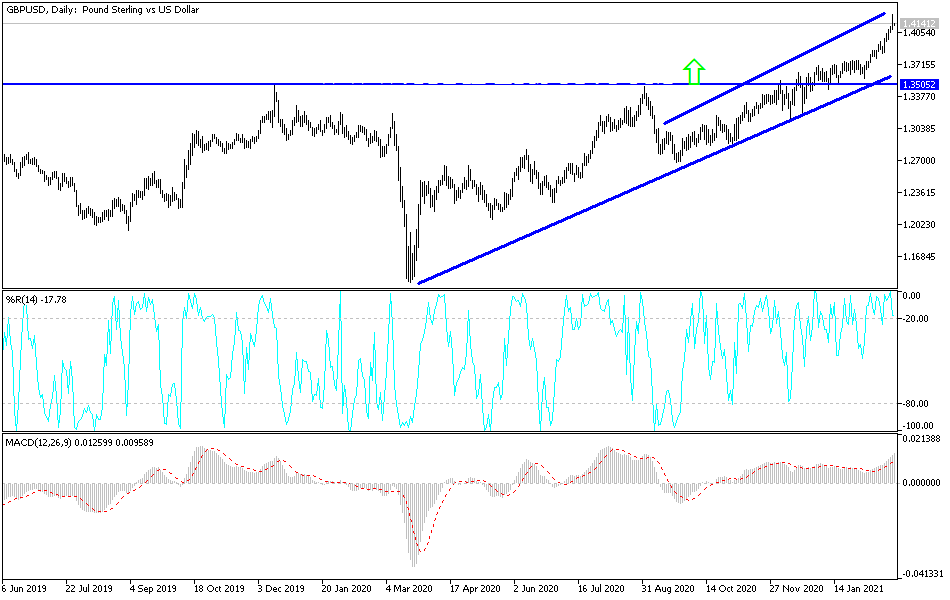

The British pound shot higher during the trading session on Wednesday to reach towards the 1.42 level before pulling back significantly. At the end of the day, the market could not sustain the massive move outside of the uptrending channel, and by pulling back the way we have, we ended up forming a bit of a shooting star. That is not a huge surprise, due to the fact that the market is basically a bit parabolic, so this point it is likely that we would see at the very least some type of pullback in order to build up enough momentum to continue to go higher.

To the downside, the 1.38 level is an area where I think a lot of support shows up, not only due to the fact that it is just above the recent breakout point, but it is also where the uptrend line is starting to come back into play. The 50-day EMA underneath the uptrend line also offers support, so I think given enough time value hunters would get involved based upon the massive momentum that we have seen. Furthermore, I think that this market probably is starting to focus on the idea of the United Kingdom opening up quicker than many of its G-10 peers, mainly because of the vaccination program that has been so successful in that country. Beyond that, Brexit seems to have not brought on the apocalypse for the British, so I think we are going to get a bit of an extended relief rally. Historically speaking, this market is much more comfortable with the 1.50 level then where we are right now.

On pullbacks, I think that it is only a matter of time before people start to pay attention to the fact that the stimulus package in the United States is going to be huge, coming in at roughly $1.9 trillion. That should put downward pressure on the US dollar, so longer-term I think it is only a matter of time before the uptrend would continue. The market should continue to find buyers on dips, but I think this market has simply gotten far too ahead of itself. The 1.42 level is an area that had previously been resistance, so it makes sense that we would stall here.