The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

It is a good time to be trading markets right now, as there are some valid and strong long-term trends in favor of stocks and riskier assets.

Big Picture 14th February 2021

In my previous piece last week, I saw the most attractive trade opportunities as looking for selective longs in the NASDAQ 100 Index and the GBP/JPY currency cross.

This was a good, profitable call, as the NASDAQ 100 Index rose by 1.57% over the week, while the GBP/JPY currency cross rose by 0.49%.

Last week’s Forex market saw the strongest rise in the relative value of the Australian dollar and the strongest fall in the relative value of the U.S. dollar. There is a long-term trend in the U.S. dollar, which is making the Forex market quite interesting to trade now.

Fundamental Analysis & Market Sentiment

The headline takeaway is that we saw last week a continuation of risk-on sentiment globally. Major U.S. stock market indices such as the S&P 500 and NASDAQ 100 indices closed Friday at all-time high prices. Other global stock indices are also strong, most notably in Asia where the Nikkei 225 Index also closed at an all-time high price.

Last week was unusually quiet in terms of news that moved the market, with very few major economic data releases or political developments to affect prices. There was little word on the progress of the development of a new U.S. economic stimulus package, with impeachment trial and subsequent acquittal of ex-President Trump dominating the headlines, but to no effect on the market. There was a release of U.S. inflation data which came in at +0.3% in line with the consensus expectation.

The biggest news apart from booming stock markets was continuing exuberance in cryptocurrencies, with Bitcoin continuing to break to new all-time highs. The price has traded above $49,000 per coin over the last few hours.

Last week saw the global number of confirmed new coronavirus cases and total deaths drop worldwide. Although concerns remain that new mutations of the virus may be spreading which are more deadly and possibly resistant to the first generation of vaccines which are being rolled out, some nations are getting to a point where they either have begun or shortly will begin to ease lockdown restrictions.

Many countries have begun vaccination programs. Israel has vaccinated over 42% of its population (including 80% of over-50s) with a first dose of the Pfizer vaccine, and over 27% with a second and final dose. The U.A.E. is next with over 49 doses given per 100 people so far, followed by the U.K. at 22.

Real-world data from Israel, which has used the Pfizer vaccine, shows that the vaccination is about 93% successful at preventing serious illness from coronavirus infection, and there is reason for optimism that vaccination can be a valid route back to reopening of the economy.

The strongest growth in new confirmed coronavirus cases is happening in Albania, Argentina, Bahrain, Barbados, Belarus, Brazil, Bulgaria, Cuba, Czech Republic, Dominican Republic, Ecuador, Egypt, Estonia, Finland, Greece, Guatemala, Hungary, Iran, Iraq, Jamaica, Jordan, Kuwait, Latvia, Lebanon, Malta, Moldova, Mongolia, Montenegro, North Macedonia, Paraguay, Qatar, Senegal, Serbia, Slovakia, Slovenia, Somalia, Sri Lanka, Sweden, and Thailand.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar index printed a reasonably large, bearish engulfing candlestick last week. The consolidation of the past few weeks appears to have ended, with the dollar showing some bearish momentum and closing at its lowest price for six weeks. Overall, next week’s price movement in the U.S. dollar looks likely to be downwards. For this reason, it will probably be wise to only trade the USD short over the coming week.

NASDAQ 100 Index

The major U.S. technology index closed at an all-time high price on Friday right at the top of its weekly range. These are bullish signs. This index looks likely to rise further over the coming week, especially as global stock markets are generally bullish.

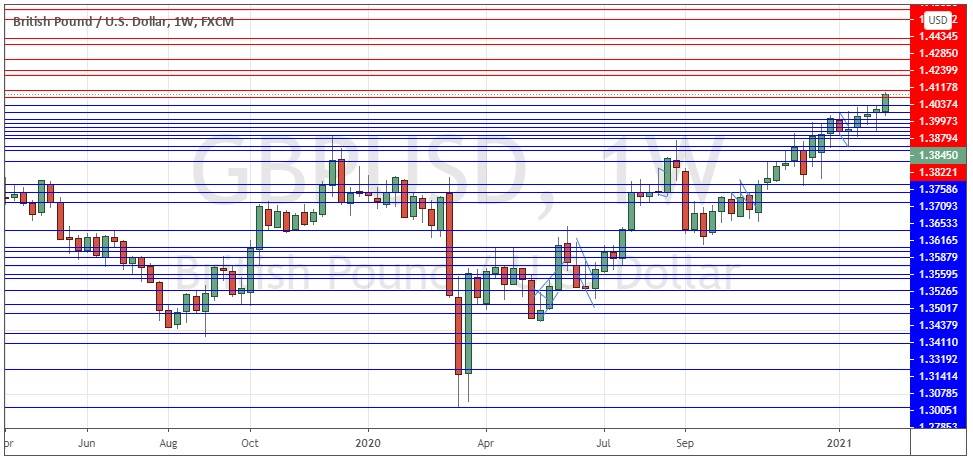

GBP/USD

We saw a strong, relatively large bullish candlestick in this currency pair last week, closing near the high of its range. This is the highest weekly close in over 2 years. These are all bullish signs, but an additional important factor is that the pound rose last week against the dollar, yen, and euro – all its major counterparties. It is likely that the pound will continue to rise over the coming week.

BTC/USD

Bitcoin has seen a meteoric, parabolic rise in its price over the past few months, which just gets stronger and stronger following its consolidation a few weeks ago. It has reached new all-time highs in recent hours, and the price chart below shows that its rise over the past week in dollar terms has been its largest for years, and possibly ever. Cryptocurrencies in general and Bitcoin particularly the subject of intense speculative interest and media coverage. This is a bubble, and it will burst, but short-term traders are likely to still see some long trade entry opportunities over the coming week if using a Bitcoin trading strategy. It could be a good idea to buy bullish reversals following dips over the coming week using a reasonably tight volatility-based hard stop loss.

Bottom Line

I see the best likely opportunities in the financial markets this week as being long of the NASDAQ 100 Index and the GBP/USD currency pair, while there may be good conditional short-term opportunities in trading Bitcoin long.