in the short term. Also, losses in the equity and commodity markets had a bearish effect on the positively correlated EUR/USD price, although the currency was also hampered by the European Central Bank (ECB) statements, which raise concerns about EUR/USD's gains affecting trade. Whereas, the strength of the euro negatively affects global trade competition.

The ECB's statements came alongside the threat to impose restrictions on the EU’s export of coronavirus vaccines, which went into effect on Sunday and will require permits for all exports by national governments that can halt shipments if manufacturers fail to fulfill what the EU says are contractual obligations.

“The risk is that vaccination in Europe could be two quarters later than in the United States and Britain,” said Athanasius Vamvakides, Head of Forex Strategy at BofA Global Research. "Threats to ban the export of the vaccine may backfire, and we hope that they will not be followed. The EU economy is weak and getting weaker. The lockdown continues and vaccination has been disappointingly slow. The European Central Bank is also defending to stem the strengthening of the euro. We had an interest rate sell-off earlier in the year, and a sell-off of stocks. However, the EUR/USD is still slightly above our expectations of 1.20 for the first quarter. We suspect the main reason is that real money, which is long on EUR/USD, has not given up, at least not yet. Hedge fund positions were much lighter. Therefore, the dollar has stopped selling.”

The export restrictions are a potential source of tension with other countries outside Britain this week, and they serve as a direct reminder of the lackluster progress in Europe in the field of vaccinations, which contrasts with the performance of the United States as Washington is working to bridge the gap with the United Kingdom. At the same time, the concerns of the European Central Bank are a burden on the EUR/USD pair. “The EUR/USD has stabilized above 1.2100 for most of last week, which shows more signs of resilience in the face of dollar buying pressures and discouraging contagion data in Europe,” said Peter Karbata, Chief Analyst at ING. "The inflation figures are expected to rise thanks to the increase in the German value-added tax and higher energy prices. While the dollar may fail to show signs of weakness, we see no reasons for the euro to lose its resilience.”

Consumer price inflation in Europe has remained below zero since September 2020, but expectations were to rise from -0.3% to 0.4% weighted for January, with core inflation rising sharply from 0.2% to 0.7%. Both numbers will still leave inflation well below the ECB target, while the increases will mostly be the results of one-time factors that will not be repeated, and in general the data will remain welcome from the euro.

Fearing the medium- to long-term outlook to reach a far-fetched threshold of “close to 2% but less than 2%”, it appears that European Central Bank policymakers are increasingly trying to stabilize the EUR/USD price away from further counter increases. Bank officials told Bloomberg News last week that they are seeing investors reduce the odds of a future rate cut, days after it was reported that they were also investigating the impact of the Fed's monetary policy on the EUR/USD.

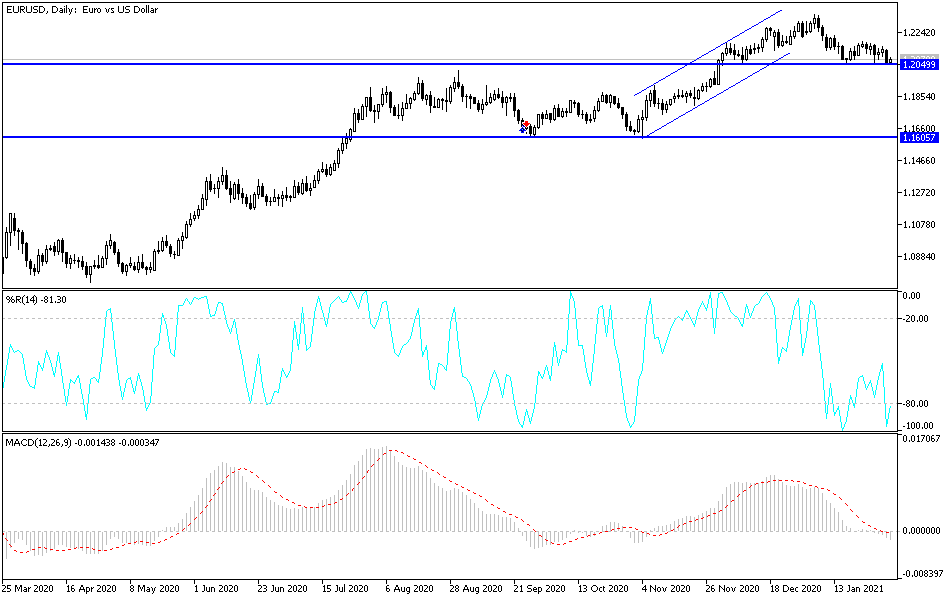

Technical analysis of the pair:

Approaching and moving below the support level of 1.2000 will increase bearish dominance and cause a general bearish trend. There will be an opportunity to test stronger support levels that are currently closer to 1.1990 and 1.1880. On the upside, bulls will not control the pair's performance on the daily chart without moving towards the 1.2300 resistance again. European vaccination hurdles, coinciding with the record numbers of injuries and deaths from the epidemic, means investors are fleeing risk, which will be good for the continued gains in the dollar as a safe haven.

Today's economic calendar data:

Focus will be on the announcement of the growth rate of the Eurozone economy.