Last week's downward correction pushed the EUR/USD pair to the 1.1952 support level, its lowest in two months, before settling around 1.2050 after the US jobs numbers were announced. The pair has recently recovered to trade above the 38.20% Fibonacci level. It is now stabilizing above the 100-hour SMA line. The 200-hour simple moving average is a few levels higher. Also, Friday's bounce pushed the currency pair to overbought levels on the 14-hour RSI on the hourly chart.

The most prominent announcement was that of the US jobs report for January 2021, as the results showed the success of the US economy in adding 49,000 new jobs in the non-agricultural sector, lower than expectations of 50,000 new jobs. Average hourly earnings for the month of January registered (annual) growth of 5.4%. This was better than the expected growth of 5.1%. The unemployment rate decreased to 6.3%, down from 6.7% in the previous month. This was also better than the expected rate of 6.7%. The initial and continuing jobless claims also exceeded expectations.

From the European Union, Eurozone retail sales for the month of December beat expectations (year-on-year) of 0.3% with a change of 0.6%. The change (monthly) of 2% was also better than the expected change of 1.6%. The Preliminary Core CPI for January came in at 1.4%, compared to expectations (year-on-year) of 0.9%. The change (monthly) also beat expectations of 0.5% with a record 0.9%.

In a new setback for the European Union's efforts to obtain vaccines against the coronavirus, the French pharmaceutical company Valneva signed a government contract for 60 million doses of their vaccine. The buyer is the United Kingdom, not the European Union, and Christelle Moranques, president of the Pays de la Loire Regional Council, tried to wrap her head around the missed opportunity. She told the Associated Press that the British “rolled the red carpet for this company, helped fund and set it up...and we were helpless.”

The UK has now ordered another 40 million doses and has options to order more from Valneva, who has a factory in Scotland. In return, the European Union is still in talks with the company.

In a sign of potential relief, new confirmed cases of COVID-19 in the United States have halved, from a daily average of around 250,000 in early January to more than 120,000 recently. However, the number of cases remains high, and states and localities have imposed restrictions on working hours and capacity. In addition, many Americans avoided shopping, traveling, eating out, and attending mass events for fear of infection. Overall, Sal Guatieri, chief economist at BMO Capital Markets, described the January US job acquisition as "disappointing". But he added that "expectations are getting brighter with the increase in the pace of launching the vaccine, and the unemployment rate continues to decline."

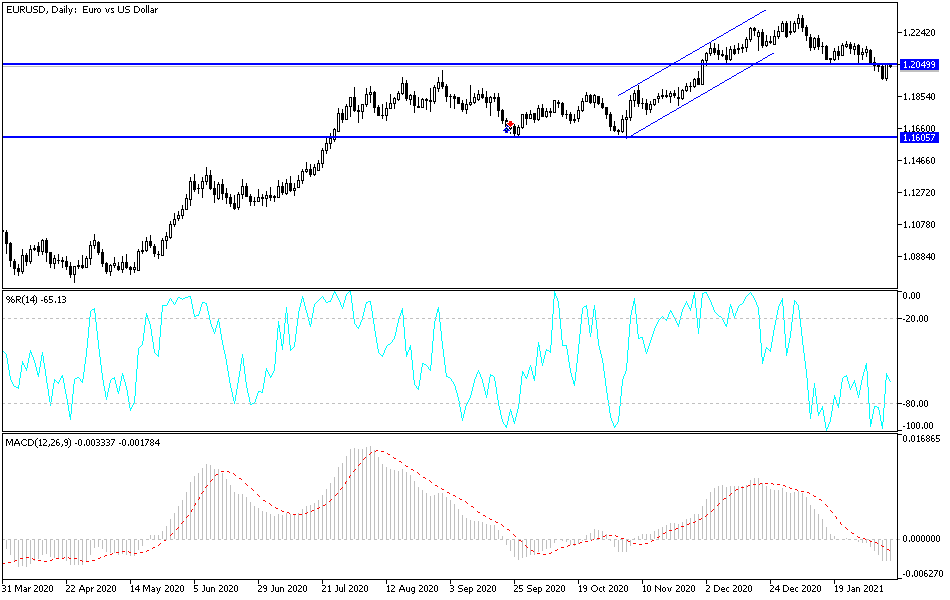

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the EUR/USD has recently rebounded from a new 3-month low after declining at the beginning of the month. The currency pair has now risen again, trading above the 38.20% Fibonacci level over the same time period. The bulls are looking to extend the current retracement towards 61.80% and 76.40% Fibonacci levels at 1.2079 and 1.2109 levels, respectively. On the other hand, the bears will target the short term pullback gains at 23.60% Fibonacci at 1.2000 or below at 1.1967.

In the long term, and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a sharp ascending channel, which indicates a strong long-term bullish momentum in market sentiment. The pair has recently retreated to approach the 14-day oversold levels of the RSI. Therefore, the bears are looking to extend the current decline towards 1.1950 or less to 1.1855. On the other hand, the bulls will target long-term profits around 1.2120 or higher at 1.2200.

Today's economic calendar is devoid of important economic data. Only German industrial production and the Sentex Investor Confidence Index in the Eurozone will be announced.